Firm Size and Currency Choice in Japanese Exports

Firms that export make strategic choices about the prices and quantities of the goods they sell as well as the currency in which they invoice their buyers. Unlike firms in other advanced countries, firms in Japan are less likely to invoice their exports in their own currency than in US dollars. Between 2014 and 2023, more than half of Japanese exports were sold in dollars, while exports priced in yen accounted for just over one-third of the total despite Japanese government initiatives in the 1980s and 1990s to internationalize the yen and promote its use in trade invoicing.

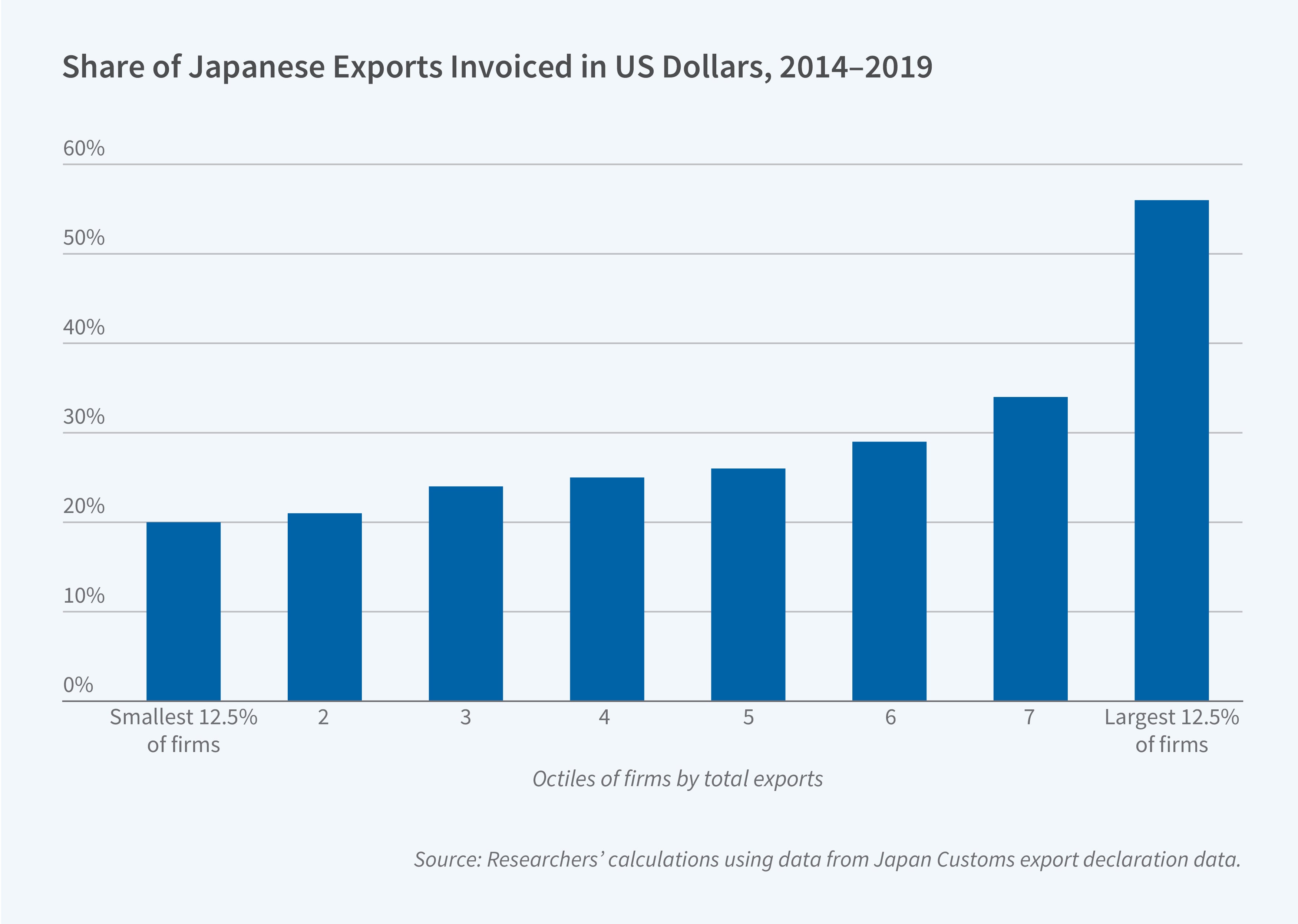

In The Myth of US Dollar Dominance in Japanese Exports: New Evidence from Japanese Customs Level Data (NBER Working Paper 33748), researchers Uraku Yoshimoto, Kiyotaka Sato, Takatoshi Ito, Junko Shimizu, Yushi Yoshida, and Taiyo Yoshimi used newly available Japan Customs transaction data combined with comprehensive firm-level information from the Ministry of Economy, Trade and Industry to analyze the invoicing practices of Japanese exporters. They find that dollar invoicing is dominant only for the largest firms and that yen invoicing is far more popular among small and midsize businesses.

Large Japanese exporters are more likely than small ones to invoice in US dollars because they are better positioned to manage currency risk.

The researchers analyzed more than 4.4 million export transactions by 8,644 firms that exported goods to 233 countries between 2014 and 2019. They found that the smallest one-quarter of Japanese exporters used yen invoices nearly three-quarters of the time. Even for firms in the top quartile of the exporter size distribution, yen-invoiced exports outnumbered dollar-invoiced ones by 52 to 39 percent. Only among the top octile (12.5 percent) of Japanese exporters did the pattern flip: 56 percent of exports for this group were invoiced in dollars, while 40 percent were in yen. Among the largest 1 percent of exporters, 56 percent of exports were invoiced in dollars while 30 percent were in yen. This pattern is not the result of pricing to the destination market, namely the US. The researchers found a similar pattern when they limited their attention to exports only to other Asian countries.

One likely reason for the association between firm size and currency preference is the capacity to hedge foreign-currency risk. Large firms, on average, have greater corporate resources to devote to financial functions, so they can enter into financial transactions to mitigate the risk to their income in yen even when they invoice in dollars.

Intra-firm exports are another reason for the observed pattern. The largest Japanese exporters are more likely than smaller firms to have substantial networks of foreign subsidiaries. Firms in the top quartile of exporters sent an average of 39 percent of their exports to a company-owned subsidiary overseas, compared with only 15 percent for the smallest. These networks allow large firms to offset import payments with export revenues, a process known as operational hedging. If a Japanese firm’s foreign subsidiary is earning foreign currency, typically dollars, it can use those dollars to pay for intra-firm imports from Japan. Small firms, in contrast, with fewer opportunities for operational hedging, are more likely to pass exchange rate risk on to their customers by invoicing their exports in yen. In some cases, potential buyers may demand more favorable terms to absorb exchange rate risk. They might, for example, ask the exporter to share the cost if exchange rates shift significantly within a certain period after the sale.

- Laurent Belsie

The researchers gratefully acknowledge financial support from the JSPS KAKENHI (Grant Numbers JP24K16379 to Uraku Yoshimoto, JP19H01504, JP23H00836, JP23K25533 and JP23K17550 to Kiyotaka Sato, JP24K04962 to Junko Shimizu, JP22K18527 and JP25K00649 to Yushi Yoshida, and JP20H01518, JP20KK0289 and JP23K20152 to Taiyo Yoshimi).