Financial Institutions and Supply Chain Dynamics

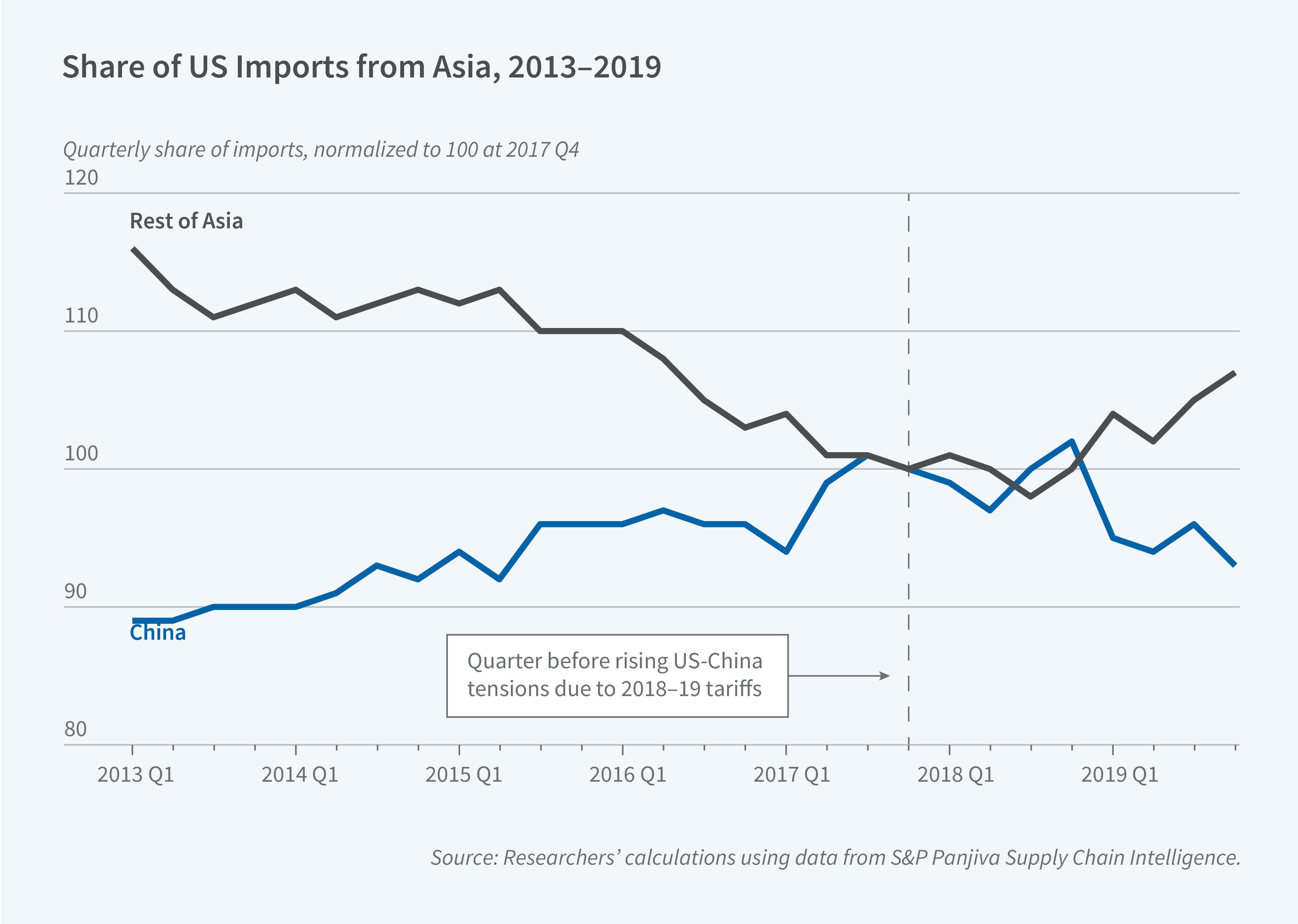

As US-China trade tensions escalated in 2018–19, American firms scrambled to reorganize their supply chains. In Bank Financing of Global Supply Chains (NBER Working Paper 33754), Laura Alfaro, Mariya Brussevich, Camelia Minoiu, and Andrea Presbitero study how commercial banks facilitated this shift by providing both financial and informational support. Firms that relied on Chinese suppliers before the tariff increase reoriented imports toward other Asian countries. The probability of withdrawing from a relationship with a Chinese supplier rose by 82 percent, while the probability of entering a new relationship with an Asian supplier outside China nearly doubled.

During the 2018–19 US-China trade war, American firms exposed to tariffs, particularly those with ties to banks with trade finance operations in Asia, shifted their supply chains from China to other Asian countries.

Exposed firms decreased the share of their imports coming from China by 86 percent and increased the share coming from other Asian countries by 48 percent. This realignment was slow: on average, it took firms nearly 3 years to find a new Asian supplier. Firms with existing supplier relationships in Asian countries other than China were significantly more likely to find new suppliers, as were those in industries with less specialized inputs.

Tariff-exposed firms increased their borrowing to manage these disruptions. Their utilization of credit lines rose by 0.7 percentage points and they took out new loans at higher interest rates, suggesting a need for liquidity to cover the costs of higher tariffs and supplier switching. Relative to firms that were not exposed to Chinese suppliers, these firms paid interest rate premia of up to 18 basis points on new loans.

Firms connected to “specialized banks,” institutions with a history of trade financing operations in Asia, fared better than those without such ties. These banks helped their clients reconfigure supply chains. Firms with such ties were 15 percentage points more likely to shift to a new supplier and were also able to borrow at lower interest rates, by about 19 basis points, than firms with less globally connected banks.

Firms were 10–15 percent more likely to establish a relationship with a supplier in a new country and were close to 6 months faster in matching to that new supplier if their bank had a local affiliate there, which suggests that information and relationship networks were important. In line with this interpretation, specialized banks with Asian branches earned more than 2 percent in additional advisory fee income during the tariff period.

- Abigail Hiller

This project is supported by the Fundação Carlos Chagas Filho de Amparo à Pesquisa do Estado do Rio de Janeiro, Grant/Award Number: SEI-260003/000532/2023.