COVID-19’s Fiscal Impact on Social Security: Mortality Effects and Survivors’ Benefits

Excess mortality during the COVID-19 pandemic has complex implications for Social Security's fiscal outlook. In The Effect of US COVID-19 Excess Mortality on Social Security Outlays (NBER Working Paper 33465) researchers Hanke Heun-Johnson, Darius Lakdawalla, Julian Reif, and Bryan Tysinger examine how pandemic-related deaths affected Social Security's Old-Age, Survivors, and Disability Insurance (OASDI) program. They focus on three distinct effects: reduced future benefit payments to primary beneficiaries, lower future payroll taxes, and increased survivors' benefit payments.

On balance, excess deaths related to the COVID-19 pandemic reduced Social Security program liabilities by $156 billion, as decreased future benefit payments outweighed lost payroll taxes and increased survivors' benefits.

The researchers analyze approximately 1.35 million excess deaths between March 2020 and January 2023 among individuals over the age of 25. They use the Future Elderly Model and the Future Adult Model, dynamic microsimulation models that incorporate demographic, health status, and economic variables to project Social Security benefits.

They find that pandemic-related excess mortality reduced OASDI liabilities by $156 billion on net, or by approximately $115,000 per excess death. This net effect is the sum of several offsetting gross components. There is a $219 billion reduction in future retirement benefits that would have been paid to deceased individuals, a $44 billion decrease in future payroll tax revenues from workers who died prematurely, a $25 billion increase in survivors' benefits for spouses and children of the deceased, and a $6 billion reduction in disability benefit payments.

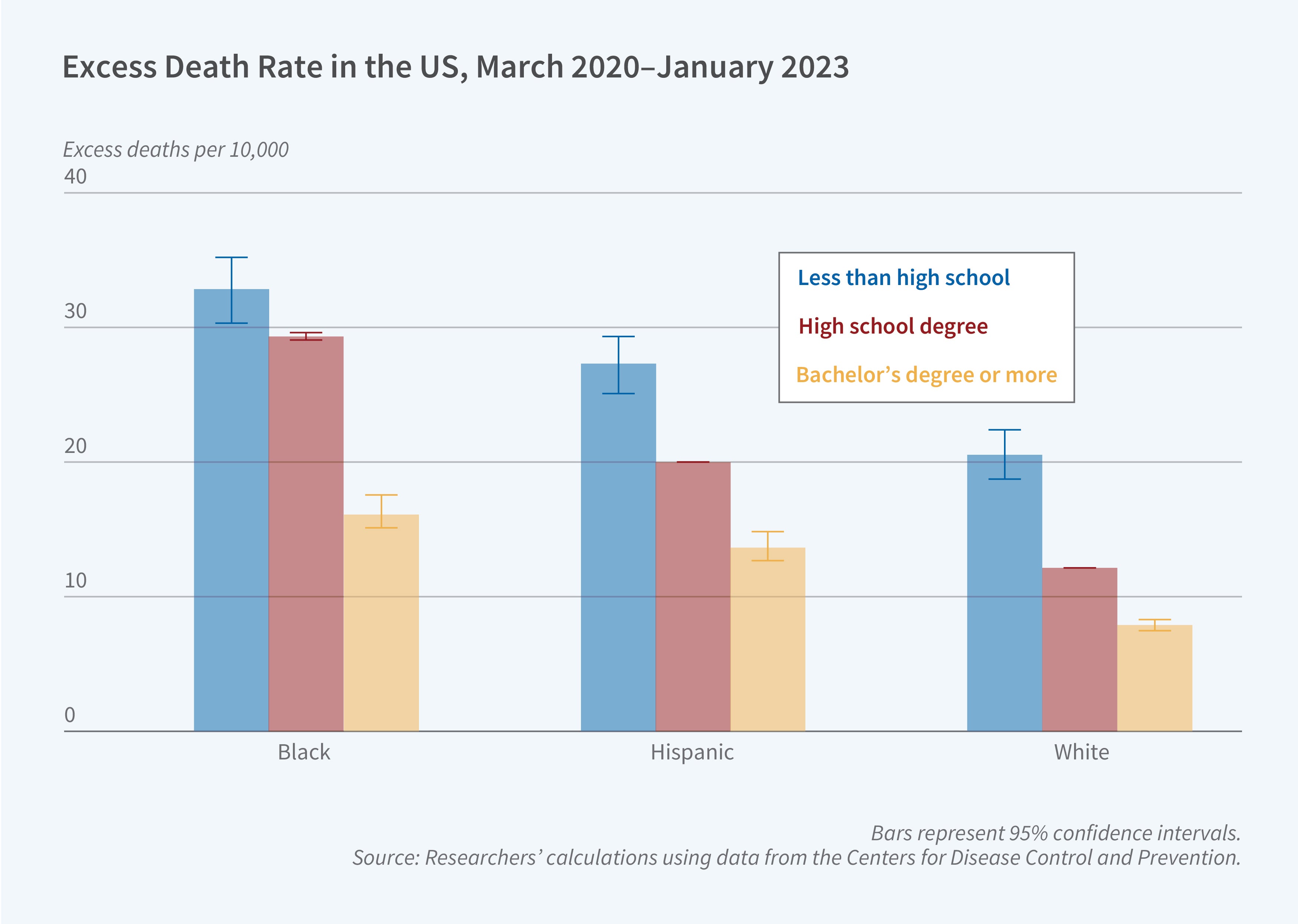

The researchers find significant racial and ethnic disparities in both mortality rates and survivor outcomes. While non-Hispanic Whites accounted for 67.3 percent of excess deaths and 83.8 percent of the net fiscal impact, Black and Hispanic populations experienced higher per capita death rates, and left behind more underage children per capita. Their children had more remaining years until they reached the age of 18: 22.7 and 15.0 years per 1,000 children, respectively, compared to 9.4 years for White children.

The researchers estimate that 202,000 children under age 18 lost a parent during the study period. There were 43,000 children of Black decedents, 65,000 of Hispanic decedents, and 94,000 of White decedents. Survivors’ benefits for Black and Hispanic children were lower than those for White children across all educational levels.

The study accounts for age-specific mortality risks, health comorbidities, and differential life expectancies. The findings suggest that while pandemic mortality marginally improved Social Security's financial position, it exacerbated existing racial and ethnic disparities in the program's impact on families.

The research reported herein was performed pursuant to grant RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. Additional support for this work was provided by the Peter G. Peterson Foundation. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA, any agency of the Federal Government, or NBER. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.