How Short-Term Private Disability Insurance Affects Public Disability Benefits

Forty percent of US workers have access to employer-provided short-term disability insurance (STDI). This insurance generally pays benefits to disabled workers during the five-month waiting period between disability onset and when Social Security Disability Insurance (SSDI) benefits can commence. By providing income during the waiting period, STDI may encourage more disabled workers to apply for SSDI, leading to more SSDI awards. However, employers who offer STDI have a stronger financial incentive to offer accommodations to disabled workers to help them to remain on the job instead of taking up STDI benefits, which could reduce SSDI applications and awards.

Examining the effect of STDI access on SSDI applications and awards is challenging, since workers with and without STDI access may differ in ways that affect their probability of using SSDI. In The Long-Term Externalities of Short-Term Disability Insurance (NBER RDRC Working Paper 21-10), researcher Michael Stepner provides evidence from Canada on the effect of employer-provided STDI on public long-term disability insurance (LTDI).

The author focuses on Canadian firms that end their STDI programs. By comparing employees whose firms have just ended their STDI plans to employees whose firms are about to end STDI, he is able to isolate the effect of STDI coverage on LTDI receipt. To undertake this analysis, the author constructs a new dataset of linked Canadian administrative tax and benefit records that includes STDI coverage and LTDI receipt for the full population for the period 2000 through 2014. Nearly 6,000 firms ended their STDI plans during this period.

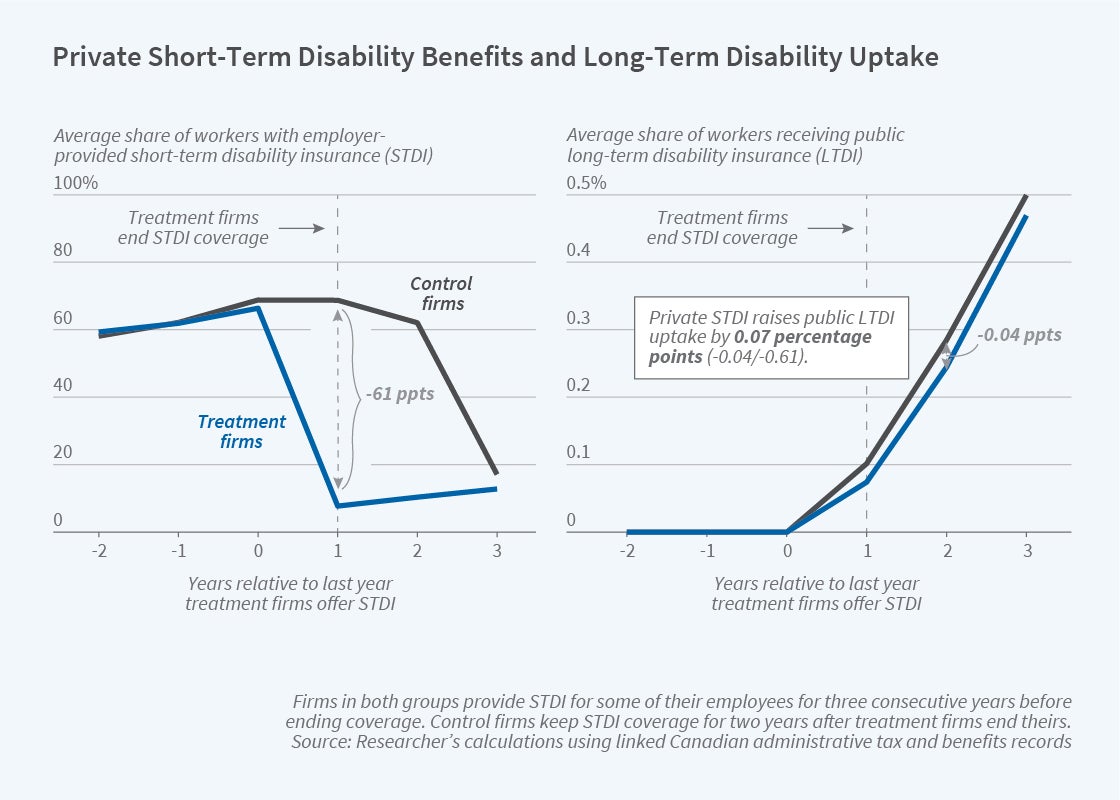

The first finding is that when a firm stops providing STDI to its employees, the probability that employees of the firm have STDI falls by 61 percentage points. The effect is not 100 percent because some employees were not covered by the STDI plan, while others continue to have STDI coverage through another employer.

Employees whose firms stop providing STDI are 0.040 percentage points less likely to be receiving LTDI two years later than are employees with ongoing STDI coverage. Combining this with the first estimate implies that having STDI coverage increases the probability of receiving LTDI by 0.07 percentage points, an increase of 33 percent.

These results indicate that the employee response to having benefits during the waiting period dominates the effect of any increased workplace accommodations associated with STDI. Employer provision of STDI therefore raises public expenditures on LTDI. The author estimates that if no Canadian employers had provided STDI between 2000 and 2014, there would be 18,300 fewer LTDI recipients in 2015 and government LTDI expenditures would be C$230 million Canadian — or 5 percent — lower. For employers to face the additional government expenditures incurred due to STDI provision, the government would need to impose a tax of C$35 per insured worker per year.

Reflecting on the implications of this study for active policy discussions, the author notes that some analysts have “proposed that universal private STDI would result in more workers with work limitations receiving assistance and returning to work and thereby reduce long-term disability rates and expenditures. This paper shows that the opposite is true, and that expanding private STDI would increase public LTDI spending.”

Financial support was provided by the Social Sciences and Humanities Research Council of Canada. The views expressed in this paper do not necessarily reflect the views of Statistics Canada or any department of the Government of Canada. The research reported herein was performed pursuant to grant RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA, any agency of the federal government, or NBER. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.