C-Suite Differences: Public versus Privately Held Firms

Private equity (PE) firms’ business model is to acquire privately held companies, to change their strategy and operations with the goal of improving profitability and growth, and ultimately to sell the companies for a profit. The senior management team is replaced at a majority of private equity acquisitions. More than 40 percent of PE firms report that this is a key way to improve their acquisitions’ success.

In The Market for CEOs: Evidence from Private Equity (NBER Working Paper 30899), Paul Gompers, Steven Kaplan, and Vladimir Mukharlyamov compare the characteristics of CEOs installed by PE firms to the characteristics of those who become CEOs at publicly traded companies. They note that existing academic work on CEO labor markets focuses almost exclusively on public companies, neglecting the PE-owned enterprises that represent a large and growing part of the US corporate sector.

At publicly traded companies, 72 percent of new CEOs are promoted from within, while at firms owned by private equity investors, two-thirds are external hires.

The researchers combine a variety of data sources to identify and study privately owned US companies that were (i) valued at more than $1 billion, and (ii) acquired by a PE firm between 2010 and 2016. Their sample covers 192 buyouts with an average deal size of $2.6 billion. They focus on the first new permanent CEO following a buyout and investigate that person’s previous job title and employer.

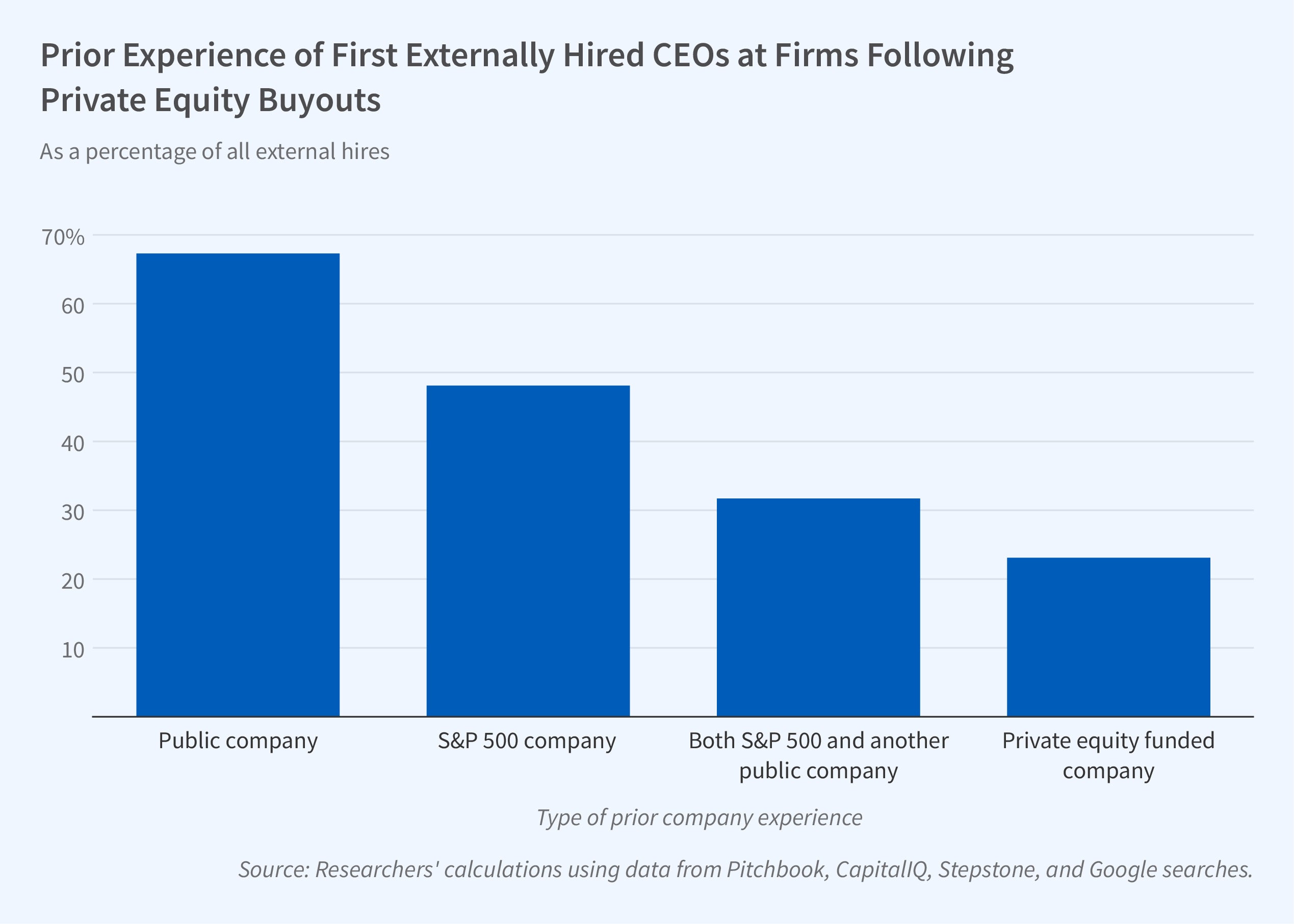

Two key differences emerge between CEOs appointed at private firms owned by PE investors and CEOs who receive the top job at publicly traded companies. The first concerns their backgrounds. At publicly traded companies, 72 percent of new CEOs are internal hires promoted from lower-level executive positions within the company, suggesting that firm-specific experience is considered an important qualification for becoming the CEO. In contrast, only 24 percent of new CEOs appointed at PE-owned firms are internal promotions. Nearly 67 percent of the PE appointees were neither executives nor board members of the company they were selected to lead.

The majority of the external hires are raided executives — non-CEO executives at other companies who were recruited by the PE investor to become CEO of the acquired firm. Twelve percent are raided CEOs — individuals who previously held a CEO position at another company, including many publicly traded firms. This pattern suggests the existence of a fluid labor market between public and private CEO jobs that may put upward pressure on the compensation of CEOs of publicly owned companies. The results also suggest that possessing prior firm-specific knowledge is not an essential qualification for being appointed CEO of a PE-owned firm. Most of the PE-firm CEOs did have relevant industry experience suggesting that industry experience and general CEO skills are transferable across companies.

Contrary to the folk wisdom that PE investors bring in outsiders to deal with poorly performing companies, no association between a company’s pre-takeover performance and the probability that an external CEO is appointed was found.

The second difference between the CEOs at publicly traded and PE-acquired firms is compensation. The compensation of CEOs appointed by PE investors is not made public, while the compensation of CEOs of publicly traded companies is. The researchers use information from 41 companies in their sample that later went public, triggering a release of information about CEO compensation, to make assumptions about appointed CEOs’ equity stakes. They estimate that CEOs appointed by PE investors earn substantially more in total compensation than CEOs of comparably sized publicly traded companies, and nearly as much as CEOs of much larger S&P 500 companies. The extra earnings may compensate to some degree for the greater risk of termination at PE-owned firms. The first-year CEO turnover rate at PE-owned firms is 15.4 percent compared to 11.7 percent at publicly traded firms.

— Shakked Noy

The NBER's Bulletin on Entrepreneurship, Entrepreneurship Working Group, and related initiatives are supported by the Ewing Marion Kauffman Foundation.