Medical Spending of the Elderly

While the rate of growth of health care spending in the U.S. has been lower over the past decade than in previous decades, health care costs remain a concern for policy makers and the public. Health care spending on the elderly is of particular interest, due to the rising share of the population in this group and the fact that per capita health care spending for the elderly is substantially higher than for the population as a whole.

In Medical Spending of the U.S. Elderly (NBER Working Paper 21270), researchers Mariacristina De Nardi, Eric French, John Bailey Jones, and Jeremy McCauley explore the medical spending of Americans aged 65 and older. The authors make use of data from the 1996 to 2010 waves of the Medicare Current Beneficiary Survey (MCBS). The MCBS links administrative Medicare records to survey information from households, providing high-quality data on Medicare payments as well as spending by other payors; respondents are followed for up to three years, providing a longitudinal view of spending.

The financing of health care for the elderly is complex. Virtually all people over age 65 are eligible for Medicare, which provides insurance for hospital stays, doctor visits, and since 2006, prescription drugs. There can be substantial copayments for services covered by Medicare, which may be paid by a supplemental private "Medigap" insurance plan or out-of-pocket by the beneficiary. Nursing home expenses are a significant concern for the elderly, with costs on the order of $77,000 to $88,000 a year in 2014. Relatively few older individuals have long-term care insurance, so most of these costs are paid either out-of-pocket or by Medicaid for those who have exhausted their own financial resources.

The authors begin by reporting the share of medical expenditures financed by different payors. The government pays for two-thirds of health care spending by the elderly, with Medicare accounting for 55 percent, Medicaid for 10 percent, and other government programs for 3 percent. Medicaid funds a larger share of expenses for women than for men (12 percent vs. 6 percent), as older women are more likely to have nursing home stays. Nearly 20 percent of the medical spending of the elderly is financed out-of-pocket, while 13 percent is covered by private insurance.

Medical spending by the elderly is highly concentrated. Individuals in the top 5 percent of the distribution of total expenditures spend about $98,000 per year, nearly seven times the overall average of $14,000 and accounting for 35 percent of all medical spending. Out-of-pocket expenditures are even more skewed, with almost half of expenditures made by the top 5 percent of spenders. As the authors note, "even with public and private insurance, out-of-pocket medical expenditure risk is significant."

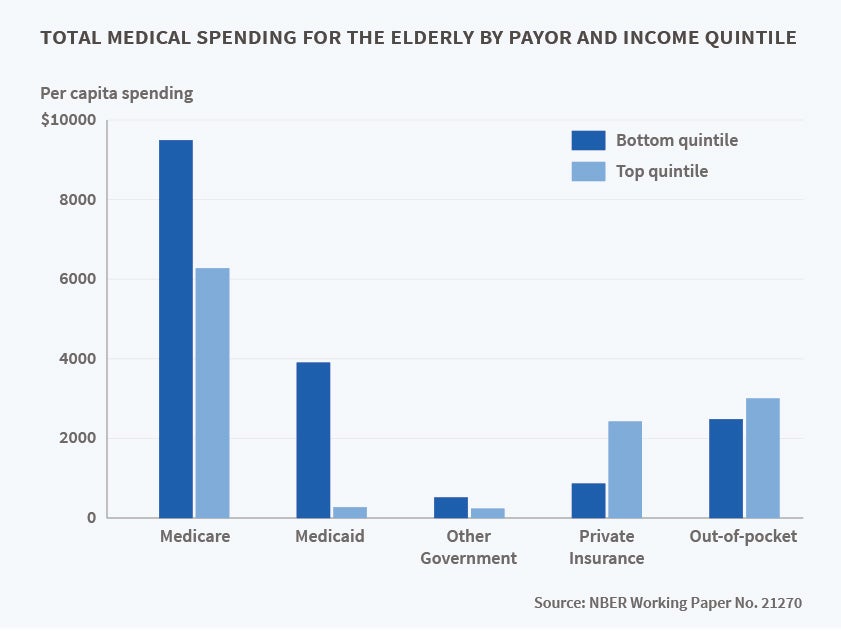

Turning to the question of how expenses vary with gender and income, the authors find that total spending by all payors is on average about $1,100 per year more for women than men. This difference is due to higher expenditures on nursing homes for women — excluding these costs, average total annual spending is about $500 less for women. By income, those in the bottom income quintile spend about $5,000 more per year than those in the top quintile. Again, nursing home expenditures are key — excluding these, those in the bottom quintile spend only $1,000 more per year. The financing of health care varies also dramatically by income. In the bottom quintile, Medicare pays $9,500 a year and Medicaid $3,900, while private insurance covers just $900 and out-of-pocket spending is $2,500. In the top quintile, Medicare pays $6,300 and Medicaid only $300, while private insurance pays $2,400 and out-of-pocket spending is $3,000.

Another important issue is the persistence of medical spending over time — are this year's low and high spenders likely to have similar expenses in future years? The authors find that the answer is yes. Those in the top quintile of spending in one year, for example, have a 54 percent chance of being in the top quintile in the next year and a 48 percent chance of being in the top quintile in two years. The chances that an individual in the lowest quintile of spending will remain a low spender one or two years later are 62 and 58 percent, respectively.

Finally, the authors document that medical spending more than doubles between ages 70 and 90 and ask how much of this increase can be explained by large medical expenditures right before death. They find that medical spending in the last year of life is $59,000, accounting for 16.8 percent of spending by those over age 65 and 6.7 percent of spending at all ages. Medical spending in the three years before death accounts for 13.4 percent of aggregate medical spending. The authors conclude "while end-of-life spending is high in the United States, it hardly explains all of why medical spending in the U.S. is so much higher than in other countries."

De Nardi acknowledges support from the ERC (grant 614328) and from the ESRC through the Centre for Macroeconomics. French acknowledges support from a grant from the Michigan Retirement Research Center.