How Do Retirement Ages Affect Retirement?

Facing rising life expectancies and falling birth rates, many countries have raised retirement ages in their public pension programs to ameliorate long-run fiscal deficits. In the US, the normal retirement age has gradually been rising from age 65 and will reach age 67 for those born in 1960 or later.

Public pension retirement ages — including the early retirement age (ERA) when benefits are first available and the normal retirement age (NRA) around which the benefit calculation is centered — may influence workers' decisions of when to exit the labor force. Indeed, in many countries there are spikes in retirement at these ages. While there may be changes in the financial incentive for continued work that occurs at these ages, past research suggests that these changes alone are insufficient to explain the increase in retirement. An alternative explanation for the spike is that pension retirement ages establish an important social norm for retirement behavior.

Testing this theory empirically has proven challenging. While there are many instances of countries changing the early or normal retirement age in their pension plan, these reforms typically include other changes that can also affect work incentives and behavior. In the US, for example, the rise in the NRA has resulted in a decrease in the lifetime value of benefits, since for a given retirement age, the monthly benefit amount is lower when the NRA is higher. This makes it difficult to determine whether any tendency to retire later after the reform reflects a response to the later NRA or to the reduction in pension wealth.

In Relabeling, Retirement and Regret (NBER RDRC Working Paper NB19-20 and NBER Working Paper 27534), researchers Jonathan Gruber, Ohto Kanninen, and Terhi Ravaska explore this question in the context of a major pension reform in Finland. Importantly, the reform included a major relabeling of pension retirement ages that was accompanied by modest and continuous changes in financial incentives, enabling the researchers to identify workers' retirement responses to pension retirement ages.

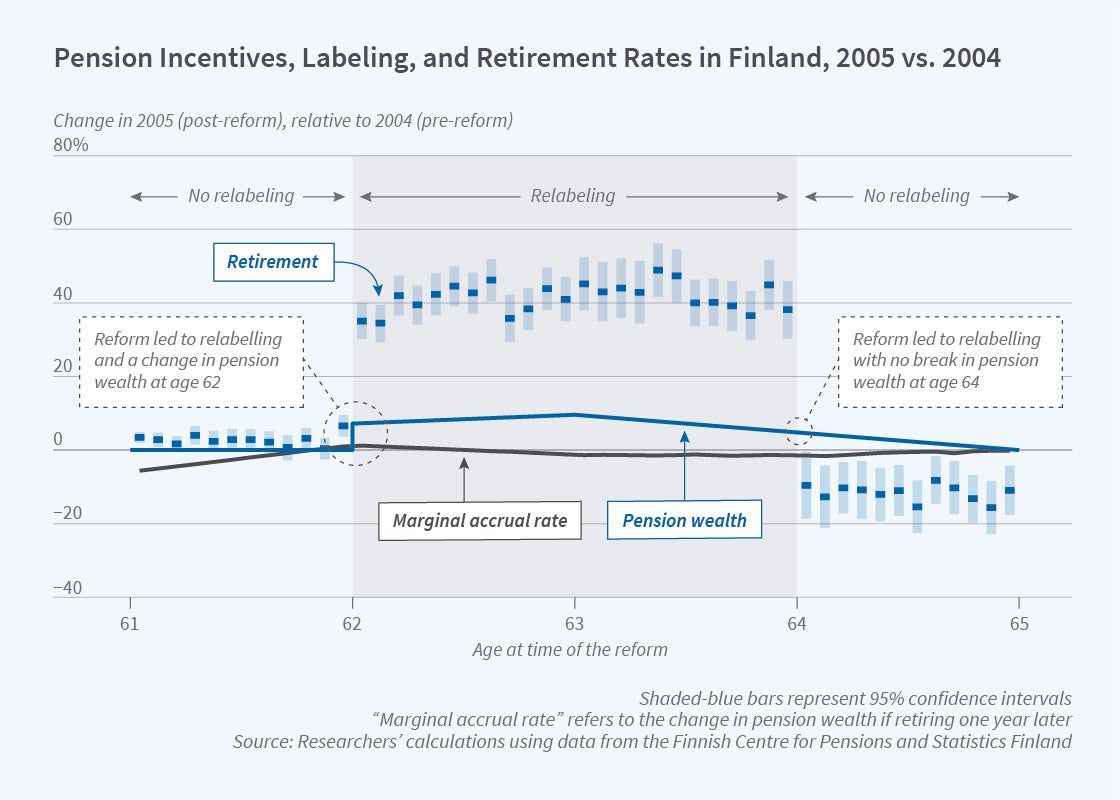

Before 2005, workers in Finland faced an ERA of 60 and a NRA of 65. In 2005, the system was reformed so that a new "flexible" retirement age was introduced at age 63. Workers who were age 62 at the time of reform could access the new flexible benefit as soon as they turned 63 (within the next 12 months) but also experienced some changes in pension wealth and in the accrual rate (the change in pension wealth resulting from working another year) due to the reform. Workers who were 63 at the time of reform also experienced changes in both retirement ages and financial incentives. By contrast, workers who were age 64 at the time of the reform were unaffected by the access to new retirement option, since they could already anticipate having access to normal retirement benefits at age 65, but had similar changes in financial incentives. Comparing these groups of workers allows the researchers to isolate the effect of relabeling age 63 as a focal retirement age.

The authors find that there was a 40 percentage point increase in retirement at age 63 among the cohorts suddenly made eligible for retirement. This extremely large and immediate response to the relabeling of age 63 as the new normal retirement age suggests that "relabeling is as powerful as enormous changes in pension wealth or dynamic pension retirement incentives" in driving retirement decisions.

The authors also explore regret: whether pension retirement ages affect the decision to return to work. They find that workers induced to retire by the relabeling reform are much more likely to return to work over the next three years than is the typical worker.

The authors note that their analysis does not allow them to separate changes in worker retirement choices due to this policy change from potential employer responses to the law change that might independent interact retirement. Disentangling these responses is a priority for future work. Overall, the paper's clear conclusion is that the labeling of particular retirement ages through the pension plan is a powerful determinant of retirement decisions.

This research was performed pursuant to grant RDRC18000003 from the US Social Security Administration (SSA) to the NBER, funded as part of the Retirement and Disability Research Consortium.