Asset Demand Systems in Macro-Finance

Every asset pricing model starts with assumptions about investors’ preferences, beliefs, and constraints, and firms’ technology or cash flows. Market equilibrium requires that investors’ asset demands be equal to the supply of various assets. Thus, asset demand systems play a critical role in determining asset prices.

In recent years, the availability of portfolio-holdings data and progress on longstanding identification challenges have revealed an important fact: asset demand for individual stocks, the aggregate stock market, government and corporate bonds, and exposure to common risk factors are much less elastic than standard asset pricing models predict. The large price reactions around events such as index additions and quantitative easing can only be explained by low-demand elasticities.

Many questions in financial economics and in the policy sphere require a well-specified asset demand system to understand how a shift in demand for specific assets or how a group of investors will affect asset prices. Examples include: How much of the secular decline in real interest rates is explained by the safe asset demand of foreign and wealthy investors? What is the convenience yield on US long-term bonds and equities? What is the impact of socially responsible investing or tighter capital regulation on the cross-section of corporate bonds and equities?

Here we summarize our research that uses a demand system approach to better understand the US stock market, the euro-area government bond market, and international bond and equity markets.

Asset Demand Is Surprisingly Inelastic

If asset supply is fixed in the short run, the average demand elasticity for a group of investors can be estimated through an exogenous demand shock to another group of investors. A classic example is an addition or deletion on the S&P 500 index.1 Passive mutual funds and, to a lesser degree, active investors benchmarked to an index experience a demand shock when a stock is added to the index. This demand shock is a shift in the residual supply curve that serves as an instrument to estimate the average demand elasticity for the complementary group of investors that accommodate the demand shock.

Recent research has used novel identification strategies and extended the analysis of demand shocks beyond a small set of stocks that are affected by an index addition or deletion. Yen-Cheng Chang, Harrison Hong, and Inessa Liskovich use a regression discontinuity approach at the cutoff between Russell 1000 and 2000 indices.2 Anna Pavlova and Taisiya Sikorskaya systematically extend this approach to all major stock indices.3 Simon Schmickler exploits variation from institutional investors’ predictable rebalancing across stocks due to dividend payouts.4

We use variation in investment mandates across institutional investors to estimate a demand system for the entire cross-section of US stocks.5 The median demand elasticity across stocks in a given period averages to 0.4, but there is significant heterogeneity across stocks with elasticities up to 2. Our estimates, which agree with demand elasticities estimated by others, are three orders of magnitude smaller than those implied by calibrations of standard asset pricing models. For example, a calibration of the capital asset pricing model (CAPM) implies a demand elasticity for individual stocks that exceeds 5,000.6 Investors should easily arbitrage any deviation from the CAPM because with limited idiosyncratic risk at the individual stock level, there is a high elasticity of substitution across stocks.

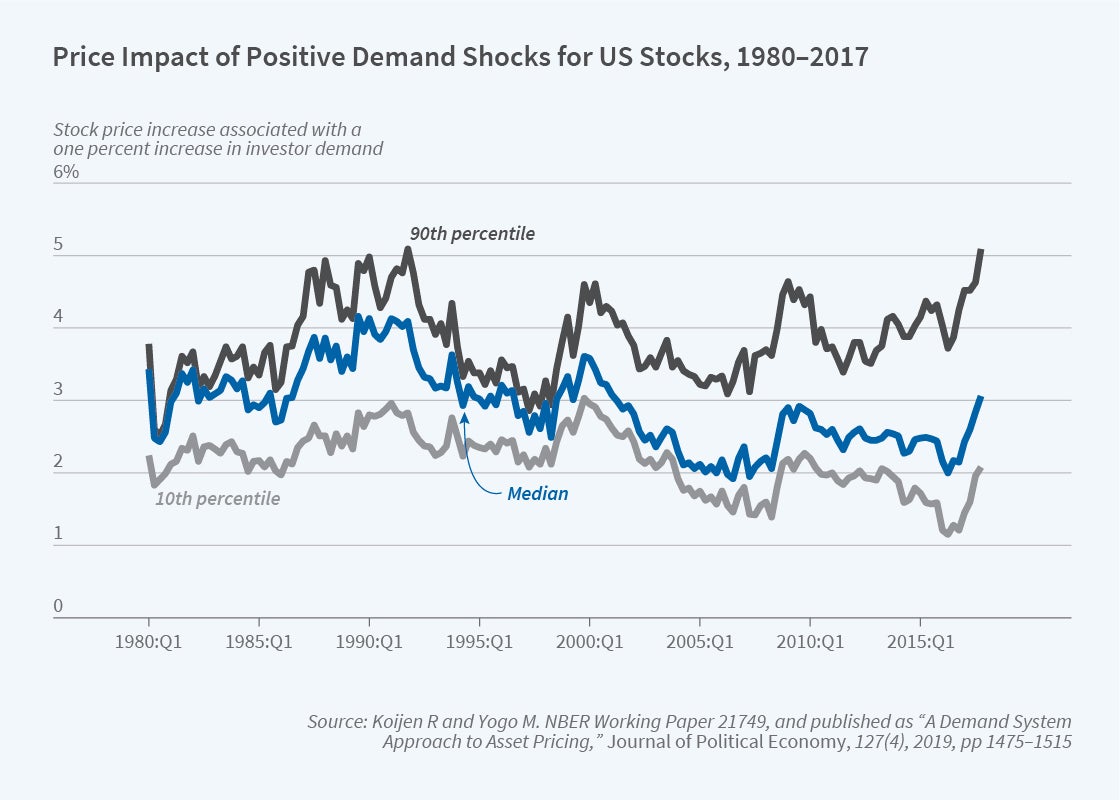

In addition to the fact that demand elasticities are low, we find that they vary across stocks and over time. Figure 1 reports the price impact in the cross-section of US stocks, which is inversely related to the demand elasticity. A price impact of 3 means that the stock price increases by 3 percent for a 1 percent demand shock to all investors. The price impact is countercyclical because demand elasticities fall during recessions when investors are more constrained, more risk averse, or more uncertain about future returns.

The fact that demand elasticities are much lower than their model-implied counterparts extends beyond individual stocks to common risk factors such as size and value7 and the aggregate stock market.8 It also extends to bond markets, including the cross-section of US corporate bonds,9 government bonds across countries,10 and the substitution between Treasury and AAA corporate bonds.11 We estimate an international asset demand system based on country-level holdings and find low demand for long-term bonds and equities.12

The Importance of a Well-Specified Asset Demand System

The foregoing evidence suggests two essential features of a well-specified asset demand system. First, asset demand curves must actually match the observed portfolio holdings of households, institutional investors, or countries. Second, the demand elasticities with respect to prices, asset characteristics, and investor attributes and constraints have to match the empirical estimates.

In this section, we give five examples of quantitative questions that require a well-specified asset demand system for credible answers. A common theme is that we would like to know how a shift in demand for specific assets or for a group of investors affects asset prices, which in turn affect the real resource allocation decisions of firms and households.

First, an active literature studies the secular decline in nominal and real interest rates, its possible connection to declining firm-level investment, and its implications for the fiscal capacity of countries. Possible causes include foreign demand for safe assets (the global saving glut), the asset demand of wealthy households (the saving glut of the rich), and shifts in asset demand due to changing demographics (the rising share of the population at older ages). A well-specified asset demand system is necessary to quantify how such shifts in asset demand affect asset prices.

Second, an international finance literature studies the special role of the US dollar as a reserve currency and the convenience yield that US assets earn as a consequence.13 A well-specified asset demand system is necessary to estimate how a shift in foreign asset demand would affect asset prices if US assets were not special. We estimate an international asset demand system based on country-level holdings and find a large convenience yield of 2.15 percent for US long-term bonds and 1.70 percent for US equities.

Third, central banks have used quantitative easing in response to the global financial crisis, the European sovereign debt crisis, and the COVID-19 crisis. They purchase large quantities of long-term government bonds, corporate bonds, mortgage-backed securities, and even equities in some cases. A well-specified asset demand system is necessary to assess the impact of quantitative easing on asset prices and the distribution of duration and market risk across households and institutional investors. In work with François Koulischer and Benoît Nguyen, we estimate a demand system for euro-area government bonds to assess quantitative easing in the euro area since March 2015.14

Fourth, socially responsible investing has become increasingly popular. Investors could potentially affect firms’ investment decisions by increasing their allocation to “green” firms or excluding “brown” firms. A well-specified asset demand system is necessary to assess how socially responsible investing affects firms’ investment decisions through their cost of capital. In joint work with Robert Richmond, we estimate an asset demand system with environmental scores to quantify the impact of socially responsible investing on stock prices.15

Fifth, in the aftermath of the global financial crisis, regulators have tightened capital regulation for banks, insurance companies, and even asset managers through liquidity requirements and redemption gates. The portfolio choice of institutional investors appears to be sensitive to capital regulation, especially when these investors are financially constrained. Because insurance companies are the largest institutional investors in the corporate bond market, risk-based capital regulation of insurers could have an important impact on corporate bond yields.16

US Stocks from the Perspective on an Asset Demand System

Our research makes three contributions that operationalize a demand system approach to asset pricing.17 First, we show that traditional mean-variance portfolio choice implies a logit demand function under empirically supported assumptions of a factor structure in returns and factor loadings depending on asset characteristics. To match the observed portfolio holdings, we allow asset demand to depend on unobserved characteristics that capture beliefs about risk and profitability, which we call latent demand. Second, we propose an instrumental variables estimator for the asset demand system based on the variation in investment mandates across institutional investors. Third, we use the asset demand system for applications such as liquidity measurement, variance decomposition, and return prediction.

Our analysis yields four key findings. First, institutional investors’ portfolios are remarkably heterogeneous, both in the extensive margin — which stocks they hold — and in the intensive margin — how much they hold of the stocks they own. The median investor holds only 70 stocks at a given point in time and has held only 110 stocks over the previous three years. The set of stocks ever held is remarkably stable over time — consistent with the presence of investment mandates — and this motivates our identification strategy.

Second, most of the cross-sectional variance of stock returns is explained by latent demand rather than observed asset characteristics. Although this result is consistent with a longstanding puzzle of excessive nonfundamental volatility in financial markets, our approach opens new avenues for research and suggests the value of connecting latent demand to measures of beliefs and constraints through analyst forecasts or textual analysis of earnings calls and media coverage.

Third, households and smaller institutional investors explain a higher share of the cross-sectional variance of stock returns than larger institutional investors during the global financial crisis. Although the top 30 institutional investors manage about a third of the US stock market, they explain only 4 percent of the cross-sectional variance of stock returns. Larger institutional investors are actually buy-and-hold investors that do not trade much across stocks during market stress.

Fourth, reversion to the mean in latent demand generates predictable variation in the cross-section of stocks. Stocks with high latent demand are relatively expensive and have low expected returns. This new source of predictability cannot be explained by conventional factors such as the market beta, size, value, and momentum.

Potential Directions for Future Research

Arbitrage pricing theory and consumption-based asset pricing have had very successful runs over the last 30 years, with both empirical successes and deep puzzles documented by researchers. Research on demand system asset pricing that attempts to learn about asset prices based on portfolio holdings data has only begun.

As we have discussed, a logit demand function could be micro-founded by mean-variance portfolio choice. However, a more realistic model of asset demand is possible by incorporating the objectives and constraints of specific groups of investors. For example, mutual funds care about benchmarking, and insurance companies care about risk-based capital regulation. Thus, micro data on such constraints would help us build a more realistic asset demand system.

An unresolved question is why empirical estimates of demand elasticities are so much lower than those implied by calibrations of standard asset pricing models. Benchmarking could lower demand elasticities for stocks included in an index, but the empirical evidence on low elasticities is broader and cannot be entirely explained by benchmarking. An alternative hypothesis is that investors cannot estimate expected returns accurately and consequently do not trade aggressively against large price movements (as in the model of Gabaix and Koijen).18 Asset pricing theories with heterogeneous priors, inattention, or costly information acquisition could explain heterogeneity in portfolios and potentially explain low demand elasticities. Making these models both tractable and realistic enough to explain actual portfolio holdings data should be high on the macro-finance research agenda.

Endnotes

“Price and Volume Effects Associated with Changes in the S&P 500 List: New Evidence for the Existence of Price Pressures,” Harris L, Gurel E. Journal of Finance 41(4), September 1986, pp. 815–829; “Do Demand Curves for Stocks Slope Down?” Shleifer A. Journal of Finance 41(3), July 1986, pp. 579–590.

“Regression Discontinuity and the Price Effects of Stock Market Indexing,” Chang Y, Hong H, Liskovich I. NBER Working Paper 19290, revised October 2013, and Review of Financial Studies 28(1), January 2015, pp. 212–246.

“Benchmarking Intensity,” Pavlova A, Sikorskaya T. London Business School Working Paper, September 2020.

“Payout-Induced Trading, Asset Demand Elasticities, and Market Feedback Effects,” Schmickler S. Princeton University Working Paper, July 2021.

“A Demand System Approach to Asset Pricing,” Koijen R, Yogo M. NBER Working Paper 21749, revised July 2019, and Journal of Political Economy 127(4), August 2019, pp. 1475–1515.

“Why Do Demand Curves for Stocks Slope Down?” Petajisto A. Journal of Financial and Quantitative Analysis 44(5), October 2009, pp. 1013–1044.

“Ratings-Driven Demand and Systematic Price Fluctuations,” Ben-David I, Li J, Rossi A, Song Y. NBER Working Paper 28103, revised October 2021.

“In Search of the Origins of Financial Fluctuations: The Inelastic Markets Hypothesis,” Gabaix X, Koijen R. NBER Working Paper 28967, June 2021; “Predictable Price Pressure,” Hartzmark S, Solomon D. University of Chicago Working Paper, revised October 2021.

“Institutional Corporate Bond Pricing,” Bretscher L, Schmid L, Sen I, Sharma V. London Business School Working Paper, revised December 2021.

“Inspecting the Mechanism of Quantitative Easing in the Euro Area,” Koijen R, Koulischer F, Ngyuen B, Yogo M. NBER Working Paper 26152, revised March 2021, and Journal of Financial Economics 140(1), April 2021, p. 120. “The Impact of Pensions and Insurance on Global Yield Curves,” Greenwood R, Vissing-Jorgensen A. Harvard University Working Paper, December 2018.

“The Demand for Treasury Debt,” Krishnamurthy A, Vissing-Jorgensen A. NBER Working Paper 12881, January 2007. Published as “The Aggregate Demand for Treasury Debt” in the Journal of Political Economy 120(2), April 2012, pp. 233–267.

“Exchange Rates and Asset Prices in a Global Demand System,” Koijen R, Yogo M. NBER Working Paper 27342, June 2020.

“From World Banker to World Venture Capitalist: US External Adjustment and the Exorbitant Privilege,” Gourinchas P, Rey H. NBER Working Paper 11563, August 2005.

“Inspecting the Mechanism of Quantitative Easing in the Euro Area,” Koijen R, Koulischer F, Ngyuen B, Yogo M. NBER Working Paper 26152, revised March 2021, and Journal of Financial Economics 140(1), April 2021, pp. 1–20.

“Which Investors Matter for Equity Valuations and Expected Returns?” Koijen R, Richmond R, Yogo M. NBER Working Paper 27402, June 2020.

We review this literature in Financial Economics of Insurance, Koijen R, Yogo M. 2022, forthcoming from Princeton University Press.

“A Demand System Approach to Asset Pricing,” Koijen R, Yogo M. NBER Working Paper 21749, revised July 2019, and Journal of Political Economy 127(4), August 2019, pp. 1475–1515.

“In Search of the Origins of Financial Fluctuations: The Inelastic Markets Hypothesis,” Gabaix X, Koijen R. NBER Working Paper 28967, June 2021.