The 2018 Martin Feldstein Lecture: The Two Faces of Liquidity

It has been about 10 years since the global financial crisis. What have we learnt about it? The behavior of financial-sector participants was clearly aberrant, and needed to be rectified. We have had a tremendous amount of regulation since then, especially focused on banks. Whether this will solve the underlying problems is an issue that is much debated. Yet we have at least attempted to tackle the problems of poor incentives and distorted financial firm capital structures, including mismatched asset-liability structures.

We have paid far less attention to the shadow financial sector — the financial institutions other than the banks — or to the role of macroeconomic conditions in precipitating the crisis. We do acknowledge the need to bring the shadow sector under the regulatory net, for we did learn that institutions can infect one another through common markets. We are less clear about what ought to be done. On macroeconomic conditions, even when we do acknowledge a role, when it comes to altering policy, we shrug and move on. Somehow, it seems that we have agreed that macroeconomic conditions are outside the remit of anyone tasked with addressing financial stability. I will argue in my talk today that this is a mistake.

Financial Conditions and Monetary Policy

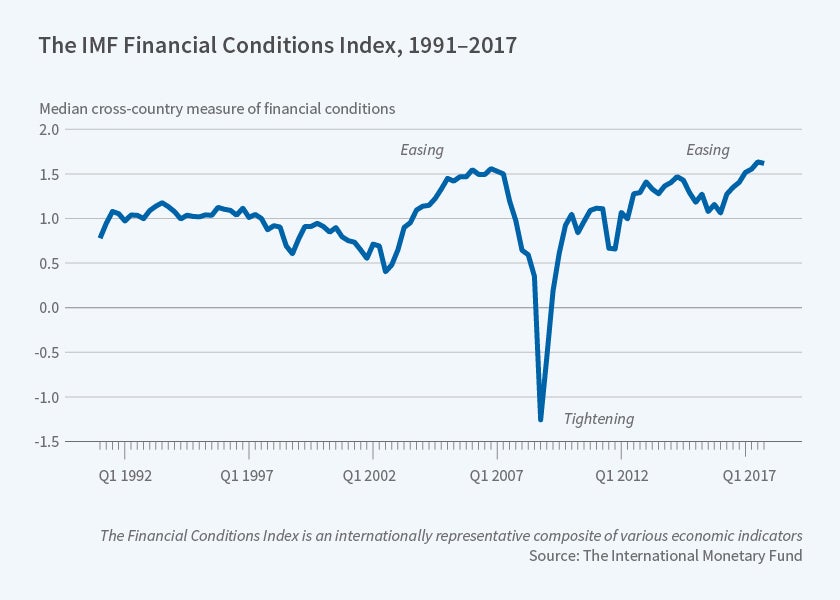

Figure 1, computed by the IMF, is the median at every point in time of the distribution of financial conditions across countries, with higher being easier.1

What we see is that leading up to the financial crisis, we have a tremendous easing of financial conditions, even though the Fed started raising the federal funds rate in June 2004. As the crisis spread in 2007, we had an extremely sharp tightening of financial conditions. By the middle of 2009, you see financial conditions easing once again, and they have continued to become much easier.

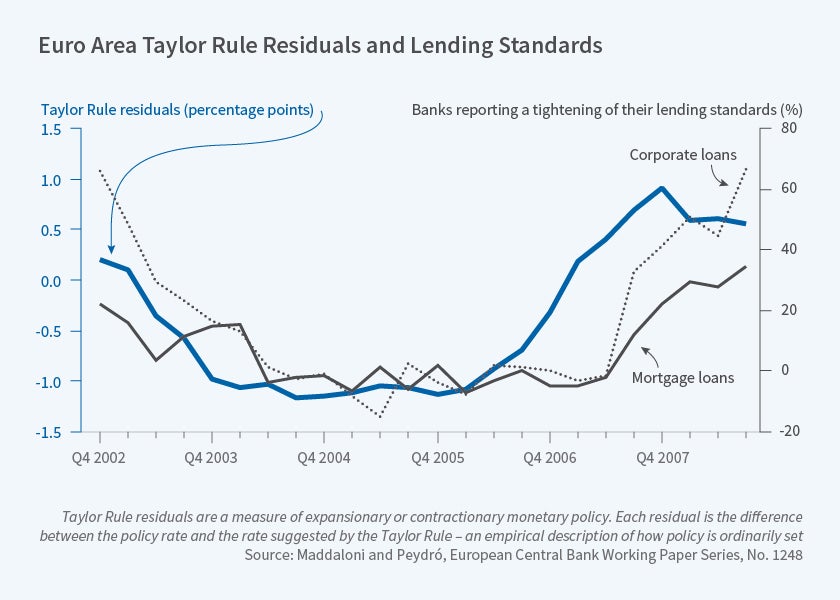

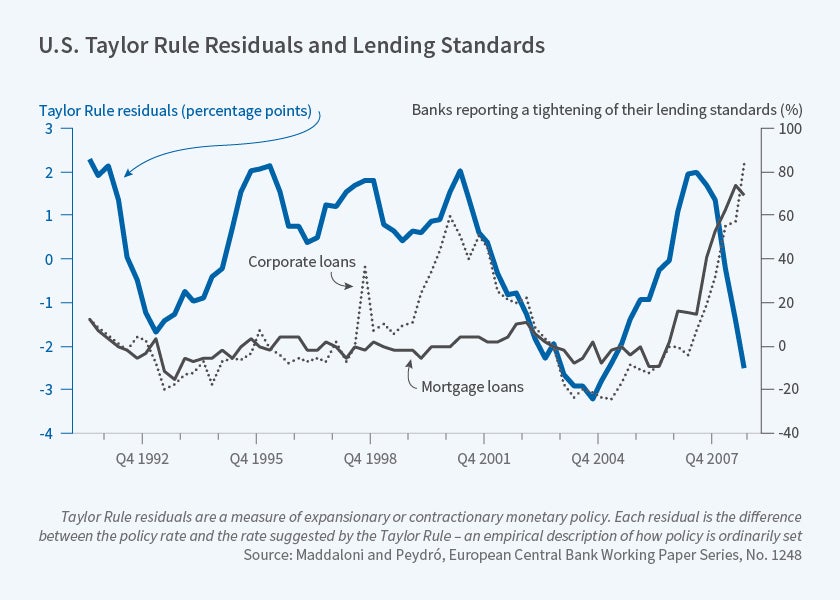

Now consider two figures from the work of Angela Maddaloni and José-Luis Peydró.2

Figure 2 suggests that monetary policy in the Eurozone was very accommodative before the crisis, as measured by Taylor rule residuals (the difference between policy rates and rates suggested by the Taylor rule, an empirical description of how policy is ordinarily set). It also indicates that lending standards for corporate loans and mortgage loans did not start tightening until after Taylor rule residuals became positive. In other words, there seems to be a lag between a tightening of monetary policy and a tightening of representative elements of financial conditions.

In Figure 3, we see a similar picture for the United States, with major components of financial conditions tightening with a lag, especially after Taylor rule residuals become positive. Put differently, part of the reason there is so much of a gap between when the Fed started raising interest rates and when financial conditions started tightening may well be because monetary conditions remained very accommodative until 2006.

These figures are obviously not proof that credit conditions remained easy before the crisis because monetary policy was easy. All I want to establish is that it is not entirely ridiculous to argue that monetary policy's influence needs to be investigated in any post-mortem of the crisis. However, for the rest of the talk, it is sufficient for my purposes if you grant me that financial conditions were easy for a long period before the crisis.

The Consequences of Easy Financing Conditions

What are the consequences of easy financing conditions? The seminal work of Claudio Borio and Philip Lowe suggests sustained rapid credit growth combined with large increases in asset prices increases the probability of an episode of financial instability.3 More recently, in a study of crises, Arvind Krishnamurthy and Tyler Muir show that credit growth and credit spreads are negatively correlated before a crisis begins, with spreads widening a little only just before the onset of the crisis.4 The change in credit spreads as the crisis occurs seems to predict the extent of the subsequent output decline. It seems the credit markets do not really price in the crisis until it is almost upon them; the greater their complacency, the greater seems the gravity of the crisis. David López-Salido, Jeremy Stein, and Egon Zakrajšek5 and Atif Mian, Amir Sufi, and Emil Verner6 find similar effects. What theories might account for this?

Three come immediately to mind. One is herd behavior in banking markets. Perhaps the most famous statement made before the crisis was by Chuck Prince, the chairman of Citigroup, who responded thus to a question from the Financial Times: "When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing."

I met Mr. Prince at a conference a few years later and I asked him, "So why did you say that?" He responded that he had a whole lot of investment bankers who were doing deals. And while he was aware the quality of deals was falling, he knew that if he stopped them from doing more deals, they would have left immediately for a job with the competition. Hiring and grooming people is tough. So in an attempt to preserve the franchise, so to speak, he had to let them go a little more to the edge.

Now, of course, he was making a calculation that retaining these people was more important than the cost to the balance sheet in terms of deteriorating credit quality. The statement came back to haunt him. But nevertheless, there was a rationale, which is that since everybody was doing it, Citi could not be the only one to stop. Herd behavior models of banking such as one I have analyzed have this flavor; being the lone lender to stop lending has costs.7 For instance, in a credit boom, loan officers may believe they have to maintain the pretense that they have really good lending prospects, and credit quality has not deteriorated, since no one else seems to be worried or shows signs of problems. Rather than be singled out as the incompetent lender who cannot find good prospects, the loan officer ensures credit spreads do not reflect deterioration, and neither does loan volume. Indeed, if any borrower cannot repay, he lends him more money to paper over default, thus "ever-greening" the loan. It is only when credit problems become overwhelming, marking the start of the crisis, that banks start declaring their true losses and stop lending, at which point it is much easier for everyone else to disclose their mistakes, since they will no longer be outliers. The longer the period of hiding, of course, the greater the losses that have built up, and the greater the deterioration in credit quality when the crisis starts.

Then there are true behavioral models such as that of Nicola Gennaioli, Andrei Shleifer, and Robert Vishny in which investors get lulled by a series of good signals to overweight the probability that the state of the world is good.8 A few bad signals do not cause investors to worry that the bad state may be imminent, because they still think the good state is likely. Eventually, though, enough bad news leads to a radical change in beliefs, and investor pessimism causes the financial crisis. So there is a neglect of the "tail" bad state initially and excessive credit extension, an initial underreaction to bad news, and eventually, overreaction.

A different behavioral model, in which there is a distribution of optimists and pessimists in the economy, is advanced by John Geanakoplos.9 Relative to pessimists, optimists think there is a higher probability of the good state, where the price of the asset being traded will be higher still. They are willing to buy the asset, and even borrow to buy yet more. The pessimists sell at the price available in the market, and lend money to the optimists. The arrival of good news therefore enhances the wealth of optimists, and their positive views have greater impact on the asset price. In contrast, bad news renders a few optimists bankrupt, and allows the consequent preponderance of pessimists to push down the asset price. Therefore there is overreaction to news in either direction because it changes the wealth of players, and therefore effectively changes the monetary weight placed on beliefs. So behavioral explanations of various kinds could be useful in explaining the abrupt shift that we saw from the complacency before the crisis to the panic once it got underway.

A Liquidity-based Model of the Consequences of Easy Financing Conditions

As if we do not already have enough models, let me add one more. Unlike these other models, it will relate leverage increases and spread declines directly to the easy liquidity that prevailed before the crisis. It will explain why spreads were flat until just before the crisis. We will see why sustained expectations of high future liquidity can make the subsequent downturn longer and deeper, other than just through the increase in leverage during the run-up to the crisis and the change in expectations at its onset. This model is detailed in my work with Douglas Diamond and Yunzhi Hu.10 Essentially, I will argue that high expectations of liquidity can be problematic.

I will then propose another liquidity-based model to explain why the downturn was so sharp and the recovery so abrupt. Taken together, we will see the two faces of financial liquidity, the title of this talk, and why the authorities have the serious challenge of keeping liquidity at the right level — neither too high nor too low.

Consider an industry that requires special industry knowledge to produce. Within the industry, there are firms run by expert incumbents. There are also industry insiders, who know the industry well enough to be able to run firms as efficiently as the incumbents. Industry outsiders — such as financiers who don't really know how to run industry firms but have general managerial/financial skills — are the other agents in the model.

Financiers have two sorts of control rights; first, control through the right to repossess and sell the underlying asset being financed if payments are missed, and second, control over cash flows generated by the asset. The first right only requires the frictionless enforcement of property rights in the economy, which we assume. It has especial value when there is a large number of capable potential buyers willing to pay a high price for the firm's assets. Greater wealth amongst industry insiders — which we term industry liquidity — increases the availability of this asset-sale-based financing. Because we analyze a single industry, high levels of this industry liquidity can be interpreted as an economy-wide boom. Easy monetary policy, with lower than normal policy rates, would contribute positively to industry liquidity. Clearly, this kind of control right is exogenous to the firm.

The second type of control right is more endogenous, and conferred on creditors by the firm's incumbent manager as she makes the firm's cash flows more appropriable by, or pledgeable to, creditors over the medium term. She could do this, for example, by improving accounting quality or setting up escrow accounts so that cash flows are hard to divert. We assume enhancing pledgeability takes time to set up but is also semi-durable; improving accounting quality is not instantaneous, because it requires adopting new systems and hiring reputable people, but equally, firing a reputable accountant or changing accounting practices has to be done slowly — perhaps at the time the accountant's term ends — if it is not to be noticed. So the incumbent manager sets pledgeability one period in advance, and it lasts a period.

The two sources of control rights interact. When anticipated industry liquidity is sufficiently high, increased pledgeability has no effect on how much industry insiders will bid to pay for the firm; they have enough wealth to buy the firm at full value without needing to borrow much against the firm's future cash flows. Higher pledgeability is not needed for enhancing bids when the industry is very liquid. When anticipated liquidity is lower so that industry insiders have to borrow substantially to bid for the firm, higher pledgeability does enhance their bids.

Let us now understand an incumbent firm manager's incentives while choosing cash flow pledgeability for the next period. Let us assume she may have some reason to sell some or all of the firm next period with some probability, either because she is no longer capable of running it or she needs to finance a new investment. Higher pledgeability generally increases the price at which she can sell the firm when she is no longer capable of running it, because industry insiders can borrow against future pledgeable cash flows to finance their bids for the firm. It increases the firm's debt capacity up front — we assume the incumbent has bought the firm by borrowing as much as she can to buy it, which also allows us to examine leverage choices.

However, having borrowed up front, the incumbent faces moral hazard associated with pledgeability. A higher bid from industry insiders also enables the existing creditors to collect more if the incumbent stays in control, because the creditors have the right to seize assets and sell them when not paid in full. In such situations, the incumbent has to "buy" the firm from creditors, by outbidding industry insiders or paying debt fully, which reduces her incentive to enhance pledgeability.

The tradeoff in setting pledgeability depends both on the probability she will need to sell and on the amount that she has promised to pay creditors — as well as industry liquidity, as explained earlier. A higher promised payment increases the amount that she needs to pay to "buy" the firm from creditors but reduces the residual proceeds that she receives if she sells the firm. Therefore, higher promised payments exacerbate the incumbent's moral hazard associated with pledgeability, and when they exceed a threshold, the incumbent will set pledgeability low. Anticipating this, creditors will limit how much they will lend to the incumbent up front.

In sum then, we have two outside influences on pledgeability — the anticipated liquidity of industry insiders and the level of outstanding debt. In normal times, the need to provide the incumbent incentives for pledgeability keeps up-front borrowing moderate. As prospective industry liquidity increases, though, the incumbent is able to borrow more to finance the asset, while still retaining the incentive to set pledgeability high. The credit spreads that lenders charge are contained, even as borrowing increases.

However, consider now a sustained boom that is anticipated to continue with high probability, where industry insiders will have plenty of wealth. Repayment of any corporate borrowing today is enforced entirely by the potential high resale value of the firm — at the future date, wealthy industry insiders will bid full value for the firm without needing high pledgeability to make their bid, as described by Shleifer and Vishny.11

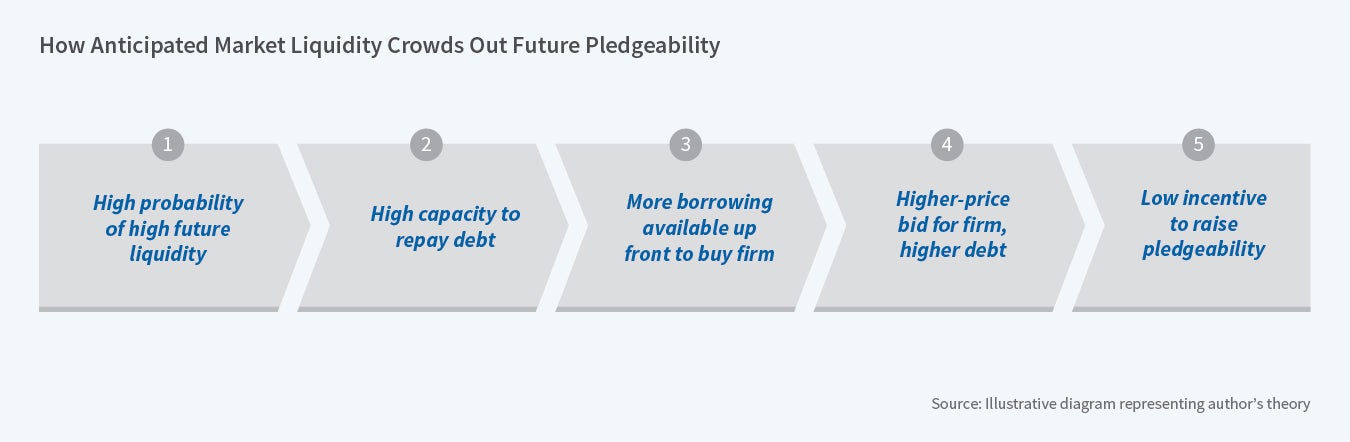

Since pledgeability is not needed to enforce repayment in a future highly liquid state, a high probability of such a state encourages high borrowing up front, which crowds out the incumbent's incentive to enhance pledgeability, even if there is a possible low liquidity state where pledgeability is needed to enhance creditor rights. In other words, when prospective liquidity exceeds a threshold, lenders stop imposing any constraint on leverage, and take their chances if that liquidity does not materialize. Leverage increases, but becomes riskier. Figure 4 summarizes this sequence.

A crisis or downturn under these circumstances occurs when liquidity does not materialize. If the low liquidity state is realized, the enforceability of the firm's debt, as well as its borrowing capacity, will fall significantly because pledgeability has been set low. Industry insiders, also hit by the downturn, no longer have much personal wealth, nor does the low cash flow pledgeability of the firm allow them to borrow against future cash flows to pay for acquiring the firm. The firm's debt capacity falls significantly, and it gets into financial distress. Credit spreads rise substantially, and they will stay high until the firm raises pledgeability, which will take time, or industry liquidity comes back up, which could take even longer. The neglect of pledgeability because of high leverage at the end of a sustained boom makes the recovery difficult and drawn out.

Testable Implications

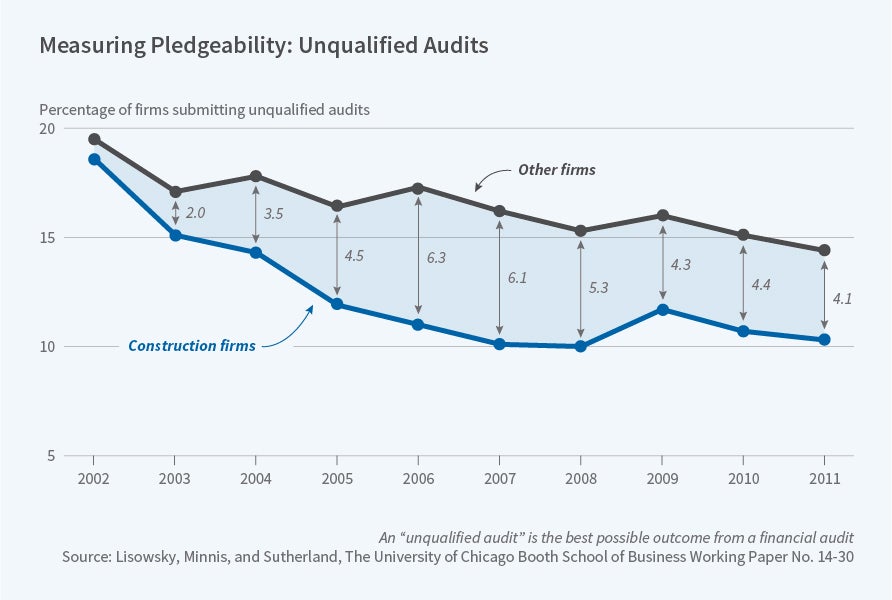

The testable implications of this model are that pledgeability falls as high liquidity persists.12 There is a greater fall in industries that are undergoing booms. Conversely, it rises over time when liquidity dries up. Petro Lisowsky, Michael Minnis, and Andrew Sutherland examine the percentage of unqualified (that is, good) audits submitted to bankers by firms in the booming construction industry before the crisis.13 As Figure 5 shows, that percentage fell steadily before the crisis, only to stabilize when the crisis hit. Of course, since other industries were booming, the percentage fell for them also.

So what we really want to see is the difference between the construction industry and others. As is clear from Figure 5, the gap increased until about 2006, around the time monetary policy started getting tight by the Taylor rule measure or around the time financial conditions started tightening. The gap then reversed. In sum, pledgeability did fall during the construction industry boom, only to reverse course, albeit slowly, as tight liquidity set in.

Recoveries following periods of an asset price boom and high leverage are thus delayed, not just because debt has to be written down — and undoubtedly frictions in writing down debt would increase the length of the delay — but also because firms have to restore the pledgeability of their cash flows to cope with a world where liquidity is scarcer. It is the need to raise pledgeability that may make the downturn more prolonged. Higher anticipated liquidity in some future states can therefore induce more eventual misallocation in less-liquid states, a spillover effect between states that operates through leverage and pledgeability!

The Sharp Onset of the Crisis

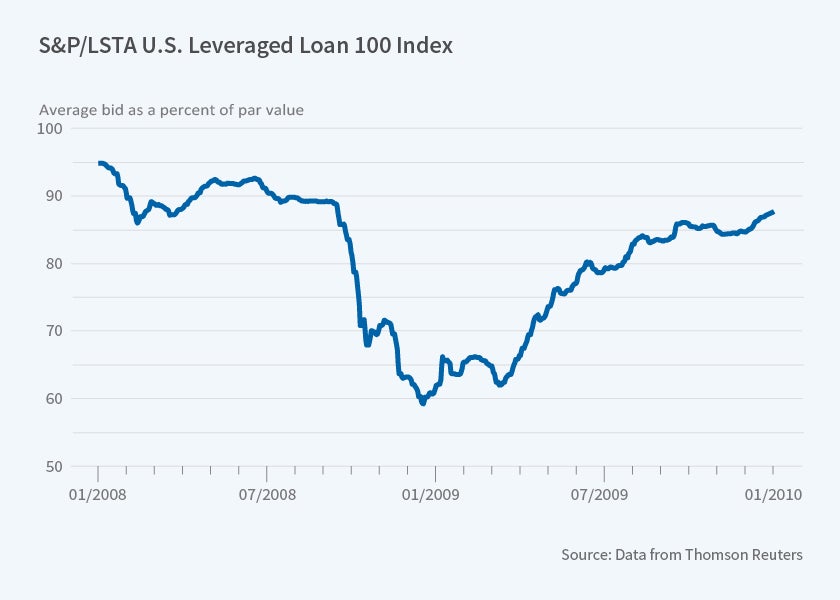

As the crisis hit, illiquidity spread through the economy, not just among corporate assets where issues like pledgeability might be a concern. Liquidity dried up for a large set of financial assets, with significant price drops and high bid/ask spreads. Consider, for example, instruments issued on the U.S. Leveraged Loan 100 Index. Figure 6 shows that the average bid collapsed from around 90 cents on the dollar to just above 60 cents around September 2008 (the Lehman Brothers crisis), while the bid/ask spread blew out from about 100 basis points to over 300 basis points. A steady recovery to normal levels started around mid-2009.

Bankers alleged a "buyers" strike during this period. What they meant, presumably, was that the market was clearing at such a low price for financial assets that few wanted to sell if they could hold on. Arbitrage opportunities also appeared, such as a large negative bond-CDS basis, which meant that a riskless position paying a positive spread over Treasuries could be created, provided one could borrow.

And there was the nub. No one, including well-capitalized liquid financial institutions, seemed willing to lend. There was a sharp rise in central bank reserves held by commercial banks from around the time of the Lehman failure, suggesting they were holding cash instead of lending. Why was there this flight to liquidity?

To explain the extreme tightness in credit and the decline in trading, I will appeal to the idea of liquidity again, this time the liquidity — or illiquidity — of financial institutions identified by Diamond and myself.14 Here is the idea: Let a set of banks which we will term "fragile," with substantial short-term liabilities, have a significant quantity of assets that have a limited set of potential buyers. One example of such an asset is a mortgage-backed security which, in an environment in which some mortgages have defaulted, can be valued accurately only by some specialized firms such as BlackRock or KKR. Furthermore, let us assume that, with some probability, the fragile banks will need to realize cash quickly in the future. Such a need for cash may stem from unusual demands of the banks' customers, who draw on committed lines of credit or on their demandable deposits. It may also stem from panic, as depositors and customers, fearing the bank could fail, pull their deposits and accounts from the bank. Regardless of where the demand for liquidity comes from, it would force banks to sell assets or, equivalently, raise money quickly at a future date. Given that the potential buyers for the bank's assets, like BlackRock and KKR, have limited resources and will drive a hard bargain, the asset would have to be sold at fire sale prices (Shleifer and Vishny, and Franklin Allen and Douglas Gale).15

One consequence of the prospective fire sale is that it may depress asset values so much that the bank is insolvent. This may precipitate a run on the bank, which may cause more assets to be unloaded on the market, further depressing the price. Importantly, the returns to those who have excess liquid cash at such times can be extraordinarily high.

Folding back to today, the prospect of a future fire sale of the bank's asset can depress the asset's current value — investors need to be enticed through a discount to buy the asset today, otherwise they have an incentive to hold back because of the prospect of buying the asset cheaper in the future. More generally, the high returns potentially available in the future to those who hold cash can cause them to demand a high return for parting with that cash today.

However, the elevated required rate of return now extends to the entire segment of the financial market that has the expertise to trade the security. If this segment also accounts for a significant fraction of the funding for potential new loans, the elevated required rate of return will be contagious and also will depress lending. Moreover, the overhang of fragile banks will affect lending not only by distressed banks but also by healthy potential lenders, a feature that distinguishes this explanation from those where the reluctance to lend is based on the poor health of either the bank or its potential borrowers. Note that the adverse effect of prospective future illiquidity on current lending is absent in models where future asset values are low for other reasons, such as reduced future payoffs. In such cases, low asset values do not lead to an elevated rate of return to buyers.

More surprising though, the fragile bank's management, knowing that the bank could fail in some states in the future, does not have strong incentives to sell the illiquid asset today, even though such sales could save the bank — sales of the asset subject to potential fire sales dry up. The reason is simple. By selling the asset today, the bank will raise cash that will bolster the value of its outstanding debt by making it safer. But in doing so, the bank will sacrifice the returns that it would get if the currently depressed value of the asset recovers. Since the states in which the depressed asset value recovers are precisely the states in which the bank survives, bank management would much prefer holding on to the illiquid assets and risking a fire sale and insolvency to selling the asset and ensuring its own stability in the future. Indeed, the bank would prefer to spend its cash to load up more on securities that are exposed to the liquidity risk because its private valuation for those securities exceeds the market's valuation. Fragile banks become "illiquidity seekers."

The intuition here is clearly analogous to the risk-shifting motive of Michael Jensen and William Meckling16 and the underinvestment motive of Stewart Myers,17 though the bank "shifts" risk or underinvests in our model by refusing to sell an illiquid asset rather than by taking on, or not taking on, a project. Also, illiquid institutions not only act as an overhang over the market, elevating required rates of return, but they also risk future insolvency by holding on to the assets, further elevating required returns. Thus, there is an inherent source of adverse feedback in any financial crisis, which is why cleaning up the financial system ex post may be an important contributor to recovery. At the same time, ex ante regulation to prevent an excessive buildup of exposure to liquidity risk may also be warranted.

In sum then, this model can explain both the trading freeze as well as the credit freeze that occurred after the Lehman debacle. The market feared that there were many banks with hard-to-sell assets, and these assets would be dumped on the market if these fragile banks had to meet demands for liquidity. Hoping no such liquidity demand would materialize, banks held on to the hard-to-sell assets, for these would generate high returns under those conditions. Anticipating that such liquidity would be demanded with high probability, thus forcing fire sales by fragile banks, healthy financial firms held on to cash so that they could put it to work at that time when returns would be high. Credit therefore became scarce, thus opening up arbitrage opportunities wherever borrowing was needed to close them.

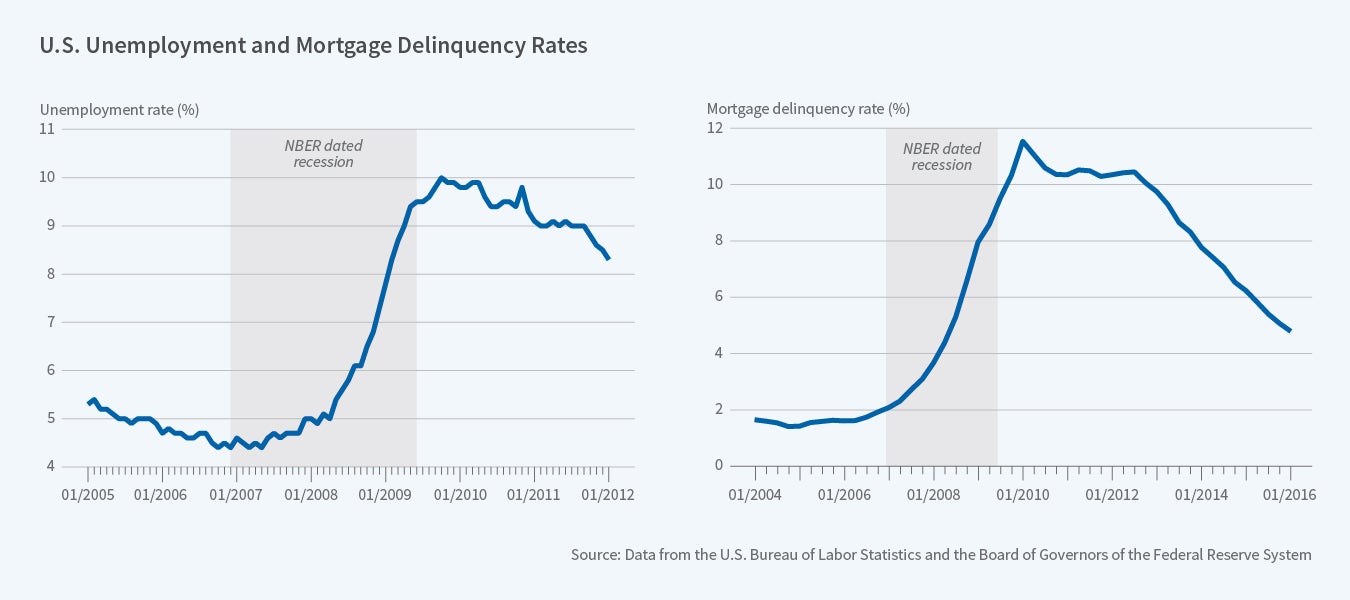

Finally, what explains the recovery in asset prices, the decline in spreads, and the disappearance of arbitrage opportunities? Was it good news on fundamentals? While the NBER dated the recovery from June 2009, that dating happens only much later. As seen in Figure 7, unemployment stabilized only in 2010, and the first month without job losses was November 2009. It is hard to imagine that it was well known that the recovery was underway from mid-2009.

Was it good news on mortgages? As seen in Figure 7 on the next page, delinquencies started declining steadily only in mid-2012.

Why then did markets start returning to normal around mid-2009? Arguably, it was a sequence of Fed emergency programs but especially the stress tests conducted by the Federal Reserve in March 2009, with the results announced in May 2009, which were responsible. The regulators examined 19 banks, and 10 were asked to raise capital. The details of each bank's examination were made public. Moreover, capital was set to be raised so that bank assets would not shrink. Finally, the Treasury backstopped banks that could not raise capital with its Capital Assistance Program.

By forcing banks to become healthy, and implicitly guaranteeing they would be, the stress tests effectively removed the overhang of potentially insolvent or highly illiquid banks, thus reducing returns from purchasing in potential fire sales or holding on to illiquid assets, thus allowing trading and lending to resume. Bid/ask spreads narrowed, asset prices recovered, and arbitrage opportunities dwindled.

In sum then, the lesson to take away from this model is that anticipated illiquidity can lead to frozen markets and credit. The authorities may need to clean up a system even in the midst of a crisis in order to restore trading and lending. So liquidity infusion into the markets and capital infusion into specific institutions may be necessary to stabilize the financial system. Of course, if a little liquidity infusion is good, why not do more, and more permanently? This seems to be the lesson financial authorities have drawn.

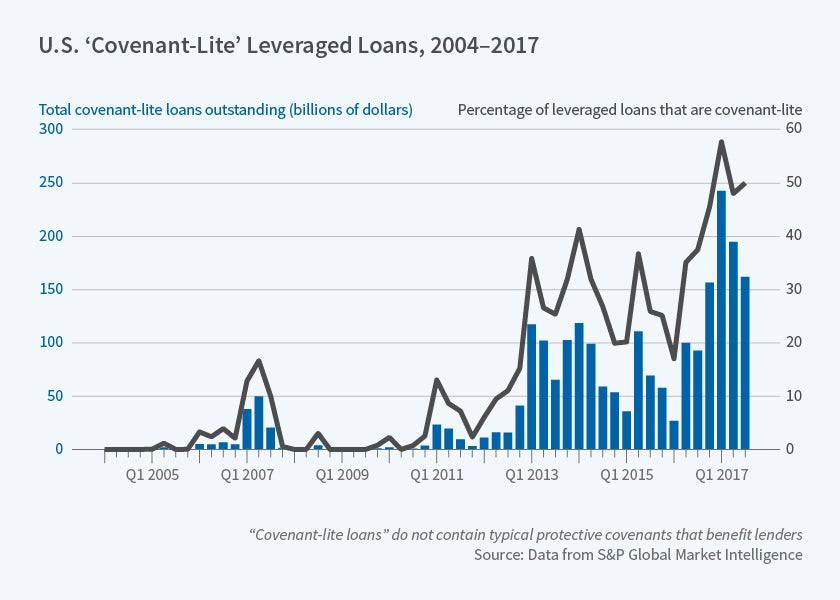

If we go back to Figure 1, financial conditions across the world are now again as easy as they have ever been. But as we saw from the first model, too much liquidity can also be bad, for it induces leverage and causes financial sector participants to effectively neglect risks. Indeed, if we look at the volume of covenant-lite loans today in Figure 8, it dwarfs the quantity before the global financial crisis.

The bottom line is that both too little, as well as too much, anticipated liquidity can be problematic for financial stability. To the extent that accommodative financing conditions (i.e., easy liquidity) are caused by accommodative monetary policy, it suggests monetary policy and financial stability cannot be separated.

How should monetary policy take financial stability into account? This, to my mind, is the huge unaddressed issue since the crisis, though some papers — for example, one by Diamond and myself,18 and another by Emmanuel Farhi and Jean Tirole19 — have made beginnings. Today, liquidity is slowly in the process of being withdrawn. Will we have better or worse outcomes than the previous time liquidity was withdrawn? I don't know, though it is clear we will have some stress in pockets where leverage has built up as easy financial conditions change. We have to see whether, this time around, it is indeed different.

Endnotes

The Financial Conditions Index, presented in the IMF's Global Financial Stability Report, is a composite of short-term rates, long-term real rates, term spread, corporate spread, interbank spread, equity price growth, equity return volatility, credit to GDP, credit growth, and house price growth.

A. Maddaloni and J. Peydró, "Bank Risk-Taking, Securitization, Supervision, and Low Interest Rates: Evidence from the Euro Area and the U.S. Lending Standards," European Central Bank Working Paper 1248, 2010, pp. 2121–65.

C. Borio and P. Lowe, "Asset Prices, Financial and Monetary Stability: Exploring the Nexus," BIS Working Paper 114, 2002.

A. Krishnamurthy and T. Muir, "How Credit Cycles Across a Financial Crisis," Stanford Graduate School of Business Working Paper, 2017.

D. López-Salido, J. Stein, and E. Zakrajšek, "Credit-Market Sentiment and the Business Cycle," Quarterly Journal of Economics, 132(3), 2017, pp. 1373–1426.

A. Mian, A. Sufi, and E. Verner, "Household Debt and Business Cycles Worldwide," Quarterly Journal of Economics, 132(4), 2017, pp. 1755–1817.

R. Rajan, "Why Bank Credit Policies Fluctuate: A Theory and Some Evidence," Quarterly Journal of Economics, 109(2), 1994, pp. 399–441.

N. Gennaioli, A. Shleifer, and R. Vishny, "Neglected Risks: The Psychology of Financial Crises," American Economic Review, 105(5), 2015, pp. 310–14.

J. Geanakoplos, "The Leverage Cycle," NBER Macroeconomics Annual 2009, 24(1), 2010, pp. 1–65, .

D. Diamond, Y. Hu, and R. Rajan, "Pledgeability, Industry Liquidity, and Financing Cycles," NBER Working Paper 23055, January 2017.

A. Shleifer and R. Vishny, "Liquidation Values and Debt Capacity: A Market Equilibrium Approach," Journal of Finance, 47(4), 1992, pp. 1343–66.

For the interested reader, related recent papers include: V. Acharya and S. Viswanathan, "Leverage, Moral Hazard, and Liquidity," Journal of Finance, 66(1), 2011, pp. 99–138; J. Dow, G. Gorton, and A. Krishnamurthy, "Equilibrium Investment and Asset Prices Under Imperfect Corporate Control," American Economic Review, 95(3), 2005, pp. 659–81; and A. Eisfeldt and A. Rampini, "Managerial Incentives, Capital Reallocation, and the Business Cycle," Journal of Financial Economics, 87(1), 2008, pp. 177–99.

P. Lisowsky, M. Minnis, and A. Sutherland, "Economic Growth and Financial Statement Verification," Journal of Accounting Research, 55(4), 2017, pp. 745–94.

D. Diamond and R. Rajan, "Fear of Fire Sales, Illiquidity Seeking, and the Credit Freeze," Quarterly Journal of Economics, 126(2), 2011, pp. 557–91.

F. Allen and D. Gale, "Limited Market Participation and Volatility of Asset Prices," American Economic Review, 84(4), 1994, pp. 933–55.

M. Jensen and W. Meckling, "Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure," Journal of Financial Economics, 3(4), 1976, pp. 305–60.

S. Myers, "Determinants of Corporate Borrowing," Journal of Financial Economics, 5(2), 1977, pp. 147–75.

D. Diamond and R. Rajan, "Illiquid Banks, Financial Stability, and Interest Rate Policy," Journal of Political Economy, 120(3), pp. 552–9, https://doi.org/10.1086/666669