Price Dispersion and Bargain Hunting in the Macroeconomy

In macroeconomic models, product markets are typically very simple. Consumers are treated as price-takers while firms trade against fixed demand curves. There is little that either households or firms can do to affect the terms of trade that they face in product markets.

But in reality there are many actions that buyers can take to influence the prices they pay. For example, in the retail market, households can pay more attention to price comparisons, travel to different stores, visit stores more frequently, switch brands, buy in bulk, or use coupons. In the wholesale market, firms can devote more resources to negotiating purchasing contracts or to exploring alternative suppliers. I refer to these actions collectively as bargain hunting. Similarly, sellers can take actions to alter the effective elasticity of demand that they face — for example, by expanding their presence in product markets through advertising, introducing new products, entering new geographic or demographic markets, or investing in long-term customer acquisition.

My research, carried out with a number of collaborators, has explored the implications of exerting effort in product markets for the behavior of the macroeconomy, both empirically and theoretically.

Different People, Different Prices

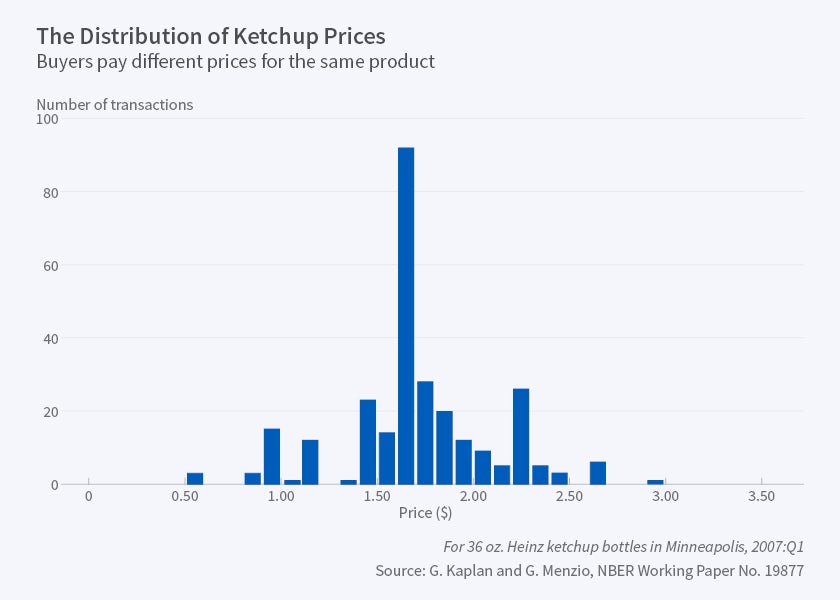

Bargain hunting presupposes that it is actually possible for a buyer to purchase the same product at more than one price. And if bargain hunting is indeed going on, then we should expect to see buyers differ in the prices they ultimately pay, in a way that is correlated with the effort they exert. A good area to start investigating bargain hunting is among final consumers in retail markets, because of the availability of detailed data on retail prices and household shopping behavior. Guido Menzio and I built on a long literature documenting price dispersion among identical goods by conducting a comprehensive investigation into the nature of price dispersion in the retail sector, with a view to relating this dispersion to bargain hunting.1

Consistent with previous studies, we confirmed that price distributions for identical goods (as defined by their bar codes) in a given geographic market and time period, are highly dispersed; on average the standard deviation of log prices is around 20 percent. However, perhaps surprisingly, only a small fraction of this dispersion arises because some stores are more expensive than other stores. We can infer this because our scanner data allows us to observe the same store selling lots of different goods, the same good sold at lots of different stores, and the same good being sold at the same store in many different transactions. Most of the observed dispersion in prices actually takes place within stores. About half is due to a transaction component that captures both temporal variation in the price of a good at a given store due to temporary sales and other price changes and the fact that not all customers pay the same price for the same good on the same day because, for example, some use coupons or loyalty cards. The other half is due to persistent differences in the prices charged for a given product across stores that are equally expensive on average.

We refer to this latter component as relative price dispersion; in a follow-up paper with Nicholas Trachter and Leena Rudanko, we confirmed its existence using a much larger scanner dataset and more systematic methods.2 We borrowed our empirical approach from labor economics, decomposing price distributions into components with different dynamic properties. This allowed us to measure how much of within-store price dispersion is due to temporal variation, like sales, and how much is due to persistent price differences. An important feature of relative price dispersion is that it implies asymmetries in the average price of different goods at different retailers: one seller may price high in one good and low in another, while another seller sets a low price for the former good and a high price for the latter good, even though on average the two sellers charge the same price for the bundle.

Price dispersion arising from either temporal variation or persistent price differences is amenable to bargain hunting. For example, temporary sales present the opportunity to time purchases in order to take advantage of lower prices; while relative price dispersion presents the opportunity to split shopping across multiple stores in order to buy each product where it is cheapest. Both types of bargain hunting require effort on the part of households, the extent of which differs across households and responds to idiosyncratic and aggregate shocks.

But households don't subsist on a single good — rather they consume large bundles of goods. Does all this heterogeneity in prices wash out at the level of the household bundle? Or is there dispersion also in household-level price indexes, i.e. in the price of bundles? Following the approach of Mark Aguiar and Erik Hurst, who investigated differences in prices paid between working-age households and retirees,3 we also examined price index distributions, and performed a similar decomposition into store components, store-good components, and transaction components. We found that there is about half as much dispersion in household price indexes as there is in prices — a standard deviation of logs of around 10 percent. Less than half of this dispersion arises because different households concentrate their shopping at different sets of stores. Rather, price index dispersion arises predominantly because different households exhibit a variety of shopping patterns at the same set of stores — shopping more or less frequently, visiting more or fewer stores on a given shopping trip, timing purchases more or less effectively, using or not using coupons.

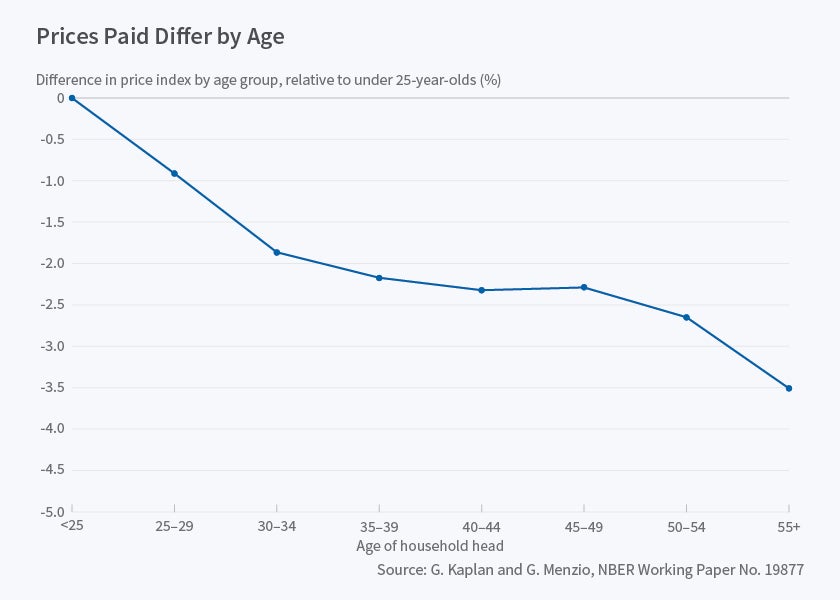

The natural next question is which households pay lower prices and which bargain hunting activities enable them to do so. We confirmed Aguiar and Hurst's finding that older households pay lower prices than younger households. We also found that households with more employed members pay significantly higher prices than households with fewer employed members, even conditional on age. Both age and employment can be interpreted as proxies for the shadow value of time, so these findings are consistent with a setting in which bargain hunting is a time-consuming activity. Indeed, regressing household price indexes on the frequency of shopping trips, the number of stores visited, and intensity of coupon usage reveals that all three are strongly associated with paying lower prices. Visiting more stores has a particularly strong effect on household price indexes.

The Inflation Rate?

Macroeconomists care about inflation, so Sam Schulhofer-Wohl and I wondered whether the vast heterogeneity in price levels translates into heterogeneity in inflation and, if so, whether household inflation is linked to bargain hunting.4 This is potentially important for monetary policy because it means that measured inflation may, in part, be determined by changes in the aggregate amount of bargain hunting.

It turns out that this is the case. Using household-level scanner data, we measured differences across households in their realized inflation rates. We found that although the distribution of realized inflation rates is centered around the aggregate inflation rate, there is tremendous inflation heterogeneity across households. The inter-quartile range of inflation rates in a typical year is around 7 percentage points. This implies huge differences across households in realized inflation — an order of magnitude larger than the time-series variation in the Consumer Price Index. Most of this variation is not attributable to differences across households in the particular products that they purchase; rather it is attributable to differences across households in the prices they pay for identical goods. In other words, inflation heterogeneity is a consequence of the price index heterogeneity described above. Moreover, inflation heterogeneity seems also to be related to bargain hunting: we found an increase in the number of shopping trips to be associated with a decrease in inflation, and vice versa.

We then explored the time-series properties of household-level inflation rates to ascertain whether time-variation in realized inflation rates for a given household causes inflation heterogeneity to wash out at longer horizons. This would be the case if, for example, household inflation rates were strongly negatively correlated over time. We find that inflation rates are only mildly negatively correlated, with an auto-correlation of –0.1 to –0.2, implying that price levels are persistent but not permanent, with a serial correlation of about 0.7 to 0.8.

To put the extent of this inflation heterogeneity and persistence in perspective, it is useful to ask how much of the overall inflation volatility experienced by a typical household is due to fluctuations in the aggregate inflation rate, as opposed to fluctuations in the deviation of its realized idiosyncratic inflation from aggregate inflation. Our findings suggest that over the last decade, fluctuations in the aggregate inflation rate contribute almost nothing to the fluctuations in inflation that households actually experience. In the recent environment of relative aggregate price stability, our findings suggest that bargain hunting, in addition to monetary policy, matters for the prices that individual households pay.

From Bargain Hunting to Price Dispersion and Vice Versa

Understanding the macroeconomic consequences of price index dispersion, inflation heterogeneity, and bargain hunting requires a theoretical framework. Although countless theories of price dispersion have been proposed over the last 40 years, most of this literature pertains to pricing of a single good rather than bundles of goods, and so cannot speak to price index dispersion, nor to relative price dispersion. Menzio, Rudanko, Trachter, and I developed a theory of relative price dispersion based on heterogeneity in bargain hunting in the population.5 Our theory adds two ingredients to the existing literature. First, it does not rely on temporal variation in prices, and hence is applicable to the persistent components of price dispersion. Second, it delivers the asymmetric pricing outcomes across equally expensive stores that is the hallmark of relative price dispersion.

Our theory extends the single-good models of price dispersion through bargain hunting developed by Gerard R. Butters,6 Kenneth Burdett and Kenneth L. Judd,7 and Menzio and Trachter.8 In our model, each household consumes a bundle of two goods and a large number of stores set prices for each good. Our key assumption is that buyers are heterogeneous in the extent to which they engage in bargain hunting, in a way that is correlated with their valuation of the goods. We assume that one type of household, which we call busy, has a high valuation of the goods and needs to buy both goods at the same store. The other type of household, which we call cool, has a lower valuation of the goods but can purchase each good at a different store, if it desires. As in Butters and Burdett and Judd, we assume that on any given day, some buyers can access only a single seller, whereas others can access multiple sellers.

The equilibrium of this model features relative price dispersion and asymmetric pricing strategies, which come about as a result of price discrimination. The difference in valuation between the busy buyers and cool buyers gives sellers a reason to try to price discriminate. The difference in the ability of the busy buyers and cool buyers to make their purchases at different stores gives sellers a way to price discriminate. By charging a high price for one good and a low price for the other, rather than the same price for both, the seller can sell more of the lower-priced good to cool customers without losing any busy customers. Relative price dispersion emerges because bargain hunting, in the sense of shopping at multiple stores, is more common among the households that value the goods less.

Bargain Hunting Matters for Macro

By embedding a product market in which price dispersion arises from bargain hunting into a general equilibrium model of the labor market, Menzio and I found that bargain hunting can have profound implications for aggregate employment.9 We considered a model in the spirit of the one developed by Dale Mortensen and Christopher Pissarides10 in which the output of a worker-firm match must be traded in a product market similar to the one described above. Consistent with the shopping patterns documented in our empirical work, we assume that unemployed workers purchase fewer goods and engage in more intensive bargain hunting than employed workers.

These differences in the shopping behavior of the employed and unemployed mean that when a firm hires an additional worker, it imparts externalities on other firms. In addition to the negative congestion externality that is standard in labor markets with matching frictions, in our model there are two positive shopping externalities. When a previously unemployed worker becomes employed, this generates a demand externality because the worker purchases more goods from other firms, and it also generates a market power externality because the worker engages in less bargain hunting. Both shopping externalities increase the profitability of other firms, to which they respond by expanding their presence in the product market. In the Mortensen-Pissarides model, this is achieved by posting additional vacancies, and if the shopping externalities are sufficiently large relative to the congestion externality, then the vacancy posting decisions of different firms become strategic complements and multiple equilibria may arise.

We infer the size of the shopping externalities from the aforementioned evidence on price distributions, price index distributions, differences in prices paid across employment states, and differences in time spent shopping across employment states. We find that these differences are indeed large enough to lead to multiple equilibria and self-fulfilling fluctuations in employment. Interestingly, we find that the market power externality is about twice as large as the demand externality, but both externalities are needed for the model to admit multiple equilibria with parameters that are consistent with the empirical evidence on shopping behavior. This finding contrasts sharply with existing models of spillovers through the product market, which typically rely on demand externalities affecting the quantity of goods sold by other firms, rather than on market power externalities affecting the terms of trade faced by other firms.

There are many fruitful directions for future research integrating household shopping behavior into incomplete market heterogeneous agent models. Moreover, because bargain hunting is likely to be important throughout the production chain, future work will also hopefully take more seriously the macroeconomic consequences of the marketing, innovation, and expansion activities in which firms routinely engage. For monetary and fiscal policies, a natural framework to start exploring these activities on either side of the product market would be Heterogeneous Agent New Keynesian models, which marry sticky price models with models of heterogeneous households and incomplete markets.

Endnotes

G. Kaplan and G. Menzio, "The Morphology of Price Dispersion," NBER Working Paper 19877, January 2014, and International Economic Review, 56(4), 2015, pp. 1165-206.

G. Kaplan, G. Menzio, L. Rudanko, and N. Trachter, "Relative Price Dispersion: Evidence and Theory," NBER Working Paper 21931, January 2016.

M. Aguiar and E. Hurst, "Lifecycle Prices and Production," NBER Working Paper 11601, September 2005, and American Economic Review, 97(5), 2007, pp. 1533-59.

G. Kaplan and S. Schulhofer-Wohl, "Inflation at the Household Level," NBER Working Paper 22331, June 2016.

G. Kaplan, G. Menzio, L. Rudanko, and N. Trachter, "Relative Price Dispersion: Evidence and Theory," NBER Working Paper 21931, January 2016.

G. Butters, "Equilibrium Distributions of Sales and Advertising Prices," Review of Economic Studies, 44(3), 1977, pp. 465-91.

G. Menzio and N. Trachter, "Equilibrium Price Dispersion Across and Within Stores," NBER Working Paper 21493, August 2015.

G. Kaplan and G. Menzio, "Shopping Externalities and Self-Fulfilling Unemployment Fluctuations," NBER Working Paper 18777, February 2013, and Journal of Political Economy, 124(3), 2016, pp. 771-825.