Co-Directors

Emi Nakamura is a Chancellor’s Professor of Economics at the University of California, Berkeley. Her research interests center on monetary and fiscal policy, macroeconomic measurement, and the determinants of business cycles. She has been an NBER affiliate since 2007.

Jón Steinsson is a Chancellor’s Professor of Economics at the University of California, Berkeley. His research interests include price rigidity, the effects of monetary and fiscal policies on economic activity, and monetary policy design. He has been an NBER affiliate since 2007.

Featured Program Content

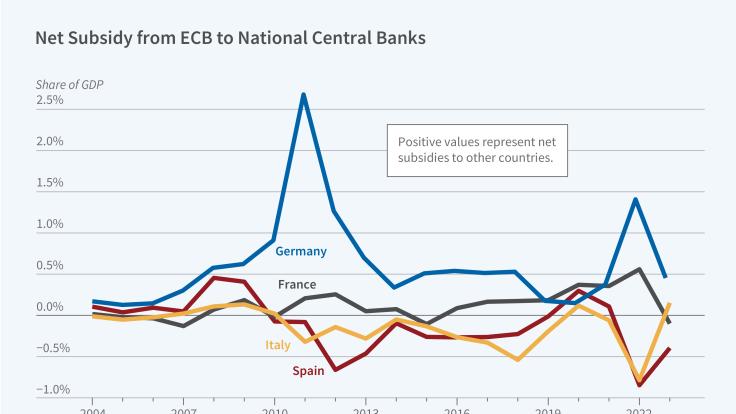

The eurozone is a monetary union without a fiscal union: Each national central bank is ultimately backed by its own government. When the European Central Bank...

Housing costs represent about 35 percent of the Consumer Price Index (CPI), making shelter inflation a critical factor in overall inflation dynamics. The...

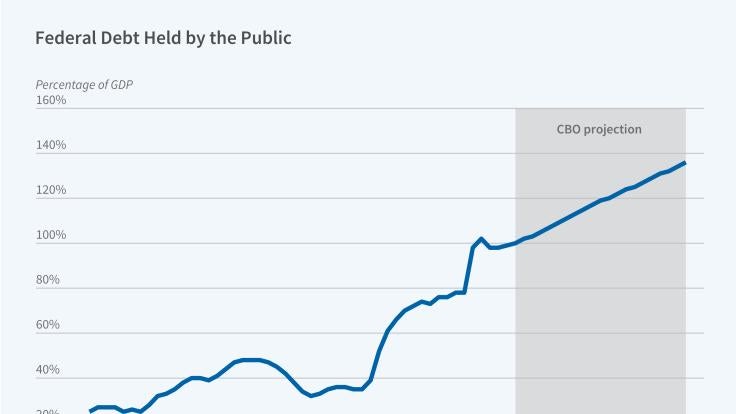

The relationship between interest rates and federal borrowing is central to assessing the economic consequences of fiscal policy. It determines the...