Why Does the Federal Reserve React to Market Downturns?

Since the mid-1990s, negative stock returns comove with downgrades to the Fed’s growth expectations and predict policy accommodations.

The “Fed put” is the expectation on the part of many investors that if financial markets decline sharply, the Federal Reserve will intervene and ease policy. The basis for this belief can be found in the history of monetary policy easing following many recent market downturns, including those associated with the 1998 collapse of the hedge fund Long-Term Capital Management, the 2001 tech bubble bust, the 2008 financial crisis, and most recently the 2020 COVID-19 pandemic.

In The Economics of the Fed Put (NBER Working Paper 26894), Anna Cieslak and Annette Vissing-Jorgensen provide new evidence on the Fed’s reaction to market declines in the last 25 years, and explore what accounts for that reaction. Since 1994, a 10 percent stock market decline has predicted a 32 basis point reduction in the federal funds rate at the next Federal Open Market Committee (FOMC) meeting, and a 127 basis point decrease after one year. The effect of stock market returns on the federal funds rate is asymmetric. While market declines predict rate cuts, market advances do not predict rate increases.

The Fed might respond to declines in the stock market because such price movements are an important source of information on what market participants expect about the future path of economic activity, potentially corroborating or conflicting with the analysis by Federal Reserve staff, or because the drop in market values may directly affect future economic activity.

The researchers document a tight link between the stock market and the Fed’s growth expectations. While the Fed’s internal measures of expected economic growth had essentially no relationship to stock returns before 1994, since then lagged stock market returns explain 38 percent of the variation in growth expectations updates. A 10 percent stock market decline is associated with a growth expectations downgrade of about 1 percentage point for the next year. The researchers find that stock market returns between FOMC meetings have stronger explanatory power for the Fed’s growth expectations updates than any of the 38 macroeconomic indicators available in the Bloomberg economic calendar.

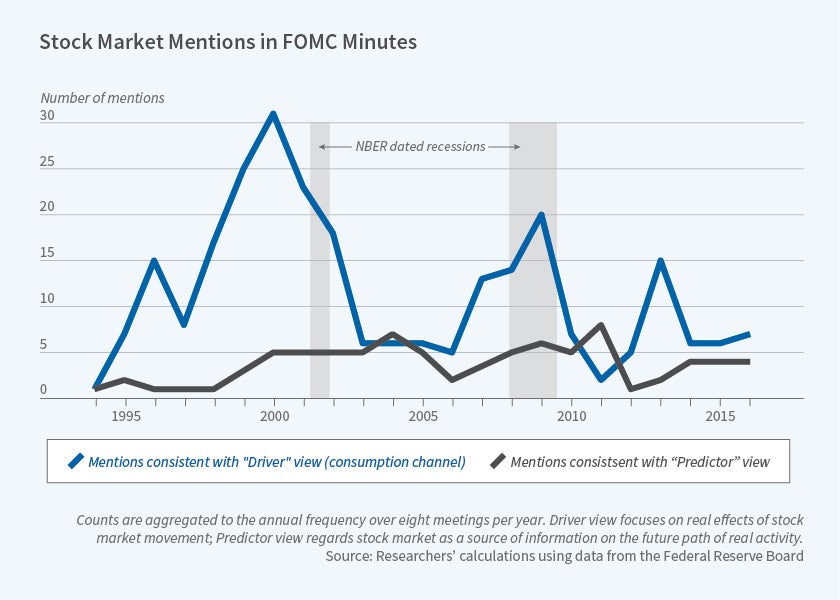

Textual analysis of the minutes of FOMC meetings from 1994 through 2016 and of meeting transcripts through 2013 provides insights on whether the stock market is viewed as driving the economy or simply predicting it. Around 80 percent of FOMC participants’ mentions of the stock market in the minutes discussed it as one of the factors driving the economy. Mentions of the stock market as a predictor of future economic developments such as growth or unemployment, and discussions of stock market determinants, were more likely to be attributed to staff than to meeting participants. Of the mentions that refer explicitly to stock market effects on consumption, 213 out of 257 refer to the wealth effect. For business investment, 9 of the 21 mentions are concerned with the effect of the stock market on the cost of capital. Results from the FOMC transcripts are broadly similar to those from the minutes, although they show more discussion of the determinants of stock market movements. These findings broadly suggest that the FOMC participants were focused more on the direct links between the stock market and future economic growth than on the stock market’s role in offering additional information about the economic outlook. On average, an additional 2.6 negative stock market mentions in the current or past FOMC meeting minutes (a one standard deviation increase) was associated with a cumulative reduction of 32 basis points in the federal funds rate.

While the FOMC discussions show a clear awareness of the potential moral hazard effects of loose policy following a crisis, these concerns do not appear to have had a major impact on policy choices. The researchers also conclude that adjustments of the Fed’s expectations about future economic growth following stock market declines were roughly in line with the adjustment of the expectations of the Survey of Professional Forecasters and the Blue Chip Economic Indicators Survey.

— Linda Gorman