Government Procurement: There is Strength in Numbers

Public sector procurement practices are often criticized for paying more for goods and services than private sector buyers. In The Benefits from Bundling Demand in K–12 Broadband Procurement (NBER Working Paper 33498), Gaurab Aryal, Charles Murry, Pallavi Pal, and Arnab Palit study an innovative procurement initiative in New Jersey that sought to improve efficiency and lower costs. The state’s public schools teamed up to procure broadband internet services collectively rather than through separate bids.

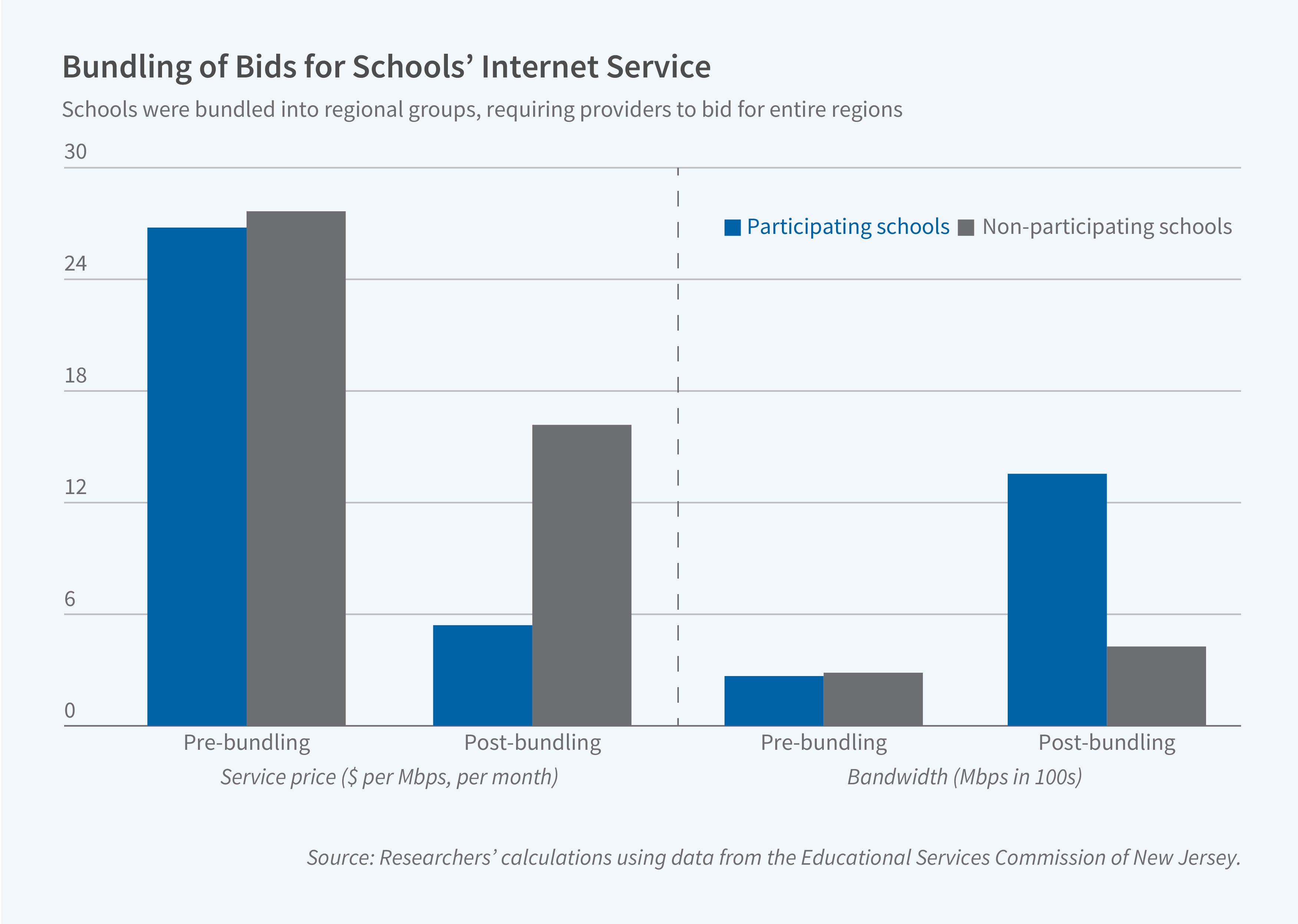

New Jersey’s broadband procurement bundling program for public schools lowered costs and raised internet speeds.

The backdrop to this state initiative is a federal program called E-Rate that subsidizes K–12 internet contracts if schools use competitive bidding to select providers. Subsidies are highest among schools in high-poverty and/or rural areas. In 2015, New Jersey implemented a program that bundled willing schools into four regional consortiums, allowing providers to bid on contracts for entire regions rather than individual schools.

The researchers compare contracts in 2014, the year before the program began, with those in 2015, the first year of the program. They estimate that the bids under the new program were lower—a monthly cost reduction of $10.32 per megabits per second (Mbps) on a base of $26.78, or 39 percent. In addition, the average internet speed tripled from 268 Mbps before the program to 978 Mbps afterward.

The primary explanation for the lower prices is greater confidence among bidders that, under the bundling system, they would serve enough schools to cover their fixed costs, incentivizing them to bid lower than they would without bundling. This reduction in what is termed “exposure risk”—the chance of winning too few schools to cover fixed costs—leads to competitive bidding behavior. The auctions did not draw in a meaningfully greater number of bidders to explain the decrease in bids.

The researchers found that most of the benefit of bundling accrued to schools that receive “Category D” internet service, which is similar to that typically provided to businesses, as opposed to “Category A” service, which is akin to residential retail service. Providing Category A service requires minimal investments, whereas delivering Category D service requires building regional data hubs.

The savings under the bundling program were comparable to the subsidies from the E-Rate program. The researchers conclude that “redesigning how public institutions purchase services may be as effective as traditional subsidies for achieving policy goals.” They also make a cautionary observation about the future: if consortiums consistently award contracts to a single internet provider, other potential providers may exit the market, reducing long-run competition.