Early Findings on State Auto-Enrollment IRA Programs

In 2017, Oregon became the first state to implement an auto-enrollment Individual Retirement Account (IRA) program. Illinois and California soon followed. Another 19 states have taken steps to create one. Under such programs, the state receives payroll data from companies without retirement plans and informs their employees that they will be enrolled in the state’s IRA program unless they opt out. For workers who do not opt out, the employer sends a share of each paycheck to the state, which deposits these funds in the employee’s IRA. All three states started with a 5 percent contribution rate. Oregon and California have the option of boosting the rate by 1 percent per year, to a maximum of 10 percent and 8 percent respectively.

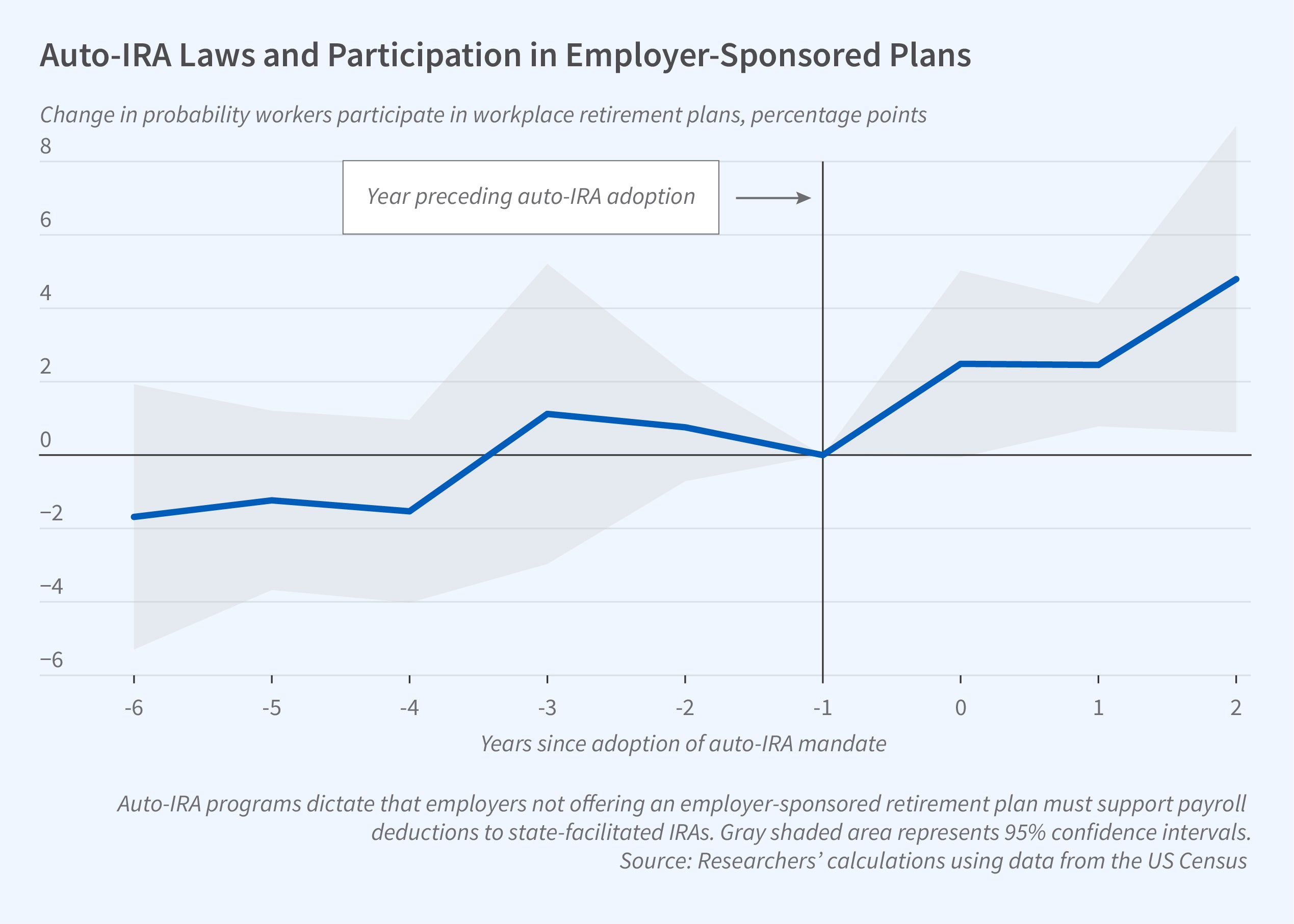

A new study, How Do Firms Respond to State Retirement Plan Mandates? (NBER Working Paper 31398) by Adam Bloomfield, Kyung Min Lee, Jay Philbrick, and Sita Slavov, finds that the introduction of state-run IRAs increased the availability and use of employer-sponsored plans, such as 401(k) plans. The researchers rely on data from the Current Population Survey (CPS) and Form 5500 filings to examine the impact of auto-IRA programs. For the CPS analysis, they focus on private-sector workers aged 25 to 54 and consider the 2009–20 period. The CPS asks the respondent whether their employer or union offers a retirement plan, and if one is offered, whether they participate.

State-level programs increase the likelihood that employers offer retirement plans and the probability that employees enroll in them.

The three states that adopted auto-IRA programs have higher workforce shares of Asians and Hispanics, and smaller shares of Blacks and Whites, than states that did not. On other metrics, however, such as education levels, employment status, the size distribution of firms, and the share of workers enrolled in employer-sponsored retirement plans before the adoption of auto-IRAs, the three states that adopted these programs are broadly similar to the 47 that did not. These factors are controlled for in the estimation of effects.

To address the possibility that some CPS respondents may confuse a state auto-IRA with an employer-sponsored plan and to complement survey estimates with granular administrative data, the researchers also analyze firm-level information from Form 5500, a disclosure document that employers who sponsor retirement plans must file with the US Department of Labor.

The researchers exploit the different roll-out dates for the auto-IRA programs in the three states that implemented them as well as the roll-out dates at firms of different sizes within each state. The data from the CPS suggest that the probability that an individual works for an employer offering a plan rises by 1.4 percentage points, on a base of 44 percent, after a state adopts an auto-IRA program. The probability of an employee participating in an employer-sponsored plan rises by about 1.1 percentage points on a base of 37 percent. The firm-level data from Form 5500 suggest that the probability that a firm offers a retirement plan rises by about 0.8 percentage points on a base of 54 percent.

— Laurent Belsie