Do Married Couples Coordinate Their Retirement Savings Efficiently?

As nearly two-thirds of US civilian workers have access to an employer-sponsored defined contribution (DC) plan, workers’ decisions as to whether and how much to contribute to their DC plans have important consequences for their retirement security. Most employers offer a “match,” where the employer’s contribution to the plan depends on the employee’s contribution, though the match rate and the amount of contributions eligible to be matched vary across employers. An employer match creates a large and transparent incentive to contribute by offering a guaranteed return on the worker’s contribution.

In married couples where both workers have access to DC plans, the match schedules of both plans are relevant for retirement savings decisions. For a given amount of total contributions, households can maximize the employer match by contributing to the plan with the higher match rate, up to the match cap, before making contributions to the other spouse’s plan.

In Efficiency in Household Decision Making: Evidence from the Retirement Savings of US Couples (NBER Working Paper 31195), researchers Taha Choukhmane, Lucas Goodman, and Cormac O’Dea explore whether households coordinate their retirement savings decisions efficiently.

To answer this question, the authors create a new dataset with information on over 6,000 employer-provided DC plans covering 44 million eligible workers. They link this employer data to IRS tax data, which provide information on the retirement savings choices of employees and allows for spouses to be linked.

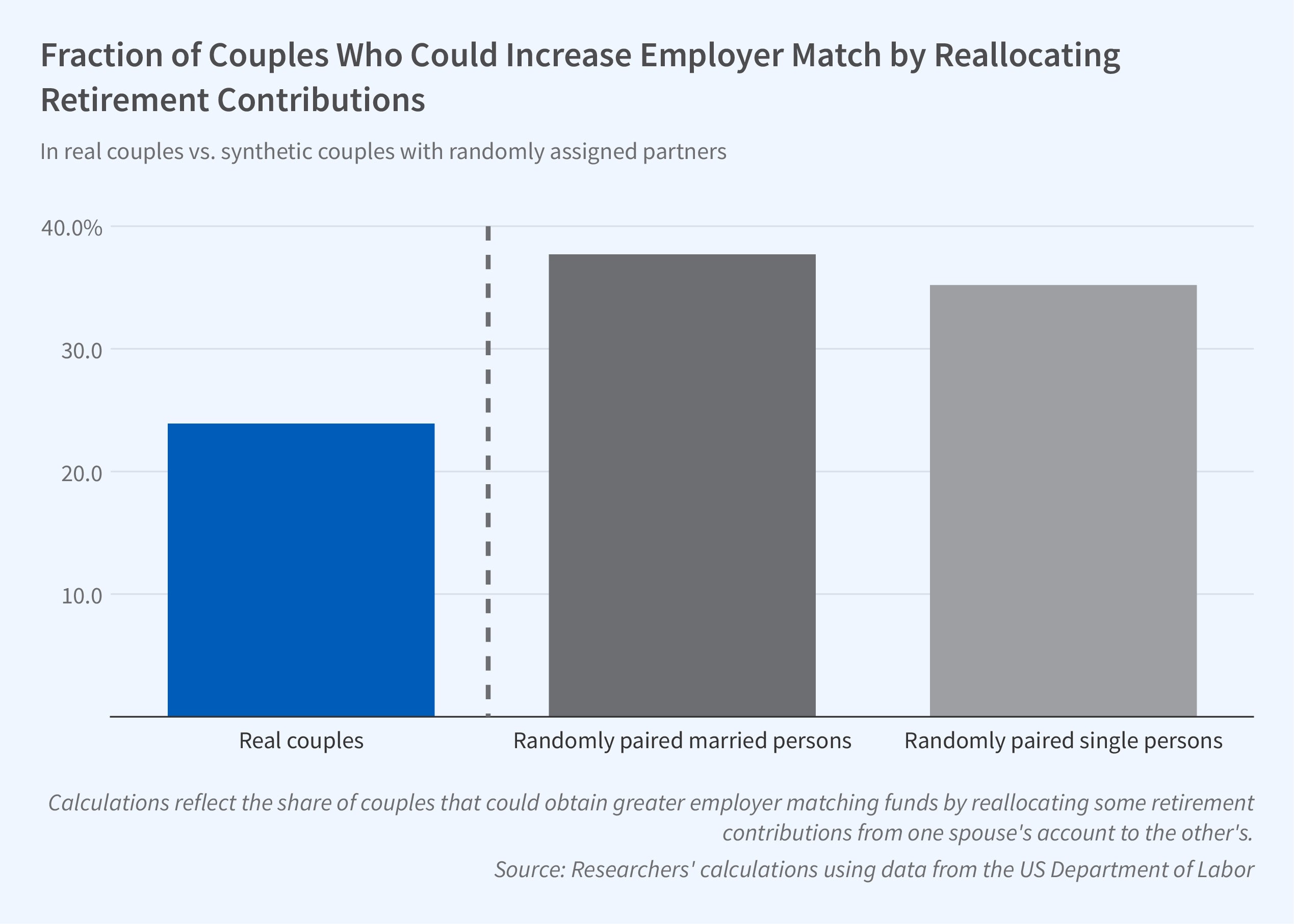

They find that 24 percent of couples in the sample fail to coordinate their contributions efficiently, in that they could reallocate their existing retirement savings contributions from the account of the spouse with a lower match rate to the account of the spouse with a higher match rate and increase the total employer match received.

To explore whether three-quarters of couples are deliberately coordinating their contributions or arriving at an efficient allocation by chance, the authors create synthetic couples by randomly matching each married person to a new “spouse” with the same age, gender, and earnings as their real spouse or by matching unmarried persons to create couples similar to real couples in the sample. Among synthetic couples, 35 to 38 percent of households fail to allocate their retirement savings efficiently. This suggests that active coordination reduces the inefficient allocation of contributions by 11 to 14 percentage points. Interestingly, when the authors follow couples over time, they find that noncoordination drops by 13 percentage points around the time of marriage and increases by 12 percentage points after a divorce, a similar size effect.

The authors probe why spouses fail to coordinate. They find that the lack of coordination cannot be explained by inertia, auto-enrollment, or simple heuristics like equalizing contributions. By contrast, households with weaker indicators of marital commitment — for example, couples who did not have a joint bank account before marriage or subsequently divorce — are less likely to coordinate. The authors interpret this as an indication of noncooperative behavior within the household. As retirement assets are considered marital property in the event of a divorce, the risk of a marital split does not provide a financial incentive to contribute to one’s own plan.

The authors estimate that the average foregone match is nearly $700 per year, representing 13 percent of the total employee contributions made by the household. More than half of couples with an inefficient allocation continue to allocate savings inefficiently four years after being initially observed doing so. This suggests that inefficient coordination of retirement contributions has a meaningful impact on retirement savings account balances.

The research reported herein was performed pursuant to grant RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA, any agency of the federal government, or NBER. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof. This project was also supported by grant number T32HS026128 from the Agency for Healthcare Research and Quality. The content is solely the responsibility of the authors and does not necessarily represent the official views of the Agency for Healthcare Research and Quality. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.