Spousal Following and Medicare Part D Plan Choice

When Medicare beneficiaries enroll in Part D, they typically choose from a menu of approximately three dozen private insurance plans that feature different combinations of premiums, copayments, and drug coverage. The optimal plan choice varies across beneficiaries, depending on their prescription drug purchases. Yet, despite the wide array of options, 73 percent of married enrollees choose the same plan as their spouse. Even among couples with observable differences in their health status, more than 60 percent choose the same plan.

Researchers Tal Gross, Timothy Layton, Daniel Prinz, and Julia Yates examine the causes and consequences of this pattern in Social Defaults and Plan Choice: The Case of Spousal Following (NBER Working Paper 34137). They study a 20-percent sample of married Part D enrollees and focus on the determinants of the younger spouse’s plan choice.

Younger spouses tend to follow their older spouse’s Medicare Part D plan choice, which raises their out-of-pocket costs for prescription drugs.

Not surprisingly, beneficiaries are more likely to select plans with lower premiums and out-of-pocket costs. Younger spouses are also more likely to select the plan that their older spouse has already chosen, even when other plans would result in lower total drug expenditures given their needs. The researchers estimate that the typical beneficiary could have saved $690 in out-of-pocket costs each year if they had chosen the cost-minimizing plan for their prescription drug purchases. Most of that saving—88 percent—could have been achieved if the couple had chosen the single plan that was best for them collectively. To save the additional 12 percent, the spouses would have needed to select different plans.

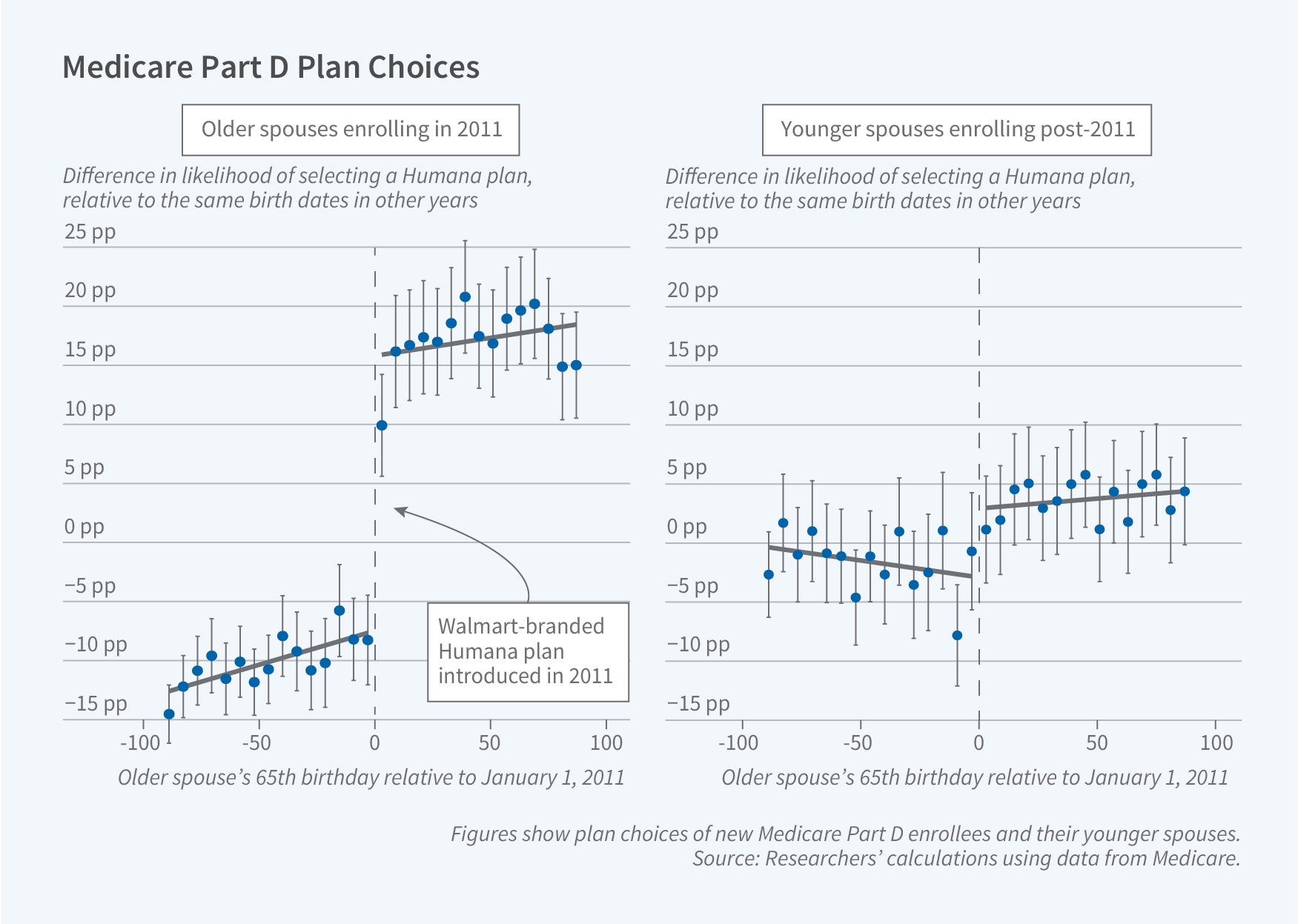

Further evidence on this tendency towards shared plans comes from the introduction of new, low-cost Part D plans. In 2011 and again in 2014, the insurer Humana introduced Walmart-branded plans that featured low premiums and copayments. Upon introduction, the plans became very popular with Part D enrollees.

The researchers compare differences in plan choices for older spouses who had their 65th birthday just after January 1st in the years when the new Humana plans were introduced, relative to other years, to differences in plan choices for older spouses who had their 65th birthday just before January 1st. Beneficiaries who turned 65 just after the plans were available are about 20 percentage points more likely to be enrolled in a Humana plan. This difference persists in subsequent years due to inertia in plan choice.

Interestingly, a similar pattern exists for younger spouses based on when their older spouse turned 65. Younger spouses are about 7 percentage points more likely to enroll in Humana if their older spouse turned 65 just after the introduction of the Humana plans than if their older spouse turned 65 just before. This pattern is evidence of enrollees following their spouse’s plan choice.

The researchers acknowledge support from the National Institute on Aging of the National Institutes of Health under Award Number P30AG012810 through the National Bureau of Economic Research’s Center for Aging and Health Research.