Rural Population Density Linked to Chinese Entrepreneurial Development

Since the early 1990s, the Chinese economy has achieved some of the highest rates of growth in GDP per capita in recorded history. This was accompanied by market reforms and the entry of private enterprises. While there were almost no private firms in 1990, there were more than 8 million registered private firms in 2009 when such firms accounted for nearly 90 percent of all registered firms.

Chinese State Administration for Industry and Commerce (SAIC) firm registration data reveal that two-thirds of new entrepreneurs originated from rural counties. This represented a significant structural transformation of the economy away from agriculture and traditional rural occupations into industrial entrepreneurship. China’s accession to the World Trade Organization in 2002 triggered a further wave of transformation, with a steep rise in exports. Homegrown private firms accounted for half of all exporting firms in 2002.

Firm revenue, total factor productivity, and export revenue all grow more quickly for firms based in counties with higher population density.

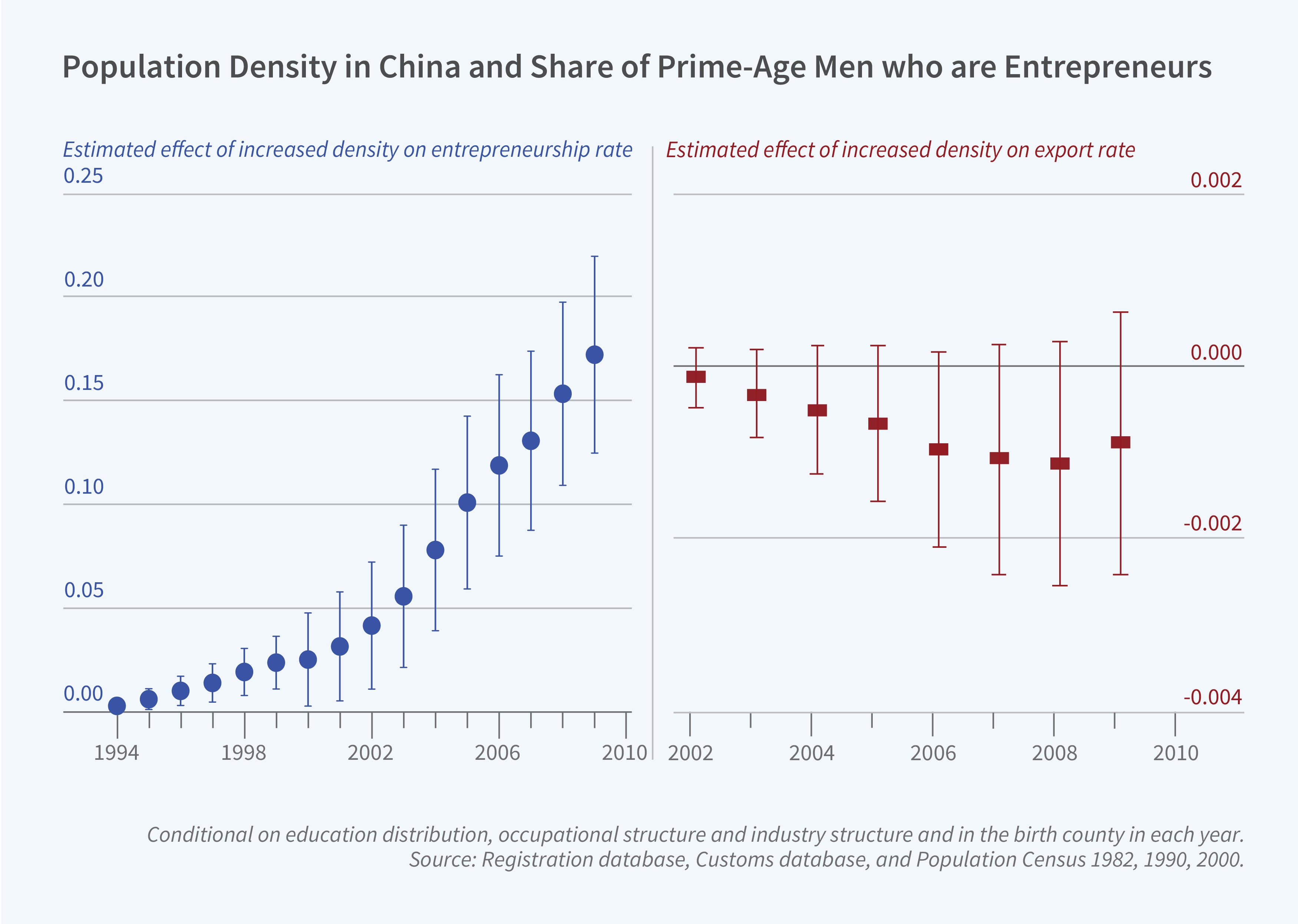

Were such waves of entry into entrepreneurship stimulated by preindustrial rural development, as measured by agricultural productivity or county population density? In Entrepreneurship in China's Structural Transitions: Network Expansion and Overhang (NBER Working Paper 31477), Ruochen Dai, Dilip Mookherjee, Kaivan Munshi, and Xiaobo Zhang analyze SAIC data and conclude that it was. The figure shows that entrepreneurial propensity — the number of registered firms in any given year in any given county divided by the number of potential entrepreneurs obtained from the population census — is positively associated with the county’s 1982 population density throughout the 1994–2009 period. This relationship is robust to controlling for county-level wealth, education, and occupational structure.

The researchers also investigate whether the subsequent transition into exporting was positively associated with county population density. They construct a measure of export propensity in each year over the 2002–09 period defined as the number of active exporters from a given birth county divided by the number of potential entrepreneurs. The estimated effect of population density, after again controlling for county-level attributes, is negative and marginally significant.

The researchers reject the possibility that these contrasting patterns for entrepreneurial and export propensity can be explained by variations in unobserved dimensions of ability or selective access to profitable locations or sectors. Specifically, net of firm fixed effects, revenues and productivity in both domestic production and exporting are observed to increase more steeply over time for firms drawn from denser birth counties. Firms from these counties perform better relative to other firms within the sector-locations where they were established.

The researchers suggest that social networks can explain these empirical patterns. They posit that networks of firms organized around hometowns are active in China and that firms from denser birth counties have access to better-functioning networks that increase the productivity of their members, both in domestic production and exporting. This induced greater entry from denser counties into domestic production. When exporting opportunities arose after 2002, however, firms that were part of successful domestic networks drawn from denser counties had weak incentives to pursue them. This represents a form of domestic network “overhang.” The researchers perform a counterfactual analysis of what would have transpired absent the domestic networks: a 40 percent decline in the number of firms in 2009, and a 16 percent increase in the number of exporters.

The researchers provide additional evidence for the network-based hypothesis by showing that in the 2010 China Family Panel Studies residents of denser counties have higher rates of local social interaction and greater trust in their neighbors, but not strangers. The SAIC data show that firms from these counties are more likely to remain connected to their birth county and to form business links with firms from the same origin operating in the same prefecture, even when they are established elsewhere. There is also a positive effect of lagged network size, and the interaction of network size with birth county population density, on firm revenues and productivity in both domestic production and exporting. These findings illustrate the role played by informal business networks in supporting and constraining entrepreneurship at the economy-wide level during the process of economic development.

— Whitney Zhang

The NBER's Bulletin on Entrepreneurship, Entrepreneurship Working Group, and related initiatives are supported by the Ewing Marion Kauffman Foundation.