Political and Economic Forces Sustaining Social Security

Government officials, regardless of their political persuasion, are increasingly serious about Social Security reform. Politicians have long recognized that the success and longevity of their policies depend on the economic and political environments in which they operate. For example, Franklin Delano Roosevelt explained, "We put those [Social Security] payroll contributions there so as to give the contributors a legal, moral, and political right to collect their pensions. With these taxes in there, no damn politician can ever scrap my Social Security program." (cited in Schlesinger, 1958). In other words, Roosevelt understood that he could not design a program for the elderly without regard for its political future; rather, he needed a design that made it difficult for future politicians to change the Social Security (hereafter, SS) program. Unfortunately, modern proposals and evaluations of changes to the SS system pay little attention to the political and economic forces that have been sustaining the program, and whether the proposals for change could endure those forces. Xavier Sala-i-Martin and I have been working to improve public pension economics along these lines.

Worldwide Challenges

Our initial step was to create international databases of the history of SS program design, including tax rates, financing methods, revenues, benefit eligibility rules, and benefit formulas.(2) Several interesting patterns emerge. First, the international history of SS includes many examples of well-intentioned reforms that were put in place but ultimately unable to resist the political forces pushing back towards the old system. Many of these are examples of countries that planned for a fully funded system (namely, a system that pays each cohort benefits equal to its lifetime contributions plus accumulated interest): Chile's original SS program, Germany's original program, one of the original French programs, the first U.S. SS law (passed in 1935, scheduled to come into effect in 1937 and to be partially funded, but rescinded in 1939), and Sweden's first system. A number of individual accounts systems (namely, systems that pay an individual benefits in proportion to his lifetime contributions) also have failed to be politically sustainable, including those in Seychelles, Egypt, St. Vincent, the system for the American clergy, and some African and Caribbean Provident Funds.

Second, public pension budgets have become very large in upper and middle income countries, with the share of labor income collected as SS taxes sometimes exceeding the fraction of the population who are eligible for SS benefits. Normalized by GDP, the U.S. SS budget is small by international standards. Third, the fringe benefit model is ubiquitous: almost all countries (including the United States, with one very recent exception) raise practically all of their SS revenue from payroll taxes on employer and employee, and pay a defined benefit that increases with lifetime earnings and declines with earnings during the beneficiary's retirement years. Even though economists disapprove of SS benefit formulas that give the elderly so little incentive to work, this feature of public pension system is ubiquitousvery common (even the United States had a significant earnings test, until the recent law change).

Fourth, while SS is undoubtedly an intense political issue, very different political regimes employ quite similar public pension systems. One of the very early programs was created in Emperor Wilhelm's autocratic German state in the 1880s. Other examples of nondemocratic countries that created such programs are Lenin's USSR in 1922, Emperor Hirohito's Japan in 1941, Kuwait in 1976, General Peron's Argentina in 1946, and General Avila-Camacho's Mexico in 1943. Examples of democracies with early SS systems include the United Kingdom in 1908, Sweden in 1913, or the United States in 1935.(3) The (presumably nondemocratic) Soviet Union in 1960-90 had a system similar to Western European systems, including retirement at early ages, pay-as-you-go, and payroll taxes (although not "paid by employees"). These basic similarities with American and Western European programs did not change under Gorbachev and thereafter, as the former Soviet citizens began to enjoy democracy.

Gil, Sala-i-Martin, and I (4) report on nine dynamic case studies -- Greece, Portugal, Spain, Italy, Argentina, Brazil, Chile, Peru, and Uruguay -- for the period 1960-90. These countries were selected based on their extreme political changes, or for their economic and demographic similarities to countries with extreme changes. With the exception of Greece and Chile, we find that formerly nondemocratic countries do not, relative to their democratic neighbors, change their program after experiencing democracy. Similarly, formerly democratic countries do not change their program when becoming nondemocratic. Greece is an exception, because spending grew slowly under the 1967-74 military regime -- relative to spending growth before and after the regime and relative to contemporaneous spending growth in democratic countries. We find an opposite pattern in Chile: most of the spending growth from 1925-80 occurred under nondemocratic regimes, and payroll tax rates reached extremely high levels under General Pinochet. Multiple regression studies of the determinants of SS spending,(5) holding constant population age or per capita income, find neither a significant partial correlation between democracy and SS spending's share of GDP, nor a significant interaction between democracy and the other variables in a spending regression. The multiple regression framework also shows how democracies and nondemocracies are quite similar in terms of their use of retirement tests, earnings tests, or in their splitting of the payroll tax between employer and employee. Whatever problems SS programs may have today, they cannot be blamed on the democratic process.

New Estimates of Social Security's Winners and Losers

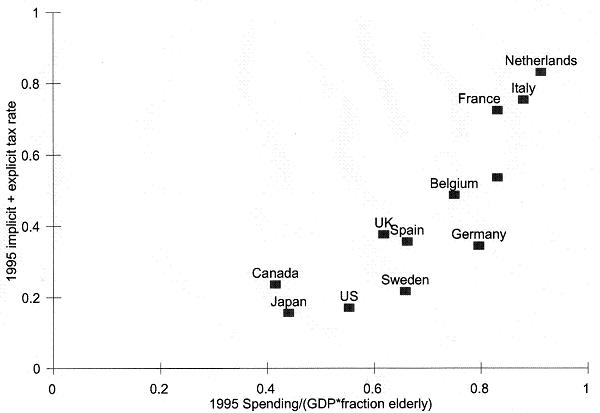

SS programs tax workers and pay benefits to the elderly, so it is often concluded that the elderly come out ahead, especially if the program had been small or nonexistent during their working years. By the same logic, the larger the program, the more the elderly benefit. However, this calculus ignores the fact that the elderly usually must retire in order to receive their benefits. When eligibility is conditioned on beneficiary earnings or labor force status, SS benefits help the elderly less than they cost the Treasury because the elderly change their labor market behavior in order to increase their benefit. In principle, a larger program might hurt the elderly if it also involved larger work disincentives. The calculations in Figure 1 show how this is a very real possibility. The horizontal axis measures the amount of SS spending, normalized by GDP and the size of the elderly population (obviously richer and older countries spend more on SS). The vertical axis measures the incentive to retire, in terms of a marginal tax rate on beneficiary earnings. The retirement incentive comes both from an explicit payroll tax and from the tax implicit in the policy of reducing or delaying benefit payments with the beneficiary's earnings. The elderly would obviously prefer a program that is far to the right because the program would be spending more on them, but would also prefer a program that is near the bottom because the program would provide the freedom to work while receiving their benefits. It is possible that the elderly would be better off with a program like Spain's or Germany's than with an Italian or Dutch program, even though the latter are spending more money, because the former make it "easier" (as compared to Italy or Netherlands) to work while collecting benefits.

Source: C. Mulligan, "Induced Retirement, Social Security, and the Pyramid Mirage," NBER Working Paper No. 7679, April 2000.

Another reason that a dollar of benefits may be worth less than a dollar to an SS program participant is that the benefits are paid later in life, and the participant may desire funds earlier in life. Here I am not simply referring to the time value of money, because the government discounts future cash flows at the interest rate, and so do many households. However, some households -- presumably the poorer and younger ones -- are borrowing constrained and would prefer to have funds now rather than during their retirement years, even if the latter were returned with interest.(6) Another factor relevant for poor households is that, in the absence of having their own retirement savings, they could attempt to live off welfare programs during their elder years. For these two reasons any mandatory public program that reallocates cash flows from the working years to the retirement years -- the current SS system as well as a mandatory retirement accounts program -- hurts the poor and helps those who would be paying for welfare programs for the elderly. In this way, public pension or retirement savings programs with voluntary participation may be more beneficial to the poor than are programs that mandate participation.

The Politics of Retirement

Clearly SS affects retirement, in part by allowing elderly people to afford a life of leisure, and in part by reducing the pecuniary gain to working during old age. But retirement may also affect SS policy, and a series of our papers explore some of the possibilities. One possibility is that retirement creates job opportunities or raises wages for the young, that SS policy was designed for this purpose, and that SS has continued to grow by serving this purpose. However, this is at best a small part of the story, because it may be that the private sector generates too much retirement rather than too little, and even if public policy were needed to encourage retirement, the optimal amount of retirement could be implemented with a much smaller budget.(7)

The AARP may be the most potent interest group in the United States, and the "R" does not stand for "old." The growth of retirement, in part because of SS but also because of changes in the private sector, has created a large and cohesive political group. The group has served to defend and expand public pension budgets, which in turn has increased the number of retirees. A full model of SS must consider the simultaneous determination of retirement and SS spending. We have taken some steps in this direction by modeling the allocation of time together with political competition among interest groups. In particular, we suggest that (nonoccupational) interest groups whose members work less are more successful. One reason is that groups working less have more time for political activities. But perhaps more important is the possibility that, when people do not work, then the amount of political issues they might worry about is smaller so they might concentrate their efforts on getting a pension or a transfer. In other words, retired people are, when it comes to the politics of age, more single-minded than workers because the latter also have to worry about the politics of occupation.

Implications for the Future of Social Security

Our findings help bring the future of SS into better focus. Without denying that the pay-as-you-go, fringe benefit model of public pensions has significant problems, our data do not give much credence to the view that SS problems are the result of "bad ideas" which are unfortunately and inexplicably hatched by policymakers, and which can be rectified merely by giving some combination of voters, politicians, and bureaucrats a better economic education. The model has persisted in too many countries for too many decades, and has shown itself to be more persistent than some well-intentioned legislation to the contrary. The size and design of SS is likely determined by political and economic fundamentals, such as interest group size, cohesion, the demand for retirement, population growth rates, the demand for insurance, and so on.

What exactly were the fundamentals that influenced the design of SS, and helped the program grow over so many decades? Regardless of how we answer this question, the historical persistence of the pay-as-you-go, fringe benefit model -- even at times in the face of legislation to the contrary -- suggests that the fundamentals (whatever they may be) are themselves persistent. Hence, at least some reform legislation will prove to evolve in the direction of the laws it replaced.

Retirement is one of the key economic and political fundamentals. Retirement and SS have a mutually reinforcing relationship -- SS encourages retirement and retirement creates an interest group cohesive enough to successfully defend the program. Ceteris paribus, reforms that remove or relax earnings and retirement tests would, by reducing retirement, help slow the growth of the program (or the growth of elderly programs more generally). But even reforms removing, say, retirement tests, might have an income effect on retirement in the other direction. In any case, we expect that the reforms most consistent with slow elderly spending growth are those that do the most to encourage work by the elderly.

Of course, there are important non-SS factors influencing retirement and its relationship with the political process. For example, campaign finance reform, if it is successful at reducing the influence of "big money," may by subtraction increase the relative influence of the retired, who have enjoyed their political success without many political action dollars (remember that the AARP was an avid supporter of the latest campaign finance reform). Changing health and mortality patterns will also help determine the number of retirees, and thereby impact SS spending. These factors and more may ultimately determine Social Security's future.

2. X. Sala-i-Martin, "A Positive Theory of Social Security," Journal of Economic Growth, 1996, and C. B. Mulligan and X. Sala-i-Martin, "Internationally Common Features of Public Old-Age Pensions, and Their Implications for Models of the Public Sector," Advances in Economic Analysis & Policy, 2004.

3. The POLITY IV (2000) project rates each of the regimes mentioned in the text (and many others) in terms of their degree of democracy on a 0 to 10 scale (10 most democratic): Germany (1), USSR (0), Japan (5), Kuwait (0), Argentina (0), Mexico (0), UK(8), Sweden (10), and US(10).

4. C. B. Mulligan, R. Gil, and X. Sala-i-Martin, "Social Security and Democracy," NBER Working Paper No. 8958, May, 2002.

5. Previous studies include D. Cutler and R. Johnson, "The Birth and Growth of the Social Insurance State," Public Choice, 120 (1-2) (July 2004), pp. 87-121, and P. Lindert, "The Rise of Social Spending, 1880-1930," Explorations in Economic History, 31 (1) (January 1994), pp. 1-37.

6. Mulligan and Philipson show how poor households may discount future cash flows at twice (or more) than the SS program does. C. B. Mulligan and T. J. Philipson, "Merit Motives and Government Intervention: Public Finance in Reverse," NBER Working Paper No. 7698, May 2000.

7. J. Bhattacharya, C. B. Mulligan, and R. Reed III, "Labor Market Search And Optimal Retirement Policy," Economic Inquiry, 42 (4) (October 2004), pp. 560-71.