What Can Housing Markets Teach Us about Economics?

Housing is a unique asset. Both an investment and a consumption good, it is traded in markets that are subject to significant search frictions and information asymmetries. In addition, housing accounts for a large share of wealth in the economy. As a result, changes in house prices can have large effects on aggregate economic activity. In combination with the availability of excellent microdata on housing transactions, this makes housing an ideal asset for the study of a range of questions of broader economic interest. In this piece, I summarize a number of findings that have emerged from my empirical research on housing markets.

Housing and Long-Run Discount Rates

Long-run discount rates play a central role in economics and public policy. For example, decisions about how much to invest in climate change abatement depend crucially on the trade-off between the immediate costs and the very long-term benefits of efforts to reduce global warming. Yet, despite their importance, there are few, if any, reliable estimates of the discount rates households attach to payoffs that accrue over horizons exceeding 30 years. This is, in large parts, due to the absence of finite, long-maturity assets necessary to estimate these discount rates.

In a set of papers with Stefano Giglio and Matteo Maggiori, I take advantage of a unique feature of housing markets in the U.K. and Singapore to provide direct estimates of long-run discount rates for housing cash flows that materialize hundreds of years in the future.1 In both countries, property owner-ship takes the form of either a leasehold or a freehold. Leaseholds are temporary, prepaid, and tradable ownership contracts with initial maturities ranging from 99 to 999 years, while freeholds are perpetual ownership contracts. This contract structure allows us to infer households' maturity-specific valuation of cash flows over horizons spanning hundreds of years. In particular, the price difference between leaseholds and freeholds for otherwise identical properties captures the present value of perpetual rental income starting at leasehold expiry, and is thus informative about households' discount rates over extremely long and previously unexplored horizons.

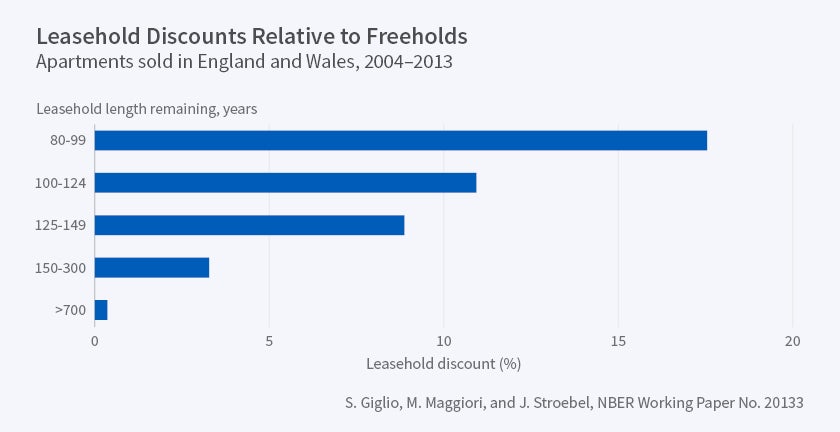

We estimate the price difference between leaseholds and freeholds of different maturities with hedonic regressions, using data on the universe of housing transactions and associated property characteristics since 1994. Our findings show that, in both the U.K. and Singapore, 100-year leaseholds are valued at 10 to 15 percent less than otherwise identical freeholds; the price difference is smaller for leaseholds with higher maturities, and goes to zero for leaseholds with remaining maturities of 700 years or more. Figure 1 shows the term-structure of leasehold discounts for the United Kingdom.

We show that these price discounts of leaseholds are not driven by institutional features of the contracts. We also introduce a large dataset on rental listings to show that, conditional on observable control variables, leaseholds of different maturities and freeholds rent for similar amounts. This suggests that differences in unobservable property characteristics across leaseholds and freeholds do not confound our findings. A natural interpretation of our results is that households attach a relatively high value to housing cash flows arising far in the future. This implies that their corresponding discount rates have to be low—according to our calculations, below 2.6 percent for housing cash flows more than 100 years in the future.

In related work together with Andreas Weber, we explore the implications of these findings for the appropriate discount rates to value investments in climate change abatement.2 We begin by providing new empirical evidence on the shape of the entire term structure of housing discount rates. In particular, we find the average return to real estate to be above 6 percent. In combination with the low long-run discount rates estimated above, this implies that the term structure of housing discount rates is steeply downward-sloping: the further out the cash-flow, the lower the annual discount rate attached to it. This suggests that average rates of return to assets, which generally average over discount rates at many different horizons, are likely to be uninformative about the appropriate discount rates for valuing very long-run costs or benefits. In addition, we emphasize that the appropriate discount rate for valuing an investment depends on its riskiness, this is, whether that investment is more likely to pay off in good or in bad states of the world. We also show that house prices are generally positively correlated with the state of the economy, which makes housing a risky asset. Similarly, to the extent that climate change abatement investments are designed to avoid climate disasters, those investments are hedge assets. This implies that the declining term structure of discount rates we find for housing should be considered an upper bound on appropriate discount rates at each horizon for valuing the benefits of climate change abatement. Quantitatively, this suggests that the true present value of investments to reduce global warming is vastly greater than the one obtained by discounting their benefits at the average rate of return to the capital stock in the economy.

House Prices and Asset Bubbles

The recent boom-bust cycle in global house prices is regularly described as the result of a house price bubble. As a result, there has been a lively policy debate about whether and how institutions such as the Fed should intervene in markets in order to prevent the emergence of such asset bubbles. Yet, theoretical models used by policymakers and researchers differ substantially over what is considered a bubble. The workhorse model of bubbles in macroeconomics is based on a failure of the "transversality condition," a condition that requires the present value of a payment occurring infinitely far in the future to be zero. Such a bubble is often called a classic rational bubble. Other, more-behavioral models of bubbles do not require this condition. These dif-ferences are not of merely theoretical interest; the positive and normative implications of models with bubbles depend crucially on precise definition of the type of bubble under consideration. Despite this, challenges to designing appropriate tests for bubbles have prevented an empirically driven narrowing of the set of bubbles under consideration.

In work with Giglio and Maggiori, I study the leasehold-freehold contract setting described above to provide a direct and model-free test of the presence of classic rational bubbles in the housing market.3 In the absence of rational bubbles, 700-year leaseholds and freeholds should have the same fundamental value, because cash flows arising more than 700 years from now have essentially zero present value, even at very low discount rates. Importantly, a rational bubble can only arise on infinite-maturity assets, and can therefore only affect the price of freeholds, but not the price of leaseholds. Consequently, any price difference between freeholds and leaseholds would reveal the presence and magnitude of a rational bubble in the housing market.

In both Singapore and the U.K., we find no statistically or economically significant difference between the prices of leaseholds with more than 700 years of remaining tenure and the prices of freeholds. This is not only true on average, but also at each point in time over the last 20 years. A variety of cross-sectional tests reveals that 700-plus year leaseholds and freeholds trade at the same price even in geographic regions that have experienced strong growth in house prices and price to income ratios. Put differently, we find no evidence of a rational bubble in these housing markets, not even during periods of significant house price growth and despite the fact that most existing time-series tests for rational bubbles suggest the presence of such a bubble in these markets.

Taken together, our findings highlight that any study of the positive and normative implications of classic rational bubbles would benefit from showing the robustness of its conclusions to considering other, more empirically plausible models of bubbles. Indeed, I believe that designing and then testing such alternative models of asset price bubbles is an exciting research agenda.

Social Networks and Housing Markets

Understanding how house prices are determined is also a motivating question in some of my other work. In particular, in joint work with Michael Bailey, Rachel Cao, and Theresa Kuchler, I analyze the effects of social interactions on individuals' housing market expectations and investments.4

Our data combine anonymized social network information from Facebook with housing transaction data and a survey. Variation in the geographic spread of social networks combined with time-varying regional house price changes induces heterogeneity in the house price experiences of different individuals' friends that is not systematically related to other factors that might also affect those individuals' housing market investments. We find that individuals whose geographically distant friends experienced larger recent house price increases are more likely to transition from renting to owning. They also buy larger houses, and pay more for a given house. Similarly, when homeowners' friends experience less positive house price changes, these homeowners are more likely to become renters, and more likely to sell their property at a lower price. These relationships appear to be driven by the effect of social interactions on individuals' housing market expectations. Indeed, survey data show that individuals whose geographically distant friends experienced larger recent house price increases consider local property a more attractive investment, with larger effects for individuals who regularly discuss such investments with their friends.

Our findings suggest that differences in social networks can be a key driver of disagreement about the value of housing assets. They also show that social interactions can play an important role in propagating house price shocks across different regions: a fundamental demand shock in one part of the United States might make people in other regions more optimistic, and drive up house prices in those regions, purely as a result of increased speculative demand.

Much work remains to be done to better understand the role of social networks in economic and social decision making. Indeed, my research suggests the potential of using newly emerging data from online social networks to help overcome some of the pervasive measurement challenges in this type of work. In ongoing research with various coauthors, I continue to use data from Facebook to analyze the effect of social interactions on a broad range of outcomes, from mortgage refinancing, to the adoption of new products, to patent citations and migration.

House Prices and Consumer Demand

In the United States, housing is the largest asset of most households. Consequently, variation in house prices can create large shocks to households' wealth, and, through home equity extraction, to households' liquidity position.

An emerging literature has started to explore the effects of changes in house prices on household consumption behavior and real economic activity. In joint work with Joseph Vavra, I contribute to this research effort, and study cross-regional variation in house price movements to better understand how local retail prices and markups respond to local demand shocks.5 This response of markups to demand shocks provides a key amplification mechanism in many New Keynesian macro models, but evidence on the cyclicality of markups from aggregate time-series data has proved inconclusive.

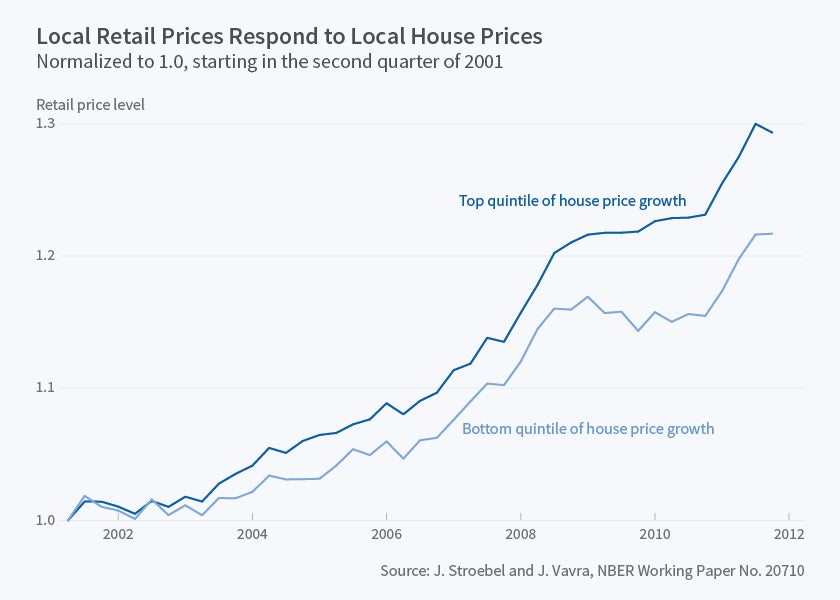

We use a large dataset of retail store scanner data to construct local retail price indices at the zip code and Metropolitan Statistical Area (MSA) levels. We then show that local retail prices respond to local house price movements. For example, Figure 2 shows larger increases in the retail price level between 2001 and 2011 in MSAs that were in the top versus the bottom quintile of house price growth over the period. Our regression analysis uncovers elasticities of retail prices to house prices of about 15 to 20 percent across housing booms and busts.

We argue for a causal response by exploiting the local housing supply elasticity to instrument for house price changes, and by showing that the response differs by the local homeownership rate: In areas with many homeowners, higher house prices lead to higher retail prices, while in areas with mainly renters we find, if anything, a negative response. We provide evidence that these retail price responses are driven by changes in markups rather than by changes in local costs. We then argue that markups rise with house prices, particularly in high homeownership locations, because greater housing wealth reduces homowners' demand elasticity, and firms raise markups in response. Data from Nielsen Homescan provides further evidence for this explanation. In particular, we find that house price increases cause home owners to spend more, and to buy fewer goods on sale or with a coupon; we find the opposite effect for renters.

Taken together, our empirical results provide evidence of a novel and important link between changes in household wealth, shopping behavior, and firms' price-setting. Positive shocks to wealth cause households to become less price-sensitive and firms respond by raising markups and prices. We hope that follow-on research to include this mechanism in business cycle models will allow researchers to better match inflation patterns in the data.

Information and Search Frictions in Housing Markets

Asymmetric information is a pervasive feature of many asset and credit markets. However, testing the empirical implications of models with asymmetric information is often challenging because of the difficulties in observing the identities of different trading parties, as well as their relative information sets. In the U.S., details about housing transactions, including the identity of buyers, sellers, and lenders, is public information. I exploit the availability of these data in a number of research papers to better understand the role of asymmetric information in housing and mortgage markets.

In the first project, I empirically analyze credit market outcomes when competing mortgage lenders are differentially informed about the expected return on a loan.6 I study the residential mortgage market where property developers often cooperate with vertically-integrated mortgage lenders to offer financing to buyers of new homes. These integrated lenders might have more information about both the value of the mortgage collateral and borrower characteristics. By conditioning their interest rate offers on such superior information, integrated lenders can subject less-informed competitors to adverse selection.

To analyze the magnitude and implications of such asymmetric information, I construct a dataset of all housing transactions and associated mortgages in Arizona between 2000 and 2010. I find that houses financed by an integrated lender outperform ex-ante similar houses financed by non-integrated competitors by 40 basis points annually. They are also 40 percent less likely to enter into foreclosure. These differences are best explained by the integrated lender's superior information about collateral quality, not borrower characteristics. For example, I show that those houses initially financed by an integrated lender continue to outperform during the ownership period of the second owner of the house, the identity of whom was unknown to all lenders at the time the original mortgage was made. This is most likely explained by differences in collateral quality, which remains constant across ownership spells. I also show that the better performance of the integrated lenders' collateral is particularly large for houses built on expansive soil, for which subsequent house prices are more sensitive to the initial construction quality. Non-integrated lenders respond to the adverse selection by charging higher interest rates for similar mortgages when they compete against a better-informed integrated lender. This raises the average financing cost of borrowers by about 10 basis points annually.

From a policy perspective, the identification of collateral values as a key source of asymmetric information in mortgage lending helps to develop and assess policy proposals to improve the functioning of this market. In particular, a stronger focus on providing independent and reliable property assessments to all market participants might play an important role in mitigating the impact of asymmetric information.

In a related project, Pablo Kurlat and I study equilibrium outcomes in housing markets with asymmetric information among both buyers and sellers.7 We document that hard-to-observe neighborhood characteristics are a key source of information heterogeneity in housing markets: Sellers are usually better informed about neighborhood values than buyers, but there are some sellers and some buyers who are better informed than their peers. To empirically test the effects of such information asymmetry, we combine data on all housing transactions in Los Angeles County since 1994, including the identities of home buyers and sellers, with information on all real estate licenses issued in Los Angeles County. We propose that real estate agents are better informed than other households about matters such as neighborhood-level demographic trends. Consistent with theoretical predictions, we find that changes in the seller composition toward more informed sellers and sellers with a greater elasticity of sale predict subsequent house-price declines and demographic changes in a neighborhood. This effect is larger for houses whose value depends more on neighborhood characteristics, and smaller for houses bought by more informed buyers. Our findings suggest that homeowners have superior information about important neighborhood characteristics, and exploit this information to time local market movements.

A second major friction in housing markets derives from the heterogeneous nature of different houses, which means that prospective buyers do not know ex ante which houses will maximize their utility. As a result, buyers and sellers must search for high-quality matches. This search friction can have quantitatively important effects on equilibrium housing market outcomes.

Monika Piazzesi, Martin Schneider, and I empirically examine the consumer search process in the housing market, and its effect on house prices, inventories, and time on market.8 In particular, rather than considering one integrated housing market, where all home buyers potentially look at all vacant houses, we analyze housing search, trading and valuation in interconnected housing market segments with heterogeneous buyers.

We use a novel dataset on online housing search from the online real estate website Trulia to measure buyer search ranges for the San Francisco Bay Area. We use these data to split the Bay Area into 576 unique market segments along the dimensions suggested by the search queries, and represent each search query as the subset of the segments that a particular searcher is interested in. We identify over 10,000 unique search patterns within our data. We then analyze the cross-section of turnover, inventory, and search activity across our segments, and relate these measures of market activity to the observed housing search behavior. We find, for example, that search activity and inventory co-vary positively within cities and zip codes, but negatively across those units.

We propose a new search model with many segments and heterogeneous searchers to capture the importance of the inter-action of broad and narrow searchers within and across segments. This model, while high-dimensional, can be estimated given our data; it shows how market activity at different levels of aggregation depends on the interaction of heterogeneous clienteles. For example, this model can explain the difference in slopes of Beveridge curves computed within cities over time, and across cities at a point in time. Within a city over time, there are "broad searchers" who are willing to buy in a given area should new inventory come on the market. This causes those segments within that city that have more inventory to attract more search activity. Across cities, however, there is variation in which cities are attractive on various dimensions. Those cities that are less attractive see less search activity and generally also have more inventory sitting on the market. The model is also informative about the transmission of shocks across segments, which depends on the presence of households that search across two segments and therefore connect them. It also shows how search frictions induce significant liquidity discounts in house prices that vary widely cross market segments. Overall, these papers highlight the ability of housing market data to shed light on the effect that various market frictions, such as search frictions or asymmetric information, have on equilibrium market outcomes.

Endnotes

S. Giglio, M. Maggiori, and J. Stroebel, "Very Long-Run Discount Rates," NBER Working Paper 20133, May 2014, and Quarterly Journal of Economics, 130(1), 2015, pp. 1–53.

S. Giglio, M. Maggiori, J. Stroebel, and A. Weber, "Climate Change and Long-Run Discount Rates: Evidence from Real Estate," NBER Working Paper 21767, November 2015.

S. Giglio, M. Maggiori, and J. Stroebel, "No-Bubble Condition: Model-free Tests in Housing Markets," NBER Working Paper 20154, May 2014, and Econometrica, 84(3), 2016, pp. 1–53.

M. Bailey, R. Cao, T. Kuchler, and J. Stroebel, "Social Networks and Housing Markets," NBER Working Paper 22258, May 2016.

J. Stroebel and J. Vavra, "House Prices, Local Demand, and Retail Prices," NBER Working Paper 20710, November 2014.

J. Stroebel, "Asymmetric Information about Collateral Values," Journal of Finance, 71(2), 2016, pp 1071–111.

P. Kurlat and J. Stroebel, "Testing for Information Asymmetries in Real Estate Markets," NBER Working Paper 19875, January 2014, and Review of Financial Studies, 28(8), 2015, pp. 2429–61.

M. Piazzesi, M. Schneider, and J. Stroebel, "Segmented Housing Search," NBER Working Paper 20823, January 2015.