Medicare and the Incidence of Household Financial Distress

There are large regional differences in the US in the prevalence of consumer financial distress as indicated by debt collection rates, bankruptcies, and low credit scores. In The Great Equalizer: Medicare and the Geography of Consumer Financial Strain (NBER Working Paper 31223), Paul Goldsmith-Pinkham, Maxim Pinkovskiy, and Jacob Wallace explore the role that Medicare plays in mitigating these geographic disparities in the older population.

Nearly all Americans become eligible for free, federally administered health insurance through Medicare when they turn 65. Gaining Medicare coverage lets those who were previously on private health insurance reduce or eliminate their premium charges. It also helps eliminate the burden of direct payments for healthcare for those who were uninsured before turning 65. Both of these factors could improve Medicare recipients’ financial health.

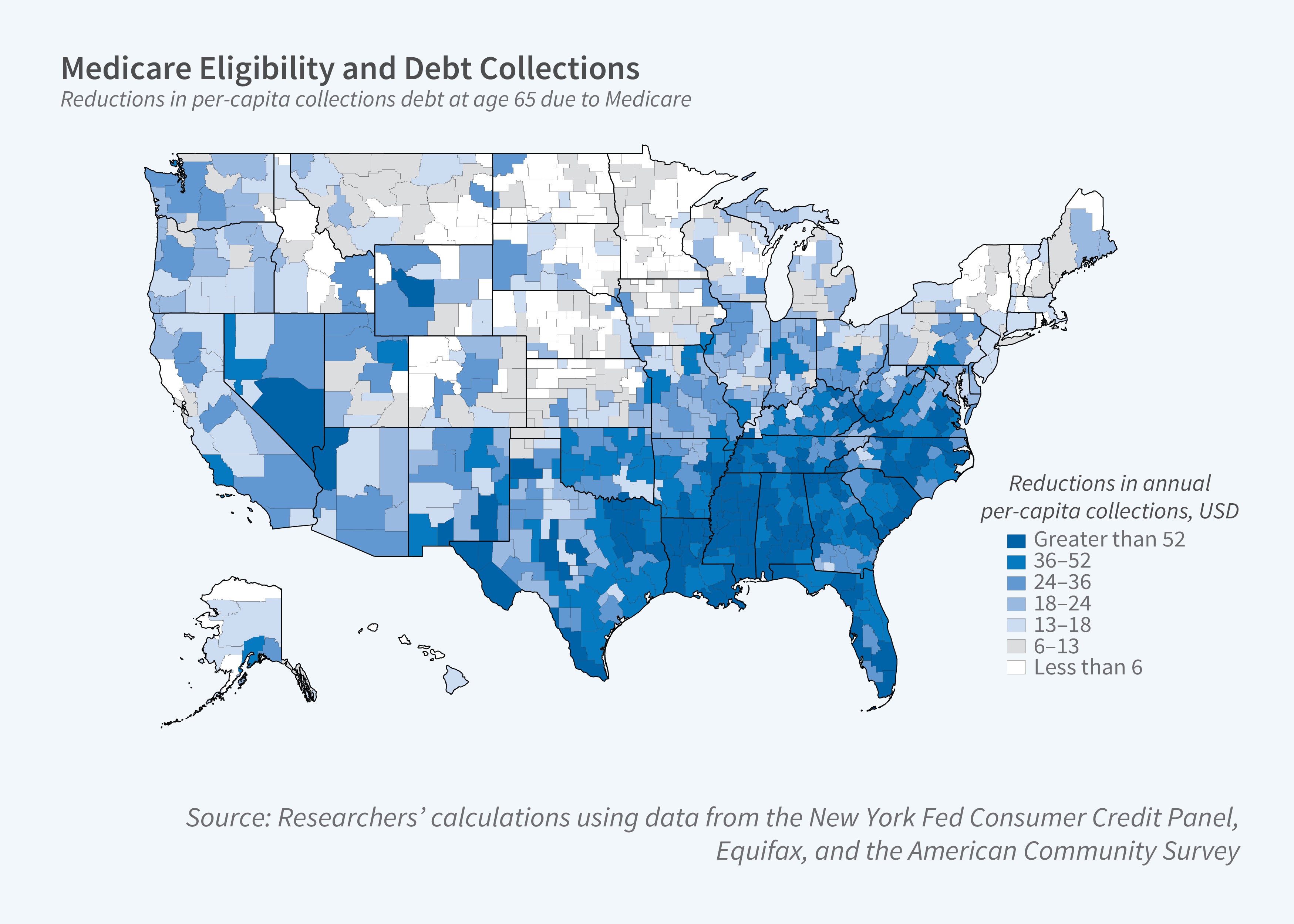

After individuals become eligible for Medicare, debts in collection decline and cross-state differences in debt burdens are reduced.

The researchers study the effect of Medicare eligibility on financial distress by comparing the incidence of such distress before and after age 65. Using data from the Federal Reserve Bank of New York’s Equifax Consumer Credit Panel, they track rates of credit card delinquency and bankruptcy as well as the amount of debt in collection.

Medicare eligibility is associated with a drop in debts in collection. The average decline is just over $28, a 30 percent reduction. Medicare eligibility also reduces disparities in average debt size across different states. The cross-state variance falls by 67 percent. Debt sizes drop most in Southern states — which have the highest baseline debt collection amounts — and in commuting zones with more for-profit hospitals, higher poverty rates, and higher shares of Black residents or residents with disabilities. There is no evidence that Medicare eligibility affects the likelihood of credit card delinquency or bankruptcy.

Medicare improves financial health more in some states than in others in part because states vary widely in the insurance rates of “near-elderly” individuals, those aged 55–64. In states with low rates of insurance among the near-elderly, Medicare eligibility significantly boosts the share of individuals with insurance. Increased health insurance coverage following Medicare eligibility explains about a third of the drop in debt collection magnitudes.

The researchers use their results to project what would happen if the Medicare eligibility age was reduced. Had such a change occurred prior to the passage of the Affordable Care Act (ACA), it would have lowered the cross-state variance of consumer financial distress, with particularly large effects in Southern states with more highly-distressed residents. Were such a change to occur today, after the passage of the ACA, the reduction in cross-state disparities would be smaller, but still substantial, because the ACA has increased coverage rates for individuals who are too young for Medicare.

—Shakked Noy