The Worldwide Impact of US Macroeconomic News

While it has been widely documented that financial conditions are correlated across countries, less is known about the origins of this comovement. A new study explores the effect of US macroeconomic news on global markets, and analyzes how such news contributes to the correlation of global stock returns. In The US, Economic News, and the Global Financial Cycle (NBER Working Paper 30994), Christoph E. Boehm and T. Niklas Kroner find that US macroeconomic news is a key force behind the observed comovement. For example, it explains, on average, about 23 percent of the quarterly variation in foreign stock returns. This finding extends prior research on monetary policy by showing that nonmonetary news about the US business cycle also influences foreign markets.

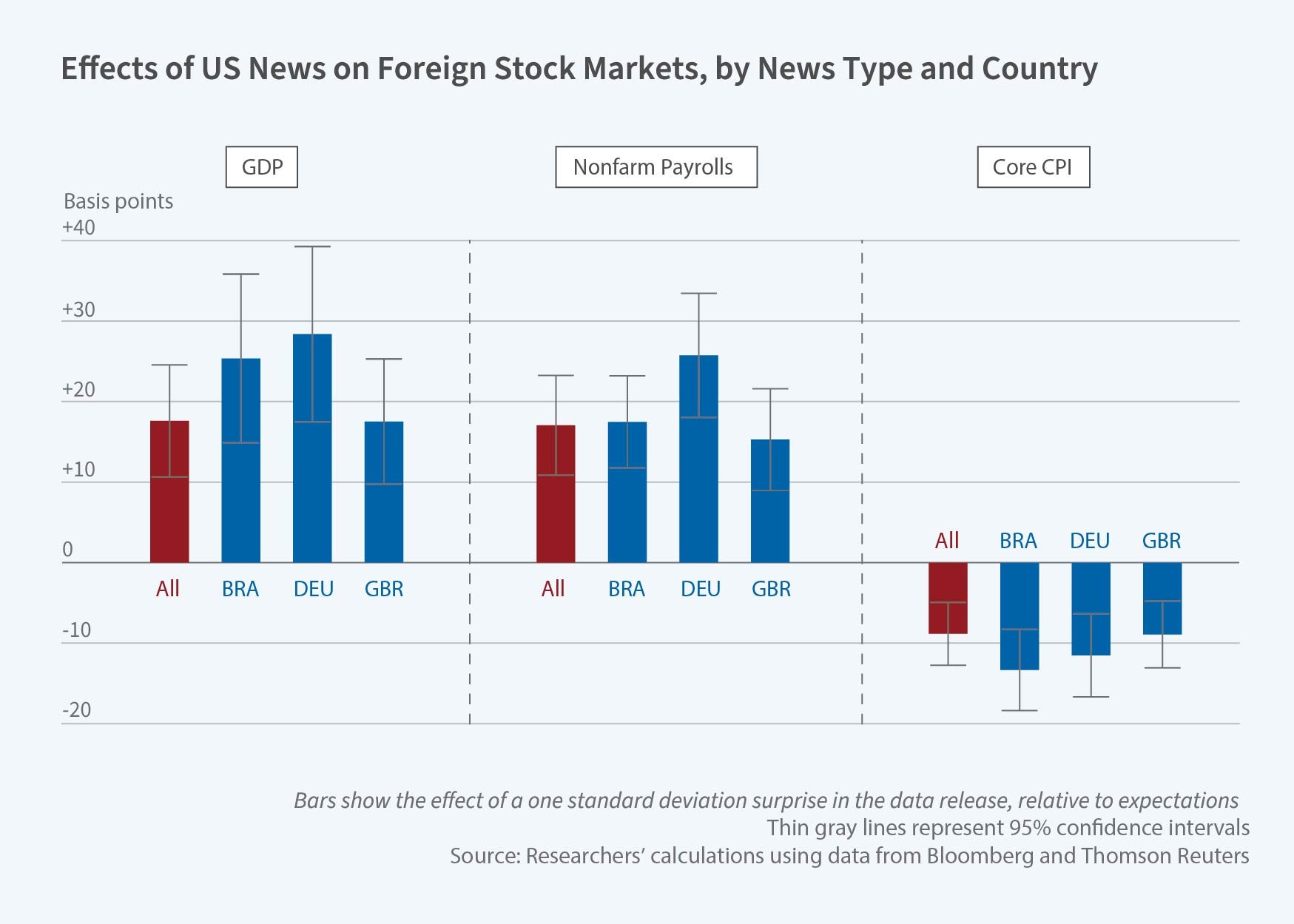

To establish the link between macroeconomic news and global market returns, the researchers analyze high-frequency intraday market data on major stock indexes in 27 countries from 1996 to 2019 to pinpoint whether foreign markets move when such shocks occur in the US. Most indexes display a statistically significant response to US news. For example, a positive surprise in US payroll employment was associated with a statistically significant stock price increase in 26 of the 27 countries. The researchers also find that US macroeconomic news explains about 15 percent of the quarterly variation in the VIX, the volatility index of the S&P 500 that is often interpreted as a proxy for global financial conditions, and about 25 percent of the quarterly variation in commodity prices.

Positive surprises in US payroll employment, and other favorable macroeconomic news, raise stock prices in global markets.

In contrast, the researchers do not find a substantively important effect of foreign macroeconomic news on US stock returns. The lack of an effect cannot be explained by less timely foreign news or lower measurement quality. A similar asymmetry exists for monetary policy. The effect of US monetary policy surprises on international equity markets is about three times as large as the effect of an equal-sized shock from the European Central Bank or the Bank of England, suggesting the greater impact of the Federal Reserve on global macroeconomic conditions. These asymmetric effects highlight the special role that the US economy plays in the international monetary and financial system.

The effect of US macroeconomic shocks on foreign stock markets can be decomposed into three components: (1) the impact of the foreign risk-free rate, (2) the impact on the country-specific risk premium, and (3) the impact on expectations of future cash flow growth. To shed light on the relative importance of these factors, the researchers study how bond yields and stock values, in the US and abroad, respond to news. Foreign bond yields respond to US macroeconomic news, though generally not in a way that can explain movements in stock prices. The researchers therefore downplay the role of changes in foreign risk-free rates and concentrate on risk premia and growth expectations. Changes in risk premia appear to be more important than changes in expected future cash flows in moving stock markets. After a positive macroeconomic surprise in the US, such as an unexpected surge in payroll employment, the risk premium for stocks falls while bond yields rise. This suggests that the news leads investors to increase their risk appetite and move from bonds to stocks.

— Laurent Belsie