Remote Work by High-Skill Workers Hurt Local Service Economies

High-skill workers’ service demand plunged early in the pandemic as some relocated and others rarely left home.

Drawn by shorter commutes and urban amenities, highly skilled, highly compensated workers in the information and management sectors moved to urban centers in recent decades, reviving cities and their service economies. As digital technologies spread, the capacity for working remotely expanded, but it was not widely utilized. That changed dramatically with the onset of the COVID-19 pandemic.

In The Geography of Remote Work (NBER Working Paper 29181), Lukas Althoff, Fabian Eckert, Sharat Ganapati, and Conor Walsh show that the COVID-induced shift to remote work has devastated the service economy that had catered to elite workers’ needs. Urban neighborhoods with more high-skill service residents have seen larger population outflows and higher work-from-home numbers throughout the pandemic, as well as larger declines in visits to local consumer-service establishments and sharper drops in residents’ spending on consumer services. Low-skill consumer-service workers in big cities lost more hours per worker than their rural counterparts.

The researchers identify four job categories, which they label Skilled Scalable Services (SSS), that account for the largest share of remote work potential: Information; Finance and Insurance; Professional Services; and Management of Companies. They estimate that 79 percent of the jobs in these four categories can be done remotely.

Drawing on monthly census surveys, the researchers track the rate of remote work across cities and industries. In May 2020, the overall remote work rate was 40 percent. When they rank cities by their density, however, they find significant variation. In the densest cities, the remote work rate was more than 50 percent, compared with 20 percent in the least dense cities. The percentage of SSS workers who worked remotely was twice that of the rest of the economy. Correspondingly, the share of SSS employment is twice as high in the densest cities as in the least dense.

By the fall of 2020, zip codes in high-density cities experienced nearly a 10 percent drop in population, while population increased by 5 percent in low-density cities, according to cellphone data. These population flows were reflected in housing demand. Zillow data on rental prices show larger declines in neighborhoods with higher pre-pandemic shares of SSS workers than in other areas. Within cities, the 10 percent of zip codes with the most SSS workers saw rents fall 16 percent more than the 10 percent of zip codes with the fewest SSS workers.

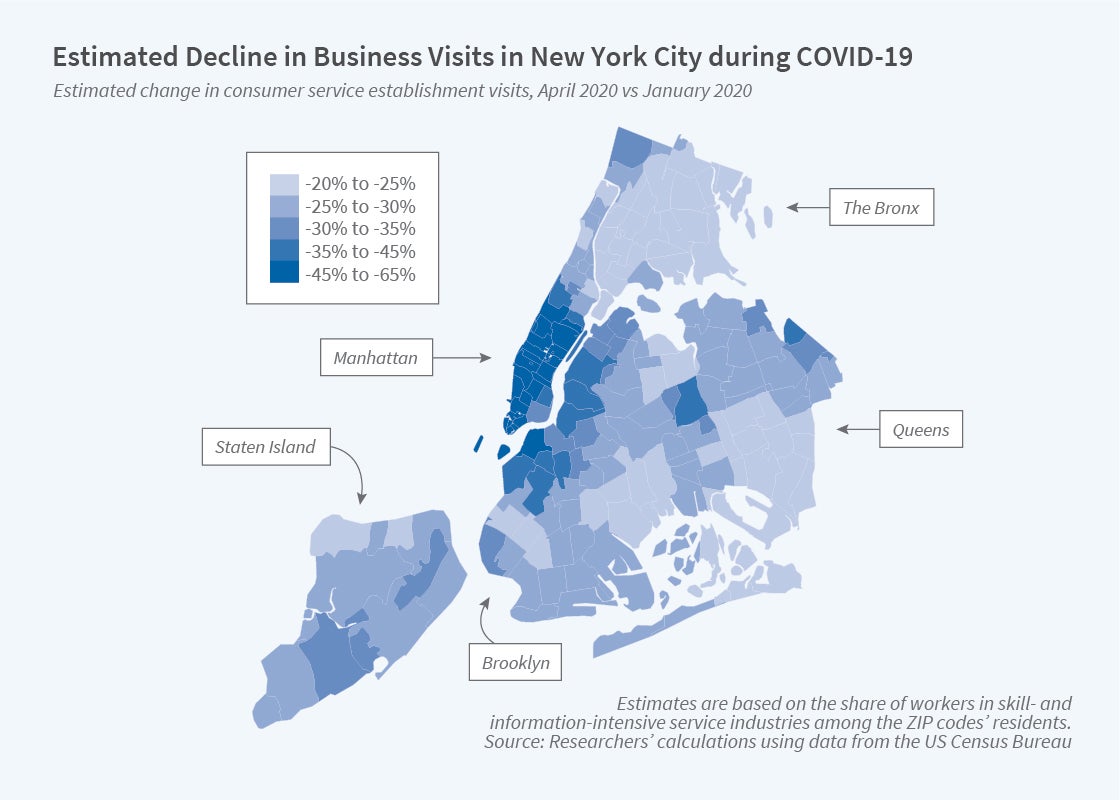

County-level data collected by Facebook suggest that SSS workers who did not relocate rarely ventured more than a few blocks from their homes. A higher share of SSS workers in a zip code was associated with a greater decline in foot traffic to hotels, restaurants, coffee shops, bars, barbershops, and other service-sector businesses. In New York City, for example, the decline in consumer visits in affluent areas of Manhattan and Brooklyn with a high density of SSS workers was twice as great as in parts of the Bronx and Brooklyn where fewer SSS workers live. The researchers estimate that a hypothetical zip code in New York with no SSS residents would have seen consumer visits decline by 38 percent between January 2020 and April 2020, while the decline could have been 80 percent or more in an area with many SSS workers.

The researchers note that if the transition to remote work for SSS occupations persists after the pandemic, the densest cities could permanently lose high-skill residents and the consumer businesses they support.

— Steve Maas