International Reserve Management in Emerging Market Economies

Analysis of the behavior of 21,447 firms in 46 emerging economies finds active central bank management of international reserves increases business investment.

When global financial risk spikes, emerging market economies can experience widened credit spreads, plunging investment, capital flow reversals, and heightened speculation about impending debt crises. If a country’s central bank accumulates international reserves during good times, it can “lean against the wind” by selling those reserves in bad ones. Management of international reserves by central banks can alleviate the financial market instabilities created by global shocks that increase business financing costs, thereby mitigating the worst effects of economic downturns and helping governments to service debt when borrowing costs increase.

In International Reserve Management, Global Financial Shocks, and Firms’ Investment in Emerging Market Economies (NBER Working Paper 29303), Joshua Aizenman, Yin-Wong Cheung, and Xingwang Qian track the investment behavior of 21,447 publicly traded firms in 46 emerging market economies. They explore the impact of active international reserve management policies that were pursued by some central banks over the 2000 to 2018 period. The researchers estimate that active reserve management is positively associated with business investment. They illustrate their findings for the case of the Philippines, a country with a GDP near the median in their sample. They estimate that a $1 billion reserve accumulation by the Philippine central bank was associated with about $200 million more in investment by the country’s 222 publicly listed firms.

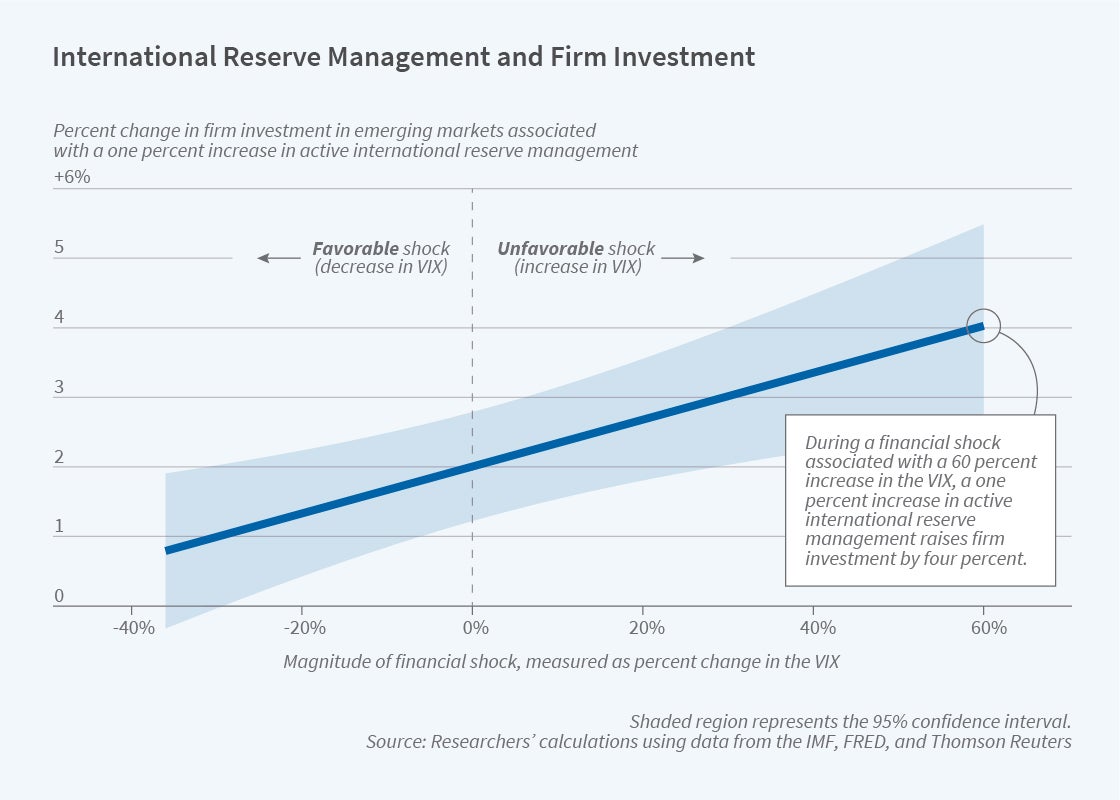

The study finds that the marginal effect of reserve management on investment increases as shocks become more severe, and declines as global risk aversion fades. The researchers measure global financial shocks using changes in the VIX index, a measure of the implied volatility of S&P 500 stock options in the United States. They define active international reserve management transactions as the residual after detrending official international reserve data from the International Monetary Fund.

There are differences across firms in the impact of active reserve management on investment. Larger firms with higher cash flows and more rapid sales growth tend to be more responsive than other firms. Financially unconstrained firms are 4.5 times more responsive than financially constrained firms. For the purpose of the study, financial constraints are defined by access to external fund sources, the ratio of tangible assets to long-term liabilities, and an estimate of the firm’s cost of external financing.

The researchers find that higher country credit spreads — larger differences between the risk-free interest rate and the interest rate charged to borrowers in that country — are negatively associated with firm investment. Managing international reserves to narrow country credit spreads is therefore one channel through which active reserve management supports firm investment. About 22 percent of the effect of active reserve management on the investment behavior of unconstrained firms, and 36 percent of the effect on financially constrained firms, is mediated by the impact of this policy on country spreads. The researchers also find that active international reserve management has a more substantial effect on firm investment in countries with capital controls.

— Linda Gorman