The Long-Term Effects of Childhood SSI Benefits

The Supplemental Security Income (SSI) program provides cash benefits and access to Medicaid to 1.3 million low-income children in the US with physical, mental, and behavioral disabilities. Supporters of the program contend that SSI can improve the long-term outcomes of children by boosting household resources of poor families raising a child with a disability. Critics argue that conditioning benefits on a child’s disability creates perverse incentives for families to present their children as disabled, which could discourage the child’s human capital development.

The effect of childhood SSI benefits on educational attainment and adult earnings is not well understood, due to a lack of evidence. Studying the long-term effects of the SSI program is inherently difficult, since child beneficiaries and nonbeneficiaries may differ in ways that could affect their adult outcomes.

Researcher Manasi Deshpande offers new evidence on this question in her study, How Disability Benefits in Early Life Affect Long-Term Outcomes (RDRC Working Paper NB20-05).

To surmount the usual estimation challenges, the author uses two policy changes that affect the probability that a child SSI beneficiary undergoes a medical review, a process that can lead to the loss of benefits. First, children approved for SSI just after fiscal year 2001 were less likely to be reviewed than those approved before this date, due to a budget cut at the Social Security Administration (SSA). Second, all children turning 18 after August 1996 had an age 18 medical review, in accordance with a provision in the Personal Responsibility and Work Opportunity Act (PRWORA), while few children turning 18 before this date had such a review. The author uses the first change to look at how an increased risk of medical review and benefit loss affects the outcomes of child beneficiaries and the second to look at how this risk affects the outcomes of younger siblings of child SSI beneficiaries, who may also benefit when the household has more resources.

The author uses SSA administrative data for the project, linking data across several different earnings and benefits files. Linking records of SSI child beneficiaries to records of their siblings presents a particular challenge. The author uses the parents’ social security number to match records for younger siblings who are also SSI beneficiaries and develops a probabilistic matching process to identify younger siblings who are nonbeneficiaries.

Turning to the results, the author finds that receiving child SSI benefits lowers the beneficiary’s own adult earnings, but this effect is not statistically significant. The precision of estimate is expected to increase over time, as more years of earnings data become available.

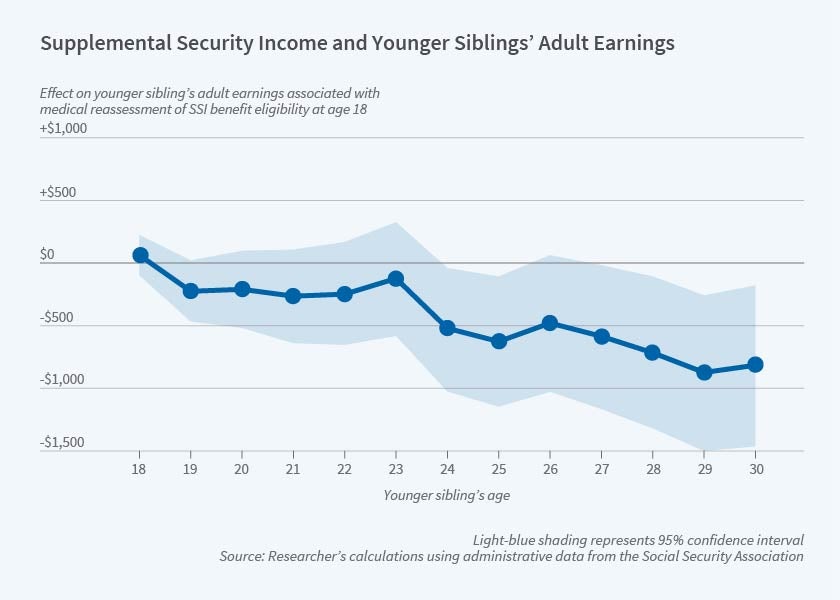

The results for the siblings of child SSI beneficiaries are clearer. The increased risk of medical review and loss of benefits at age 18 that followed the passage of PRWORA are associated with a decrease in the sibling’s adult earnings, an effect that grows in size and statistical significance as the sibling ages. The implied effect of removing an 18-year-old from SSI is to reduce the younger sibling’s earnings by $7,600 at age 29 and by an average of $5,000 per year from ages 19 to 30 for those younger siblings who are also SSI beneficiaries. The estimated effect on siblings who are not SSI beneficiaries is even larger.

The author also examines whether mothers of SSI beneficiaries experience a change in earnings when their children lose SSI benefits. She finds little response, suggesting that the adverse effect on younger siblings’ adult earnings likely operates through a decrease in household income rather than a decrease in parent time spent on childcare.

The author concludes, “this evidence suggests, for the first time, that SSI affects children’s human capital development through household resources. With additional years of data, this analysis will also provide evidence on the magnitude of the perverse incentives effect relative to the household resources effect.” In ongoing work with Alessandra Voena and Jason Weitze, Deshpande is developing a dynamic model of children’s human capital development—including the specific roles of household resources and potential perverse incentives from government benefits—and using the variation from this working paper to estimate the model.

The research reported herein was performed pursuant to grant #RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of NBER, SSA or any agency of the Federal Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.