Late-Life Income and Assets as Measured in Tax and Survey Data

To understand whether older Americans have adequate financial resources to fund their retirement years, it is necessary to have accurate information about late-life income and assets. Several recent studies have suggested that administrative data and more widely-used survey data do not always provide the same picture of retirement resources.

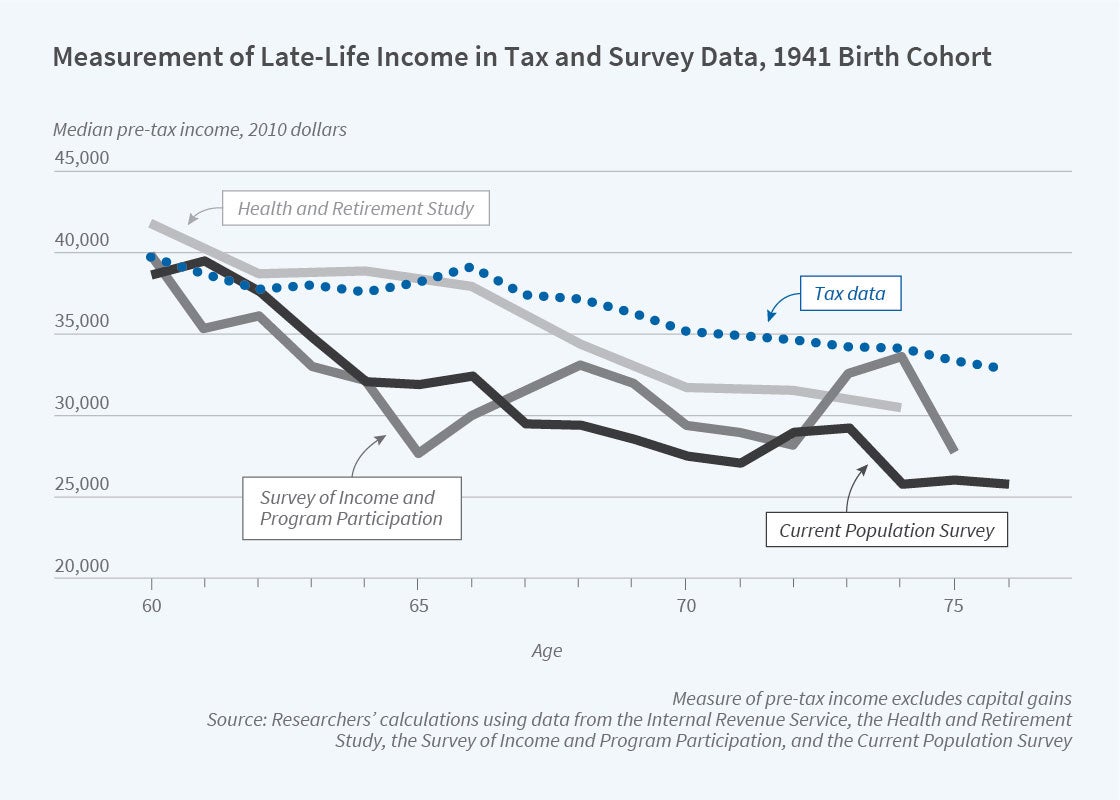

In The Evolution of Late-Life Income and Assets: Measurement in IRS Tax Data and Three Household Surveys (NBER RDRC Working Paper NB20-04), researchers James Choi, Lucas Goodman, Justin Katz, David Laibson, and Shanthi Ramnath examine this issue. Using a 5 percent sample of IRS tax records, the authors evaluate how three widely used household surveys – the Health and Retirement Study (HRS), the Survey of Income and Program Participation (SIPP), and the Current Population Survey (CPS) – capture the level of and trends in late-life income and assets.

The authors focus on individuals born between 1933 and 1952, whose tax records they observe between 2001 and 2017. The authors construct income and asset variables that are similar across the IRS data and three surveys and adjust for differences in the samples, such as whether people living in institutions or with zero tax liability are included. The analysis excludes income from Supplement Security Income (SSI), Veterans Affairs (VA) pensions, and other government transfers, as well as capital gains and losses.

A first key finding is that for middle-income households, the decline in household income with age during the early years of retirement is smaller in tax data than in survey data. Among those born between 1943 and 1949, the decline in median pre-tax income between age 58 and age 68 is 11.7 percent in the tax data, versus 24.4 percent in HRS, 16.8 percent in the SIPP, and 29.0 percent in the CPS. The reason for the discrepancy is that the surveys tend to overestimate income from work at age 58 and to underestimate income from Social Security and especially pensions.

There are some differences across the surveys, with the SIPP more closely approximating the income of older households for some specific income categories but the HRS more closely approximating total pre-tax income of older households, due to offsetting patterns in under- and overestimating various types of income. Balances in Individual Retirement Accounts (IRAs) are measured quite accurately in the HRS, especially at older ages, while the SIPP significantly underestimates IRA balances.

Second, the authors examine income growth across birth cohorts at older ages. At ages 68 to 74, median pre-tax income grew 16.3 percent from the 1933 birth cohort to the 1943 birth cohort in the tax data, compared to an increase of 21.7 percent , 23.5 percent , and 23.6 percent in the HRS, SIPP, and CPS, respectively. At ages 58 to 67, median pre-tax income grew by −0.2 percent from the 1944 birth cohort to the 1950 cohort in the tax data, as compared to −7.8 percent , −0.7 percent , and −0.9 percent in the HRS, SIPP, and CPS.

Finally, both tax and survey data indicate that non-Social Security income has been falling across cohorts for low-income households. At ages 68 to 74, non-Social Security income for households at the 25th percentile of household income fell by 16.5 percent from the 1933 to the 1943 cohort in the tax data; declines were larger in the HRS and SIPP (26.9 percent and 45.5 percent), but smaller in the CPS (11.1 percent). The share of age-72 households with neither financial assets nor non-Social Security income rose from 18.9 percent in the 1933 cohort to 20.5 percent in the 1945 cohort in the tax data; the survey data show similar trends. Interestingly, there is substantial geographic heterogeneity in the share of households that rely on Social Security exclusively, ranging from 22.1 percent in Georgia to 11.1 percent in Kansas among age-72 households from the 1933 cohort.

The authors conclude, “the tax data show considerable declines in income across the distribution as households age. However, relying on survey data alone will overstate this decline at the median during the initial transition to retirement, leading to overly dire assessments of middle-income household retirement preparedness. By contrast, while the tax data show income growth across birth cohorts, growth at older ages across cohorts is overstated in survey sources. Leaning on survey data will therefore present an excessively optimistic picture of cohort trends in retirement preparedness. All sources indicate declining income outside of the Social Security system for low-income households, as well as an increasing share of households who are entirely reliant on Social Security to finance their consumption.”

The research reported herein was performed pursuant to grant #RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of NBER, SSA or any agency of the Federal Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.