Racial and Ethnic Disparities in Retirement Outcomes: Impacts of Outreach

Workers need to prepare for their future as retirees. This is a complex task that is influenced by workers’ retirement knowledge, financial literacy, preferences, expectations, and opportunities.

In Racial and Ethnic Disparities in Retirement Outcomes: Impacts of Outreach (NBER Working Paper 30456), researchers Angelino Viceisza, Amaia Calhoun, and Gabriella Lee review literature on disparities in retirement outcomes and the potential for outreach and service delivery by the Social Security Administration and other entities to help address such disparities.

Average retirement wealth in households near retirement age is substantially higher for non-Hispanic Whites than for Blacks and Hispanics. These disparities in retirement outcomes partly reflect a long history of racism and structural barriers, including employment discrimination, occupational segregation, and low-paying jobs; limited intergenerational wealth transfers; limited home ownership and equity due to lending market discrimination; adverse health events and limited access to health insurance; and financial needs of family and friends.

Social Security plays a significant role in reducing the retirement wealth gap as it is distributed more equally across racial and ethnic groups than other forms of wealth, but it is not sufficient to close the gap. There is room for employer-sponsored retirement plans and individual retirement accounts to reduce retirement wealth disparities, but these forms of wealth require more active decision-making by individuals.

The authors report that Blacks and Hispanics feel less financially prepared for retirement and less knowledgeable about financial decisions such as how much to save for retirement, how to invest retirement savings, and how to manage spending in retirement. There are corresponding gaps in financial literacy, with Blacks, Hispanics, and American Indian and Alaska Natives tending to score lower than Whites. These gaps exist within income groups and are only partly explained by differences in family background, individual characteristics, and neighborhood socioeconomic characteristics. The financial literacy literature has established that those who are more financially literate are more likely to plan and save for retirement.

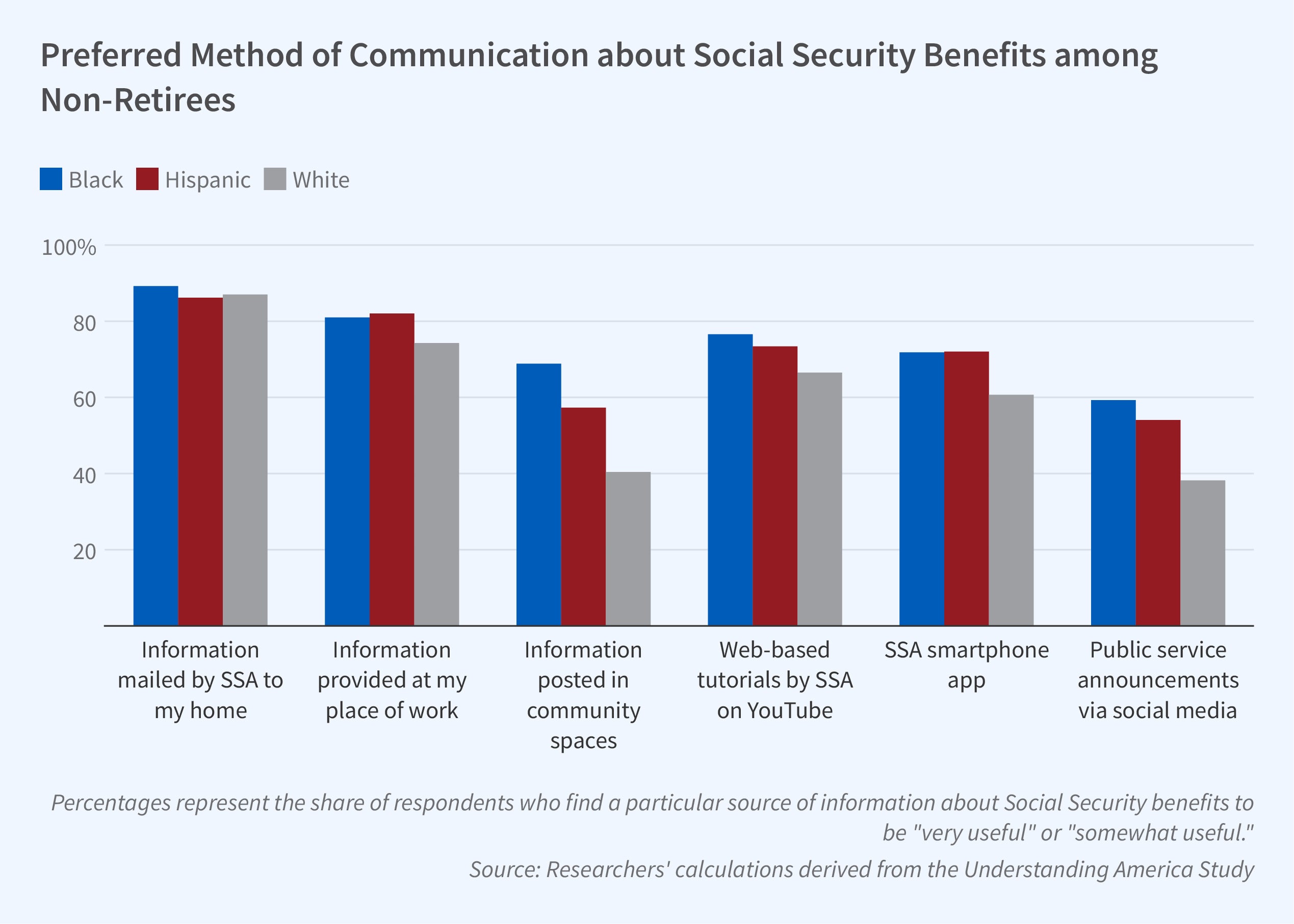

Outreach initiatives have the potential to help the public acquire information that is relevant for retirement planning. As shown in the figure, most nonretired persons report that they would find it useful to receive more information about Social Security benefits. Relative to Whites, Blacks and Hispanics have a higher demand for information from all sources, especially information posted in community spaces or provided via public service announcements on social media.

A number of studies examine the effects of outreach on retirement planning for the general population. Several studies show that the provision of information can affect behavior — for example, individuals who receive multiple Social Security statement mailings claim their benefits later and workers who receive a flyer explaining the value of contributing to their employer’s pension plan are more likely to do so. Many studies have incorporated insights from behavioral economics, like the impact of framing or nudges, or tested behavioral factors, such as time preferences or reference dependence, and found that these elements influence claiming age and retirement savings contributions. Peer effects and cultural factors, such as racial differences in trust, can also affect retirement behaviors.

The authors note that “one key avenue for future work is to design retirement outreach interventions that cater to the needs of specific demographic groups, for example, by embracing the fact that Blacks, Hispanics, and Whites have different preferences for information acquisition and rely on different types of preexisting social networks.” They suggest that this work “should capitalize on the lessons learned from prior outreach studies, for example, the role of behavioral factors, peer effects, and culture.” Finally, they note the need for methodological innovations to support these goals, including work to properly identify race and ethnicity, link across data sources, and customize data collection methods to minority respondents, including by addressing language barriers and cultural sensitivities.

The research reported herein was performed pursuant to grant RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA, any agency of the federal government, or NBER. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof. This project was also supported by grant number T32HS026128 from the Agency for Healthcare Research and Quality. The content is solely the responsibility of the authors and does not necessarily represent the official views of the Agency for Healthcare Research and Quality. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.