The Earnings of Self-Employed Workers

Self-employed workers have significantly higher average incomes and steeper, more persistent income growth profiles than their paid-employed counterparts, according to On the Nature of Entrepreneurship (NBER Working Paper 32948), a study by Anmol Bhandari, Tobey Kass, Thomas J. May, Ellen McGrattan, and Evan Schulz. The researchers analyze a new longitudinal dataset constructed from Internal Revenue Service and Social Security Administration records, thereby overcoming the limitations of household surveys that have historically been employed in entrepreneurship research. Surveys often suffer from small sample sizes, short panels, and top-coded income reports that fail to capture high incomes among some of the self-employed. The findings challenge the conventional wisdom that entrepreneurs accept lower pay in exchange for nonpecuniary benefits like flexibility and autonomy.

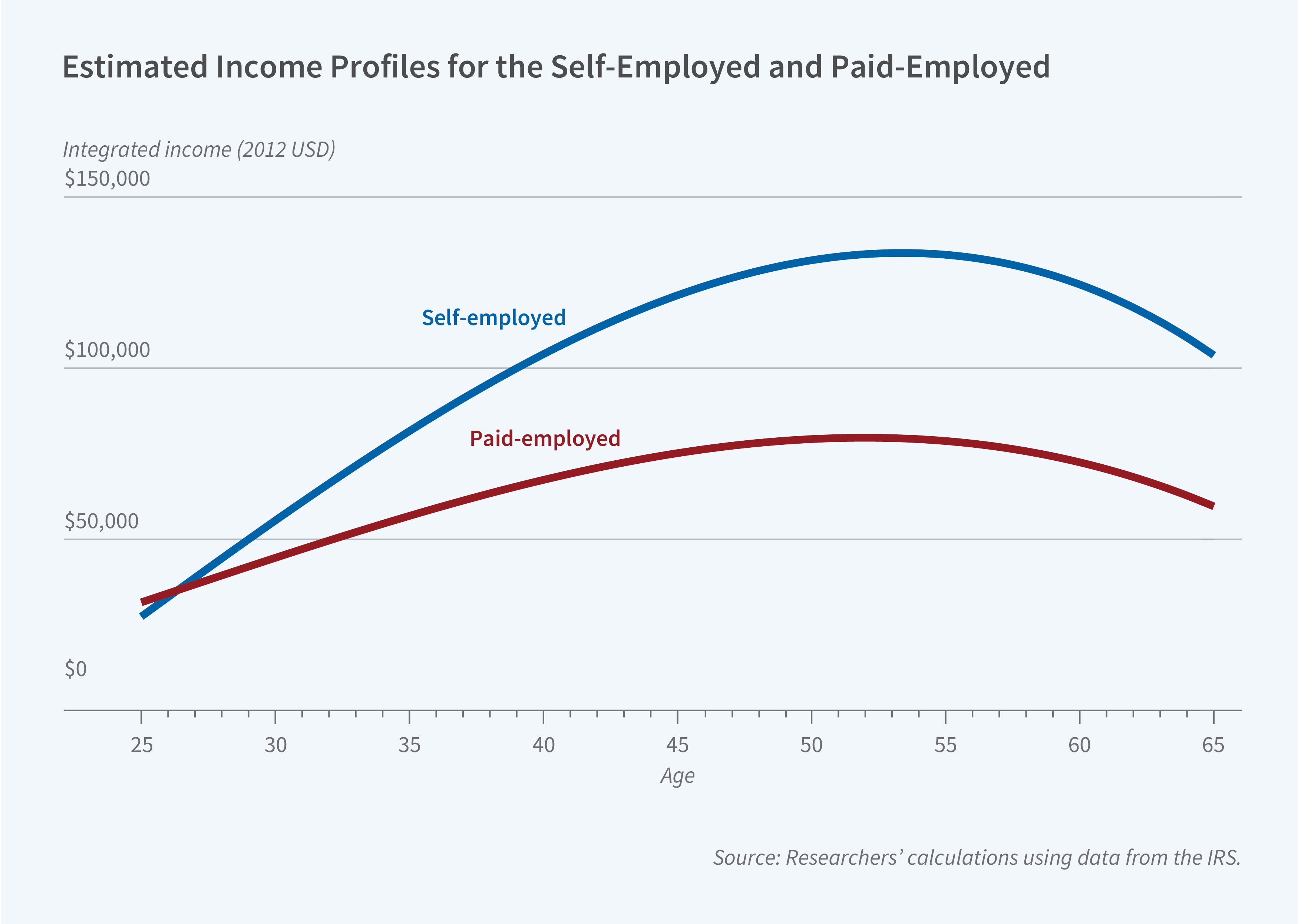

The income of self-employed individuals at age 55 is about 70 percent higher, on average, than that of similar paid employees, but it is also subject to greater fluctuations.

The researchers track pass-through business owners—sole proprietors, partners, and S corporation owners—from 2000 to 2015 and create a panel dataset consisting of individuals born between 1950 and 1975. They measure self-employment income by combining net profits from sole proprietorships, partnership income, S corporation income, and wages from S corporations that are owned by the individuals. Using this comprehensive income definition, they categorize workers into distinct employment groups based on the predominance of their employment type over the sample period.

The researchers find that individuals who tried self-employment (defined as individuals who work at least 12 years during the sample period with at most one intermediate year of non-employment, and have fewer than 12 years of paid-employment) have similar average incomes at age 25 as those who worked primarily (at least 12 years) in paid employment, but the incomes of the self-employed follow much steeper growth trajectories. By age 55, the self-employed earn an estimated average income of $134,000 compared to $79,000 for paid-employed workers with similar characteristics. This pattern holds across various subgroups defined by industry, skill level, and demographic attributes.

While more than half—57 percent—of primarily self-employed individuals earn less than comparable paid-employed peers, these individuals account for only 16 percent of total self-employment income. This suggests that while many individuals may enter self-employment for nonpecuniary reasons, most self-employment income flows to entrepreneurs who earn more than they would in paid employment.

Self-employed individuals experience greater income fluctuations than their paid-employed counterparts. The range between the 10th and 90th percentiles of the distribution of annual income changes for the self-employed is approximately 2.5 times larger than for paid-employed workers.

The study also examines business dynamism by tracking self-employment entry and exit rates. These rates are relatively constant throughout the sample period, even during the Great Recession of 2008–09. While self-employed individuals in cyclically sensitive sectors like real estate and construction experienced substantial income declines during that period, with year-over-year reductions of 50 and 33 percent, respectively, exit rates remained stable.

The researchers find little evidence of significant impediments to entering entrepreneurship. In contrast to earlier studies that concluded that liquidity constraints limit entrepreneurship, this study finds no relationship between housing price appreciation (which could be used as collateral for a business loan) and entry into self-employment. Most individuals who found new businesses maintain positive individual income despite experiencing business losses in their early years, suggesting that they have sufficient financial resources or other forms of insurance against business volatility.

For more information on the results: On the Nature of Entrepreneurship

This research was conducted while May and McGrattan were IRS employees without pay under an agreement made possible by the Intragovernmental Personnel Act of 1970 (5 U.S.C. 3371-3376), and while Kass was an employee at the US Department of the Treasury. The researchers acknowledge support from the National Science Foundation (Award #2214248). Any findings, interpretations, opinions and conclusions expressed herein are those of the authors and do not necessarily represent the views or political positions of the IRS or the US Department of the Treasury, or the NSF. All results have been reviewed to ensure that no confidential information is disclosed. All data work for this project involving confidential taxpayer information was done at IRS facilities, on IRS computers, by IRS and Department of the Treasury employees, and at no time was confidential taxpayer data ever outside of the IRS computing environment.