The Design of Trade Agreements

Since 1947 there has been a multilateral forum—first the General Agreement on Tariffs and Trade (GATT), now the World Trade Organization (WTO)—where governments meet to agree on the rules of international trade. To interpret and evaluate the role of these organizations requires a two-step research program. The first step is to identify the central problems that a trade agreement might address. The second is then to bring economic arguments to bear on the design of an agreement that would best resolve these issues. Here we review some of our joint efforts to contribute to ongoing research in this area.

The Purpose of Trade Agreements

Economists have identified two broad and possibly complementary rationales for trade agreements: to help governments in-ternalize the international externalities associated with their policy choices, and to help governments solve a commitment problem with respect to the private sector.1 Our recent work has focused on the former reason, specifically on this question: What form do the international externalities associated with trade policy take?

We have established previously that the terms-of-trade externality plays a central role.2 If governments use trade agreements to achieve mutually beneficial policy outcomes when viewed through the lens of their own objectives, then in the absence of an agreement there must be a policy inefficiency in terms of those objectives that the agreement can correct. Whether government objectives reflect the maximization of national income or the pursuit of national distributional or political goals, we found that it is the terms-of-trade externality—and the associated incentive for international cost-shifting it creates for governments with sufficient monopsony power—that lies at the heart of a trade agreement's reason to exist.

Governments do not need trade agreements to make adjustments to their own local-market prices; they have their own trade-policy instruments to accomplish this. If the government of a country wishes to adjust the local-market price of an import good to alter the level of protection it provides to its import-competing producers, it can accomplish this much with a unilateral change in its tariff. But trade agreements can help member governments make such adjustments without altering their terms of trade, and for governments with monopsony power in international markets trade agreements therefore expand the set of possibilities beyond what these governments could achieve on their own. At least some of these new possibilities can create mutual gains for the member governments, though this is so only for the possibilities that entail negotiated tariff reductions. According to this view, the purpose of trade agreements is to eliminate policy inefficiencies that exist when governments are free to exert monopsony power on international markets, depress foreign-exporter prices with their unilateral decisions to protect domestic markets, and thereby shift some of the costs of this protection onto foreign exporters. By eliminating these inefficiencies, trade agreements will lead to freer, though not necessarily free, trade.

Our early work on these issues focused on perfectly competitive market settings. In recent work, we show that the central role played by the terms-of-trade externality in identifying the purpose of a trade agreement extends to a wide variety of market settings. These settings include free-entry monopolistic competition and free-entry Cournot oligopoly, where firm-delocation/home-market effects create an incentive for trade policy intervention.3 They also include oligopolistic settings where the number of firms is fixed and profit-shifting incentives for intervention exist.4

Each of these imperfectly competitive settings introduces a rich new set of local-price externalities that complement the traditional terms-of-trade externality. We show, however, that if all governments could be induced to make policy choices that were free from terms-of-trade motives, and hence not motivated by the international cost-shifting made possible by monopsony power, then these policy choices would bring governments to the efficiency frontier defined in light of their objectives, and there would be nothing further for a trade agreement to do. The key point is that local-price externalities are "shut down" at the local prices implied by each government's policy choices if each government suppresses international cost-shifting motives when making those choices. In this sense, eliminating the cost-shifting behavior associated with the terms-of-trade externality remains the sole rationale for a trade agreement in these imperfectly competitive settings, just as in the perfectly competitive benchmark. From this perspective, the "terms-of-trade theory" of trade agreements can be understood to encompass a remarkably wide class of models.

In all of these settings, an important condition for our results is that governments have a complete set of trade policy instruments, though not necessarily domestic policy instruments. If this condition were not met, then local-price externalities would persist even if each government were to suppress international cost-shifting motives when selecting the level of intervention with the policies it does possess, and an additional purpose for trade agreements, beyond suppressing the exercise of monopsony power, would arise: solving the missing instruments problem.6

What Do Trade Negotiators Negotiate About?

Do governments use trade agreements to eliminate the policy inefficiencies that exist when they are free to exert their mo-nopsony power on international markets? We provide an answer to this question by examining the negotiated tariff cuts of 16 countries that joined the WTO in the decade following its inception, under the assumption that these countries agreed to reduce their tariffs from noncooperative (unconstrained) levels to efficient levels as the "price of admission" to the WTO.6

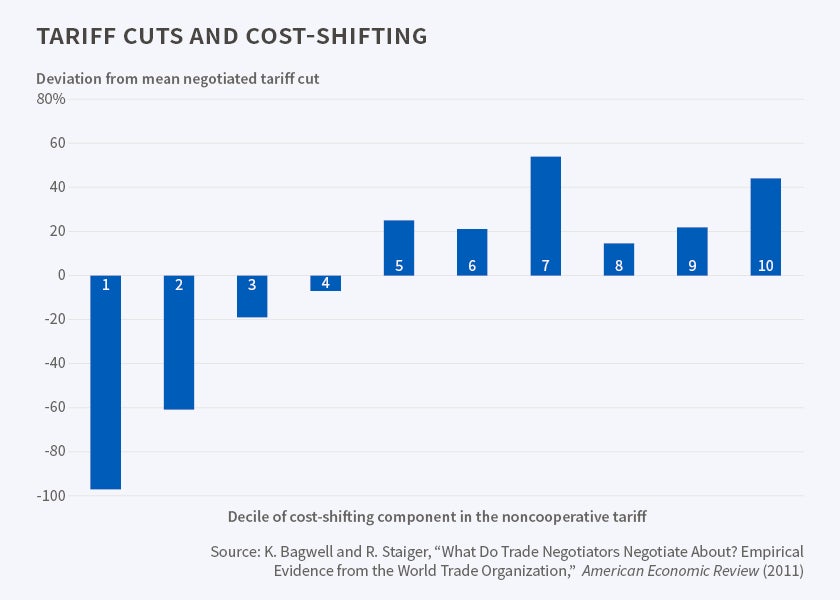

We use the terms-of-trade theory to estimate the component of the noncooperative tariff that embodies the international cost-shifting motive. [See Figure]In our most general version of the model, this estimate is a function of pre-negotiation import volumes, prices, and trade elasticities that gauge a country’s power to affect world prices. In a linear version of the model, the estimate is a function of just pre-negotiation import volumes and prices. We use these estimates to derive the pattern of negotiated tariff cuts that is implied by the terms-of-trade theory. If all governments sought to maximize national income, their tariffs would reflect only the international cost-shifting component and negotiations would eliminate all tariffs. But if governments pursue national distributional or political goals, their noncooperative tariffs reflect these goals combined with the international cost-shifting component. Estimating this cost-shifting component is then the key step to predicting the negotiated tariff cuts implied by the terms-of-trade theory; if the cost-shifting component is large, then so too should be the negotiated tariff cut.

For a subset of five of our set of 16 WTO-acceding countries for which we have data to calculate our most general measure of the cost-shifting component, the accompanying figure plots the percent deviation from mean negotiated six-digit Harmonized System product tariff cut by decile of this cost-shifting component. There is a strong positive relationship between the size of the cost-shifting component in the noncooperative tariff and the size of the negotiated tariff cut, as the theory predicts. A similar plot arises for all 16 countries when we use instead the measure of the cost-shifting component from our linear model and can exploit the wider data availability to construct this measure. And when we turn to regression analysis, we find that these basic patterns in the data survive a number of controls and robustness checks. Subsequent work has confirmed and extended empirical support for the terms-of-trade theory of trade agreements to a wider set of countries and to additional implications of the theory.7

The Design of Trade Agreements

Why does the purpose served by trade agreements matter? It matters for the design of trade agreements. Many of the core design features of the GATT can be understood as features that support governments’ efforts to neutralize the terms-of-trade consequences of their policy choices.

We show that the GATT's design pillars of reciprocity and nondiscrimination can be understood from this perspective.8 Reciprocity, defined as tariff changes that lead to equal changes in the values of a country's export and import volumes, neutralizes the terms-of-trade consequences of bilateral tariff negotiations, creating an environment conducive to tariff bargaining stripped of terms-of-trade motives. Nondiscrimination is implemented through the most-favored-nation (MFN) principle, which prevents countries from applying different tariff rates to the imports of a given product based on its country of origin. Whatever treatment is offered to the "most favored" nation must thus be offered to all nations. The MFN principle ensures that the terms-of-trade externality continues to be the key international externality associated with tariff intervention in a multi-country world. Taken together, reciprocity and MFN treatment can help to neutralize third-party externalities of tariff negotiations by preventing the terms-of-trade movements through which third-party externalities would travel. Viewed in this light, the GATT's design pillars can be interpreted as facilitating efficiency-enhancing outcomes through decentralized bilateral tariff bargaining.

In joint work with Ali Yurukoglu, we examine the implications of reciprocity and MFN treatment in the GATT multilateral tariff bargaining records from the Torquay Round (1950–51).9 In the Torquay Round, governments adopted a bargaining protocol under which they engaged in simultaneous bilateral request-offer tariff negotiations with multiple bargaining partners, and where the agreements reached in each bilateral were multilateralized to the entire GATT membership through the MFN principle. We argue that adherence to reciprocity and MFN treatment could have had the effect of dramatically simplifying these bilateral simultaneous tariff bargains, converting them from operating like an open bazaar for the exchange of market access commitments, where governments might haggle over the terms (price) of the exchange, into operating in essence like a retail store for market access where the price of market access is fixed at a reciprocal exchange of one for one.

Specifically, we show that if adherence to reciprocity and MFN treatment is strict in the sense that all bargaining proposals must satisfy these principles, then each country has a dominant strategy to immediately propose the tariffs that would deliver its desired level of market access at the existing terms of trade. And we show that multilateral rather than bilateral reciprocity is all that is required for this result. This second point is significant, because the innovation of the GATT's multilateral negotiating rounds—where many countries were negotiating bilaterally but simultaneously in the same "room"—made it possible for the first time for countries to value the indirect market-access benefits they could expect from other successful bilaterals under the MFN principle, thereby relaxing the reciprocity constraint so that negotiators could achieve multilateral rather than bilateral reciprocity.

Focusing on the U.S. bilaterals with each of its 24 bargaining partners in the Torquay Round, we find evidence that supports our analysis. The U.S. and each of its bargaining partners made initial tariff-level offers that did not change through the seven-month course of the negotiations, consistent with the stance that governments abstained from strategic considerations when configuring their opening tariff-level offers. What changed through the course of the round within each bilateral was the sets of offered products on the table, as each government sought to secure the maximum exchange of market-access commitments across partners consistent with reciprocity and its individual desires. When in the middle of the round the U.S.-U.K. bilateral broke down, the subsequent response of the remaining U.S. bargaining partners was to pull back on their market-access offers to the U.S. while the U.S. was simultaneously reissuing offers to them that it had initially made to the U.K., suggesting that before the breakdown the other U.S. bargaining partners had been counting on indirect trade benefits from the U.S.-U.K. bilateral in their efforts to secure multilateral reciprocity, and that a rebalancing of offers to maintain multilateral reciprocity was required once the breakdown became known.

In other recent work, we explore implications of our theoretical analysis for settings with important asymmetries.10 A market-access bargaining forum built on reciprocity and MFN may work well when the desire for increased market access is relatively balanced across bargaining partners, so that the reciprocal one-for-one price of exchange is approximately a mar-ket-clearing price. But when large asymmetries exist, as when some countries have already exhausted many of the possibilities for reciprocal exchanges of commitments through earlier bargains, while other countries are just beginning to engage in the process, the reciprocity requirement itself may pose a major hurdle to successful negotiations. We develop this idea as a possible contributing factor to the difficulties faced by the WTO's Doha "development" round in achieving its goal of better integrating emerging and developing countries into the world trading system.

Another core design feature of the GATT/WTO is that governments negotiate bound tariff levels or tariff caps. When a government applies a tariff that falls strictly below the negotiated tariff cap for a given good, "binding overhang" is said to occur. To study tariff caps and binding overhang, we extend the terms-of-trade theory to allow governments to negotiate a trade agreement while uncertain about the preference shocks that they may respectively and privately experience in the future. We show that expected joint government welfare in such a setting is higher when governments negotiate tariff caps and thus allow for binding overhang than when they negotiate exact tariff levels to be applied under all shocks.11 Subsequent work generalizes the analysis and characterizes settings in which a trade agreement with tariff caps maximizes expected joint government welfare among all incentive-compatible trade agreements.12 Another line of subsequent work establishes that an agreement with tariff caps is also preferred to an agreement with exact tariff levels in an alternative extension that features contracting costs.13

Not all dimensions of GATT/WTO design find clear support under a terms-of-trade interpretation, however. For example, WTO rules prohibit the use of export subsidies on manufactured goods. In a standard terms-of-trade model with competitive industries, a country that offers an export subsidy generates a positive terms-of-trade externality for its trading partner; by contrast, import tariffs are negotiated but not prohibited under GATT/WTO rules, even though in the standard model a country that imposes an import tariff generates a negative terms-of-trade externality for its trading partner. The treatment of export subsidies under WTO rules receives more support in alternative models with imperfect competition and an outside good, free entry, segmented markets, and positive trade costs. For such models, an export subsidy may generate a terms-of-trade loss for the trading partner by inducing exit and driving up prices.14 Expanding on this logic, we study a linear Cournot firm-delocation model and provide a partial interpretation of the treatment of export subsidies in the WTO.15

Could the Purpose of Trade Agreements Be Changing?

GATT was created in 1947, and we know that the nature of trade is very different now than it was then. How might these changes affect the relevance of a multilateral forum like the WTO, and how might it evolve in response? This is a natural question to ask in the two-step research program we describe above. To answer it, we must first ask whether the changing nature of trade has altered the central problems that a trade agreement might address; if the answer is affirmative, then the next step is to inquire into any new design features that may be efficiency-enhancing for member governments.

Viewed through the lens of the terms-of-trade theory, the key question is whether the changing nature of trade has altered the central role of terms-of-trade externalities in defining the purpose of a trade agreement. This is an open and important question. One possible reason that the answer could be "yes" is that the rise of offshoring and global supply chains may be changing the way that international prices and the terms of trade are determined, from traditional market-clearing mechanisms to a web of bilateral bargains over the prices of customized inputs in specialized buyer-supplier relationships that are no longer tightly disciplined by market-clearing considerations. To the extent that this change has occurred, it changes the nature of in-ternational policy externalities, extending them beyond terms-of-trade channels, and thereby creating new problems for a trade agreement to solve and new features of the trade agreement designed to solve them.16

Endnotes

For recent reviews of much of this literature, see K. Bagwell, C. Bown, and R. W. Staiger, "Is the WTO Passé?" NBER Working Paper 21303, June 2015, and forthcoming in Journal of Economic Literature, and also G. M. Grossman, "The Purpose of Trade Agreements," NBER Working Paper 22070, March 2016, and forthcoming in K. Bagwell and R. W. Staiger, eds., Handbook of Commercial Policy, Amsterdam, the Netherlands: Elsevier.

K. Bagwell and R. W. Staiger, "An Economic Theory of GATT," NBER Working Paper 6049, May 1997, and American Economic Review, 89(1), 1999, 215–48, and K. Bagwell and R. W. Staiger, The Economics of the World Trading System, Cambridge, Massachusetts: The MIT Press, 2002.

K. Bagwell and R. W. Staiger, "The Design of Trade Agreements," NBER Working Paper 22087, March 2016, and forthcoming in K. Bagwell and R. W. Staiger, eds., Handbook of Commercial Policy, Amsterdam, The Netherlands, Elsevier.

K. Bagwell and R. W. Staiger, "Profit Shifting and Trade Agreements in Imperfectly Competitive Markets," NBER Working Paper 14803, March 2009, and International Economic Review, 53(4), 2012, pp. 1067–1104.

This point is emphasized by R. Ossa, "Profits in the 'New Trade' Approach to Trade Negotiations," American Economic Review, 102(2), 2012, pp. 466–69.

K. Bagwell and R. W. Staiger, "What Do Trade Negotiators Negotiate About? Empirical Evidence from the World Trade Organization," NBER Working Paper 12727, December 2006, and American Economic Review, 101(4), 2011, pp. 1238–73.

R. D. Ludema and A. M. Mayda, "Do Terms-of-Trade Effects Matter for Trade Agreements? Theory and Evidence from WTO Countries," The Quarterly Journal of Economics, 128(4), 2013, pp. 1837–93; C. P. Bown and M. A. Crowley, "Self-Enforcing Trade Agreements: Evidence from Time-Varying Trade Policy," American Economic Review, 103(2), 2013, pp. 1071–90; and M. Beshkar, E. Bond, and Y. Rho, "Tariff Binding and Overhang: Theory and Evidence," Journal of International Economics, 97(1), 2015, pp. 1–13.

K. Bagwell and R. W. Staiger, "The WTO: Theory and Practice," NBER Working Paper 15445, October 2009, and Annual Review of Economics, 2(1), 2010, pp. 223–56; and K. Bagwell and R. W. Staiger, "Backward Stealing and Forward Manipulation in the WTO," NBER Working Paper 10420, April 2004, and Journal of International Economics, 82(1), 2010, pp. 49–62.

K. Bagwell, R. W. Staiger and A. Yurukoglu, "Multilateral Trade Bargaining: A First Look at the GATT Bargaining Records," NBER Working Paper 21488, August 2015.

K. Bagwell and R. W. Staiger, "Can the Doha Round be a Development Round? Setting a Place at the Table," NBER Working Paper 17650, December 2011, and in R. C. Feenstra and A. M. Taylor, eds., Globalization in an Age of Crisis: Multilateral Economic Cooperation in the Twenty-First Century, Chicago, Illinois: University of Chicago Press, 2014, pp. 91–124.

K. Bagwell and R. W. Staiger, "Enforcement, Private Political Pressure and the GATT/WTO Escape Clause," NBER Working Paper 10987, December 2004, and Journal of Legal Studies, 34(2), 2005, pp. 471–513.

M. Amador and K. Bagwell, "Tariff Revenue and Tariff Caps," American Economic Review: Papers and Proceedings, 102(3), 2012, pp. 459–65; and M. Amador and K. Bagwell, "The Theory of Optimal Delegation with an Application to Tariff Caps," Econometrica, 81(4), 2013, pp. 1541–99.

H. Horn, G. Maggi and R. W. Staiger, "Trade Agreements as Endogenously Incomplete Contracts," NBER Working Paper 12745, December 2006, and American Economic Review, 100(1), 2010, pp. 394–419.

A. J. Venables, "Trade and Trade Policy with Imperfect Competition: The Case of Identical Products and Free Entry," Journal of International Economics, 19 (1–2), 1985, pp. 1–19.

K. Bagwell and R. W. Staiger, "The Economics of Trade Agreements in the Linear Cournot Delocation Model," NBER Working Paper 15492, November 2009, and Journal of International Economics, 88(1), 2012, pp. 32–46.

P. Antras and R. W. Staiger, "Trade Agreements and the Nature of Price Determination," American Economic Review: Papers and Proceedings, 102(3), 2012, 470–76; and P. Antras and R. W. Staiger, "Offshoring and the Role of Trade Agreements," NBER Working Paper 14285, August 2008, and American Economic Review, 102(7) 2012, pp. 3140–83.