How Powerful Are Fiscal Multipliers in Recessions?

In policy and academic discussions of recent years, few topics have generated more interest than fiscal multipliers, which measure how much a dollar of increased government spending or reduced taxes raises output. Indeed, the magnitude of fiscal multipliers is at the core of debates about whether governments should try to stimulate their economies during a recession. Bitter disagreement in the United States and elsewhere about the course of fiscal policy during the Great Recession reflects in part how little is known about multipliers and how important this matter is for policy.

While previous research studied the effects of fiscal policy on the economy,1 a key question is how powerful fiscal policy can be in recessions, during which the need to stabilize economic activity is particularly acute. With a quickly shrinking economy in late 2008 and early 2009, existing estimates of the average effect of fiscal stimulus were potentially misleading. For example, old-style Keynesian models emphasized that increased government spending might stimulate output and have little effect on prices in times of slack but could have an inflationary effect with low output response if the economy were close to full employment. More recent theoretical work made a similar prediction in the context of a binding zero lower bound for nominal interest rates, based on the view that a fiscal stimulus would not lead to an increase in interest rates in such a circumstance.2 While reasonable to expect, cyclical variation in the size of fiscal multipliers has, until recently, been largely unexplored empirically. This glaring gap between what policymakers wanted to know and what earlier work could provide stimulated our interest in exploring state-varying fiscal multipliers.

In our initial work on this question we use a "smooth transition vector autoregression" (STVAR) that allows for transition of the economy between regimes characterized by potentially different responses to fiscal shocks.3 With only a handful of post-World War II recessions, generally short in length, a key advantage of this approach is that it exploits intensive as well as extensive margins of business cycle fluctuations. What matters is not only whether the economy is in a recession but also how deep the recession is. Our approach postulates a function measuring the probability of being in a given regime (recession or expansion) that depends on the state of the economy. The higher the probability of a regime, the more the behavior of the economy will reflect conditions in that regime rather than in the alternative regime. We calibrate this function in such a way that the implied frequency of the economy being in recession matches the frequency of U.S. recessions as determined by the NBER. To measure the state of the economy, we use a coincident business cycle indicator, the deviation of the centered seven-quarter moving average of the real GDP growth rate from the average growth rate.

The same paper makes another methodological contribution by using professional forecasts to purge predictable variation from the time series of government spending in constructing measures of unexpected changes in fiscal policy. This adjustment is potentially important because many changes in fiscal variables are predictable and hence potentially anticipated by economic agents. Treating such anticipated changes in fiscal variables as fiscal shocks can attenuate estimates of fiscal multipliers.4 To construct a long time series of fiscal forecasts at a quarterly frequency, we splice forecasts for fiscal variables using the Survey of Professional Forecasters and "Greenbook" projections made by the staff of the Federal Reserve Board.

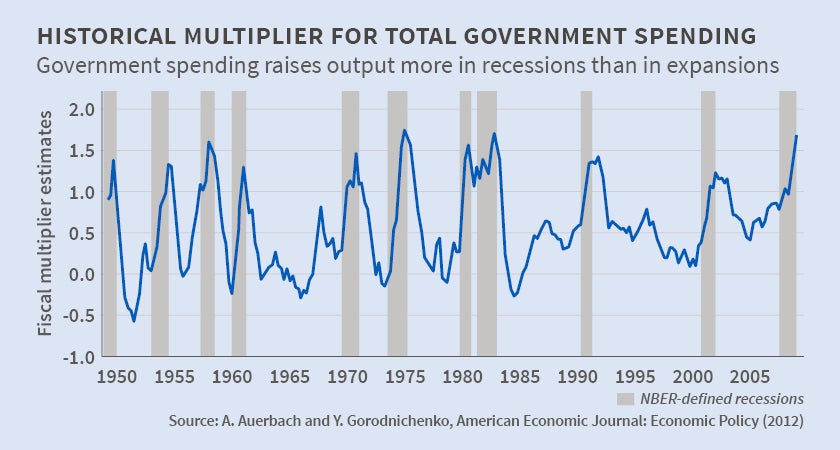

Our STVAR estimates suggest that multipliers are considerably larger in recessions than in expansions. Although exact magnitudes depend on the horizon and specifics of how multipliers are defined, we conclude that a dollar increase in government spending raises output by about $1.50 to $2 in recessions and by only about $0.50 in expansions. The figure on the next page shows a time series of multipliers over our post-war sample period based on these estimates, with the variation over time reflecting changes in the state of the economy. Controlling for real-time expectations about fiscal variables generally increases the difference in the size of the government spending multiplier across the regimes. Note that this variation in the multiplier applies broadly to recessions vs. expansions in the sense that our results are not driven by the recent U.S. experience of very low short-term interest rates and a binding zero lower bound. Our estimates suggest that fiscal policy could be a powerful tool to stabilize output and thus reduce adverse effects of business cycles.

In subsequent work, we investigate whether the government spending multiplier varies over the business cycle in other countries as well.5 Introducing a multi-country dimension increases the overall number of episodes of economies which exhibit slack or which are in recession, possibly allowing us to obtain sharper estimates of fiscal multipliers. However, the international dimension poses several statistical and computational challenges for STVARs, such as correlation of error terms across countries. To address these challenges, we introduce the method of direct projections to estimate average or state-dependent multipliers.6 Specifically, this approach involves estimating a series of linear regressions for different horizons, thus making statistical analysis straightforward and robust. Using direct projections also allows us to radically increase the number of variables we can study because this framework is a single-equation approach and thus avoids the "curse of dimensionality" plaguing simultaneous estimation in VARs. Furthermore, this approach can easily accommodate fiscal shocks that are orthogonal to the fiscal predictions of professional forecasters.

Using data for OECD countries and our approach of direct projections, we find that shocks to government spending–identified as innovations in government spending purged of fiscal forecasts made by the OECD staff–lead to stronger output responses in recessions than in expansions. We see the same pattern when regimes are defined based on current output levels rather than growth rates (i.e., boom vs. slack rather than expansion vs. recession). We also use the direct projections framework to examine responses of other macroeconomic variables–such as investment, consumption, employment, wages, and prices–to government spending shocks as a function of the state of the business cycle. By and large, the estimated responses are consistent with the old-style Keynesian view: Excess capacity is associated with larger government spending multipliers and smaller effects on prices.

The focus of this exercise was to examine domestic multipliers: If Germany has a government spending shock, how much does the German economy respond to the shock? However, the world economy is increasingly integrated and a shock in one country can spill over to other countries. To the extent that fiscal spillovers are strong, there may be added benefits and costs to one country's adoption of fiscal stimulus. Countries with strong fiscal capacity, like Germany, can help stimulate the economies of countries with weak fiscal capacity, like Greece, but spillovers from abroad also may upset economic stability.

Despite the potential importance of fiscal spillovers, there has been little work on the subject.7 In a paper based on the same data set as the previous one, we make progress in several dimensions.8 First, our sample of OECD countries is larger and more diverse than those used in previous research. Second, we again remove predictable innovations in government spending using professional forecasts. Once each country's fiscal shocks are calculated, we compute external shocks for each country as a weighted average of other countries' domestic shocks, using weights based on bilateral trade volumes. Third, we use the method of direct projections to allow the size of fiscal spillovers to depend on the state of the economy, in particular recession vs. expansion. Our estimates suggest that fiscal spillovers are comparable in magnitude to domestic multipliers and tend to be lower in expansions than in recessions. These results suggest that coordination of fiscal policies may be more valuable than previously thought.

While this recent work finds fiscal policy to be a potentially powerful tool to stabilize an economy, estimation of state-dependent, or even average, fiscal multipliers sometimes presents researchers with challenges that are difficult to address using conventional data. Specifically, given the "Great Moderation" that preceded the Great Recession, the recent macroeconomic past is characterized by relatively small business-cycle fluctuations. This data challenge is not insurmountable, however. First, as already noted, one can use variations in economic strength throughout the postwar period, not simply focusing on episodes of recession, to estimate state-varying fiscal multipliers. Second, one can focus on countries with more postwar volatility, or use longer time series with more frequent or volatile recessions, to obtain more variation in the data. We take the first of these approaches in looking at the experience in Japan, which has had a long period of economic weakness and thus potentially allows us to estimate more precisely multipliers in an economic downturn.9 One can also construct historical U.S. time series of output, taxes and government spending as far back as 1890.10 While using longer time series can be helpful, it also raises issues that may be hard to address with available data. These include structural transformations that coincide with the changing role of the government in the economy, the evolution of the tax system, and identification coming from wars that are special periods for the economy. Another approach is to use local variation in government spending and economic conditions.11 The key disadvantage of this approach is that one estimates a local rather than an aggregate multiplier; the mapping from estimated responses at the local level to macroeconomic responses is not straightforward, as some elements of local responses may overstate national responses–because of factors such as national supply constraints–while others may understate them because of effects such as positive regional spillovers.

A promising alternative to longer time series or exploiting local variation is the use of high-frequency data, which can provide many observations even in precisely defined regimes, can sharpen identification of fiscal shocks, and can keep the level of the analysis at an aggregate level.12 To illustrate the power of this approach, our most recent work involves the construction of daily series of spending and spending commitments by the U.S. Department of Defense (DoD).13 It is highly unlikely that changes in DoD spending or DoD commitments on a given day are driven by developments in the economy. As a result, the commonly used minimum delay restriction–that is, government spending cannot react to changes in the economy within a narrow time window–is likely to be satisfied. Hence, the chain of causality from changes in government spending to changes in macroeconomic outcomes is even more credible than in analysis based on quarterly data. Using high-frequency data on fiscal variables can also radically improve our ability to estimate when economic agents learn about changes in fiscal variables and when economic variables react to changes in fiscal variables. Of course, analysis at a daily frequency rules out analysis of responses of slow-moving variables like GDP or the unemployment rate, leading us to focus on financial indicators such as exchange rates and interest rates that can respond immediately.14

Using our daily series of defense spending announcements, we are able to resolve an exchange-rate puzzle in the previous literature.15 With fiscal shocks identified from actual spending data at a quarterly frequency, the U.S. dollar depreciates after a positive government-spending shock, even though the overwhelming majority of macroeconomic models predict an appreciation. We demonstrate that this puzzle evaporates when one considers responses at a higher frequency: On average, on days when the DoD announces more spending, the U.S. dollar appreciates significantly. Thus, the standard macroeconomic framework is suitable for analyses of the international effects of fiscal shocks.

During the Great Recession, countries around the world adopted expansionary fiscal policies aimed at counteracting the large negative shocks to their economies. These actions occurred in spite of skepticism among many economists about the potential of fiscal policy to stimulate economic activity. The results of our and related work suggest that fiscal policy activism may indeed be effective at stimulating output during a deep recession, and that the potential negative side effects of fiscal stimulus, such as increased inflation, are also less likely in these circumstances. These empirical results call into question the results from the new Keynesian literature, which suggests that shocks to government spending, even when increasing output, will crowd out private economic activity. While there has been some recent progress providing a rationale for large multipliers when economies confront a binding zero lower bound on interest rates, our findings apply to more general recessionary conditions, and thus present a challenge for the development of new models that, like the simple traditional Keynesian model, can encompass positive fiscal multipliers for private activity.

Endnotes

O. Blanchard and R. Perotti, "An Empirical Characterization of the Dynamic Effects of Changes in Government Spending and Taxes on Output," Quarterly Journal of Economics, 117(4), 2002, pp. 1329-68.

L. Christiano, M. Eichenbaum, and S. Rebelo, "When Is the Government Spending Multiplier Large?" Journal of Political Economy, 119(1), 2011, pp. 78–121; and M. Woodford, "Simple Analytics of the Government Expenditure Multiplier," American Economic Journal: Macroeconomics, 3(1), 2011, pp. 1-35.

A. Auerbach and Y. Gorodnichenko, "Measuring the Output Responses to Fiscal Policy," American Economic Journal: Economic Policy, 4(2), 2012, pp. 1-27.

See the discussion in V. Ramey, "Identifying Government Spending Shocks: It's all in the Timing," The Quarterly Journal of Economics, 126(1), 2011, pp. 1-50.

A. Auerbach and Y. Gorodnichenko, "Fiscal Multipliers in Recession and Expansion," in A. Alesina and F. Giavazzi, eds., Fiscal Policy after the Financial Crisis, Chicago, Illinois: University of Chicago Press, 2013, pp. 63-98.

Ò. Jordà, "Estimation and Inference of Impulse Responses by Local Projections," American Economic Review, 95(1), 2005, pp. 161-82.

A. Auerbach and Y. Gorodnichenko, "Fiscal Multipliers in Japan," NBER Working Paper 19911, February 2014.

V. Ramey and S. Zubairy, "Government Spending Multipliers in Good Times and in Bad: Evidence from U.S. Historical Data," NBER Working Paper 20719, November 2014.

For example, see E. Nakamura and J. Steinsson, "Fiscal Stimulus in a Monetary Union: Evidence from U.S. Regions," American Economic Review, 104(3), 2014, pp. 753-92, and G. Chodorow-Reich, L. Feiveson, Z. Liscow, and W. Woolston, "Does State Fiscal Relief During Recessions Increase Employment? Evidence from the American Recovery and Reinvestment Act." American Economic Journal: Economic Policy, 4 (3), 2012, pp. 118-45.

For example, we can differentiate between i) a period of binding ZLB in a recession and ii) a period of binding ZLB in an expansion. For the United States, we have enough daily observations to precisely estimate responses of macroeconomic variables to government spending shocks during these regimes.

A. Auerbach and Y. Gorodnichenko, "Effects of Fiscal Shocks in a Globalized World," NBER Working Paper 21100, April 2015.

Another source of high-frequency identification of government spending shocks could be the stock market. For example, Jonas Fisher and Ryan Peters use quarterly stock price movements of defense corporations to identify fiscal shocks. In principle, that can be done at a daily frequency. See J. Fisher and R. Peters, "Using Stock Returns to Identify Government Spending Shocks," Economic Journal, 120(544), 2010, pp. 414-26.