Privatizing Social Security: Lessons from Mexico

Social security privatization is a top political and economic issue for countries world-wide faced with aging populations and underfunded pensions. Often seen as a third-rail of American politics, aging populations may soon force the country to make tough decisions about our pay-as-you-go system, and current public pension crises have revived the private-accounts vs. public pension debate, as state governments faced with pension fund shortfalls consider moving workers toward 401(k)-style plans.

A handful of countries have already opted for partially- or fully-privatized social security systems. What can we learn from their experiences? Can a privatized social security system deliver greater retirement wealth by allowing individuals greater control over their investment decisions? Does the free market deliver price competition and efficiency? My recent research uses administrative data from OECD countries in Latin America with privatized schemes to illuminate the potential benefits and pitfalls of social security privatization. In this article, I highlight findings from two such projects.

Does Competition Work?

Mexico launched a fully-privatized defined contribution plan in 1997, with 17 participating fund managers which could compete to manage investors' privatized social security accounts. Given the tight regulations on investment vehicles, fund managers each offered one, essentially homogenous investment product. Investors could choose which firm they wanted to have manage and invest - for a fee - their personal social security account.

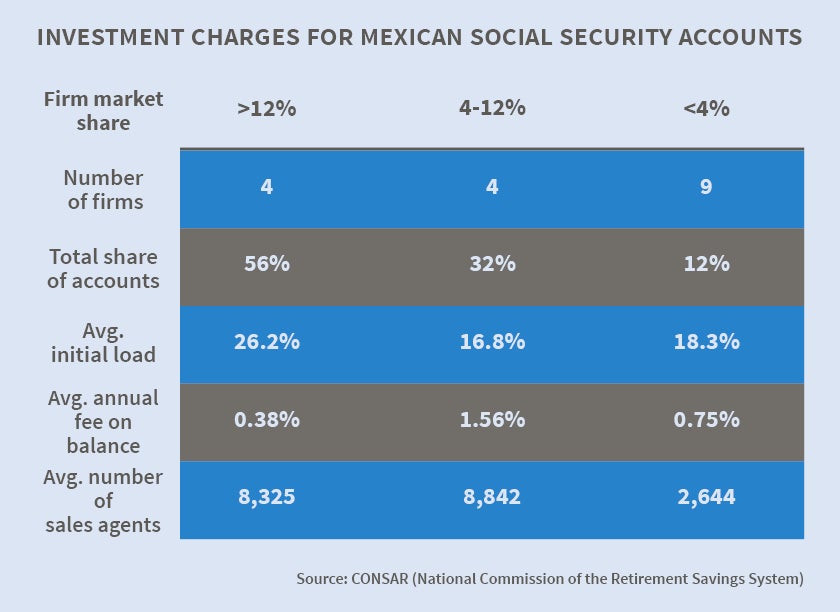

Despite the large number of competitors selling an essentially homogeneous product, management fees and fund manager profits were high. Fund managers charged an average load (a fee taken as a share of account contributions at the time of contribution) of 23 percent and an annual fee on assets under management of 0.63 percent, implying that a 100-peso deposit earning a 5 percent annual real return would only be worth 95.4 pesos after five years. Indeed, five years after the launch of the privatized system, fund managers' annual return on expenditure averaged 39 percent. How could competition among many firms result in fees at this level?

The new system was characterized not only by high fees but by high expenditures on sales force and advertising. The government, trusting competitive pressures to work to inform customers and incentivize low prices, invested little in financial education, but spent advertising funds on simply informing workers that they needed to choose among the approved social security fund managers.

Based on archived television advertisements and sales force training manuals, fund managers spent substantial resources appealing to investor emotion by communicating themes of experience, winning, and wisdom in investment. When fees were mentioned at all, it was in vague terms or focused only on the fee dimension on which the firm was relatively less expensive. Many advertising claims were technically truthful but misleading. For example, one advertisement, featuring apples, claimed that the fund manager did not take a bite out of your investment apple like other firms did. This is technically true if "bite" referred only to load fees; this firm charged no loads. However it charged by far the highest fee on assets under management. For those not working in the formal sector, or for workers with large account balances, this would in fact be the most expensive fund manager.

Fully-informed, rational decision makers shouldn’t be fooled by such advertisements, and price competition should lead to an informed marketplace. But recent theoretical models illustrate that when there is a segment of inexperienced or uninformed consumers, and firms can use advertising or complicated price structure to confuse or persuade, competition may result in high-intensity advertising, complex pricing, price obfuscation, and supra-competitive prices.1

Is this what happened in Mexico? How much of the observed high price levels can be explained by the impact of sales force on investors' attention to management fees when choosing a fund manager? In joint work, Ali Hortaçsu, Chad Syverson, and I answer these questions using administrative data from Mexico's social security system.2 The data cover all workers' contributions, balances, and investment choices for over a decade, as well as detailed information on sales-force deployment by fund managers to localities across Mexico. We use these data to examine how competition played out at the start of the system and to measure the impact of sales force on investor sensitivity to fees and brand name; we measure how much, if at all, sales force contributed to high fees in the market.

We develop a model of workers' choices of fund managers, allowing workers' price sensitivities and brand values to vary with their exposure to a fund manager's sales force as well as with the workers' demographic characteristics. The model incorporates both informative and persuasive effects of advertising, allowing exposure to sales force to both increase awareness of the product and to influence consumer's perceptions of price and non-price attributes (for example by confusing pricing or diminishing its importance).

We find that exposure to sales force had a significant, persuasive impact on investors' decisions. Sales force caused lower price sensitivity, particularly among lower-income workers, as well as higher attention to non-price brand attributes. The qualitative patterns in advertisement archives mentioned above play out in hard data on sales-force exposure and choice of fund manager.

By estimating the impact of advertising in the context of a model of investment decisions, we can learn much more about how such advertising strategies impact the success of the privatized markets. For example, we can gauge the overall contribution of advertising costs to high equilibrium fees. Using model estimates we can ask what fees would have been if sales force had no impact on preferences for price or brand attributes. When we do this, we find that total management fees paid by Mexican workers in the system would have been about 60 percent lower. Individuals would have been more price-sensitive, and fund managers would have responded by competing more on price. Competition did occur in this privatized system but it was competition on persuasion and not on price, shifting a significant fraction of GDP from savings for retirement to fund manager profits and advertising expenditures.

While it is probably impossible to regulate what salespeople communicate to potential clients, are there ways to increase competition by altering features of the market? This is an important question in policy discussions from Medicare to school choice to savings for retirement. We use our results to glean insights into how regulators might improve performance in privatized social-safety-net markets like this one.

For example, introducing a government or government-regulated competitor is often suggested as a policy tool for increasing competition. The notion is that if private competition is limited, a government player could enter, sell at cost, and enforce price competition in the market. We simulate this intervention, and find that introducing a government player does little to make the market more price-competitive. In fact, many of the existing firms in the market respond to this entry by raising their fees even further. The intuition is simple: If there are many unsophisticated consumers in the market who can be convinced by sales force to value brand over price, savvy consumers will buy from the cheap government option and private firms can raise prices on the remaining price-inelastic customer base. Think Walmart and the mom-and-pops. When Walmart comes to town, the mom-and-pops can try to match their price, or they can raise prices knowing that only price-inelastic customers will still visit their store. Walmart helps the mom-and-pop price discriminate. A government competitor in privatized social security systems or other social insurance markets could too, with regressive consequences.

Alternatively, could demand-side policies that decrease consumer confusion and increase price sensitivity - say by educating investors or simplifying fees into an easy-to-understand format - deliver a price-competitive market? In short, yes. We simulate what fees would have been if the most price-insensitive segment of the market simply paid the average level of attention to fees we observe among workers.

This intervention works: By shrinking the price-insensitive segment of the population, the policy lowers prices. Furthermore, there is a complementarity between this demand-side intervention and the supply-side policy of introducing a public option. Once consumers pay more attention to prices, the government player becomes effective, stealing substantial business from private firms unless they lower price. Combining policies would lead to a 74 percent reduction in management costs. That's a big savings given that contributions are 6.5 percent of private-sector labor earnings.

In sum, privatization can deliver efficiency, but only if investor behavior and firm response is incorporated into market design.

Designing Nudges for Fettered Consumers and Sophisticated Firms

Further evidence could be seen several years later when the government began reforms to address persistently high fees. Sensing that investor confusion about fees might be to blame, the government introduced a new fee index in mid-2005 to increase transparency and price-sensitivity. Did creating and promoting a readily understandable fee index help create a more efficient market? What do we learn about pension-plan design from Mexico's experience? In joint work with Fabian Duarte, I again make use of rich administrative data to answer these questions.3

First, I establish that even several years after the start of the system, and even with regulatory improvements to make switching fund managers easier, fees remained very high. Although millions of investors switched fund managers in a given year, they did not on average switch to lower-price fund managers. Perhaps, as found in the prior paper, sales agents obfuscated prices, presenting misleading aspects of price or emphasizing non-price attributes as the most important factors upon which to base choices. Investor choices appeared to provide no incentive for firms to lower price.

By introducing a fee index, the government hoped both to make "price" more salient and to force informative advertising, at least with respect to this one measure of price. The new fee index combined load and balance fees according to a particular formula. Sales agents were required to obtain a client's signature on a form showing a table of comparative fee-index values at the time of fund manager choice. Post-policy, workers became very sensitive to the fee index, choosing funds with a lower index on average. The policy worked at changing choices.

However, because the index was a particular combination of load and balance fee, moving to a lower-fee-index fund could actually lead workers to higher-cost funds, depending on the expected size of their formal-sector labor-earnings relative to their existing balance. Workers clearly did not understand how their personal circumstances affected the relative management costs across fund managers. A full third of those seeking lower-fee-index funds moved to funds with higher management costs for them, given their account characteristics.

Once investors flocked to lower-fee-index fund managers, fund managers also responded, but not in the way the government hoped. Rather than lowering load and balance fees, they exploited the index formula and restructured their fees to raise revenues. The fee index over-weighted load fees and under-weighted fees on assets under management. This gave firms an incentive to lower their load fees and to increase their management fees; lowering their index but not necessarily their revenues. This is the strategy fund managers followed. Fee restructuring mitigated the intended gains from the policy and redistributed the burden of management fees from higher-income to lower-income investors.

If consumer confusion and price insensitivity inhibit price competition, can distilling complex information into an easily understandable index number promote competition? Yes and no. While the new policy was successful in making investors sensitive to the new information provided, it led many to make long-term decisions not in their best interests. In theory, the new index adopted by regulators should have made fees simpler and more transparent. However, in their efforts to simplify the various fees charged into a single number, their formula did not accurately reflect true costs to investors. Firms hid behind the index, restructuring fees to increase revenues while obfuscating price increases using the index formula.

Conclusions

Overall, these research results highlight some of the challenges of privatizing social security. People face decision-making costs and difficulty with complex decisions involving long-term risks and benefits. Policies can recognize these shortcomings by designing markets that make decisions easier and by devoting attention to firm incentives. Failing to do so can take policy results far afield from their target impact.

1. See for example B. Carlin, "Strategic Price Complexity in Retail Financial Markets," Journal of Financial Economics, 91(3), 2009, pp. 278-87; and G. Ellison and S. F. Ellison, "Search, Obfuscation, and Price Elasticities on the Internet," NBER Working Paper No. 10570, June 2004, and Econometrica, 77(2), 2009, pp. 427-52. ↩

2.J. S. Hastings, A. Hortaçsu, and C. Syverson, "Advertising and Competition in Privatized Social Security: The Case of Mexico," NBER Working Paper No. 18881, March 2013. ↩

3. F. Duarte and J. S. Hastings,"Fettered Consumers and Sophisticated Firms: Evidence from Mexico's Privatized Social Security Market," NBER Working Paper No. 18582, December 2012. ↩