Behavioral Biases of Analysts and Investors

Financial analysts and stock market investors alike are subject to behavioral biases. Objective analyst forecasts can potentially help correct investor misperceptions. On the other hand, biased forecasts can reinforce or incite investor misperceptions. Furthermore, data on analyst behavior provide a rich window of insight into the nature of psychological bias among an important and incentivized group of professionals, since ex post information is available about the accuracy of analyst forecasts under different conditions. Analyst behavior also provides insights into the sources of stock market mispricing.

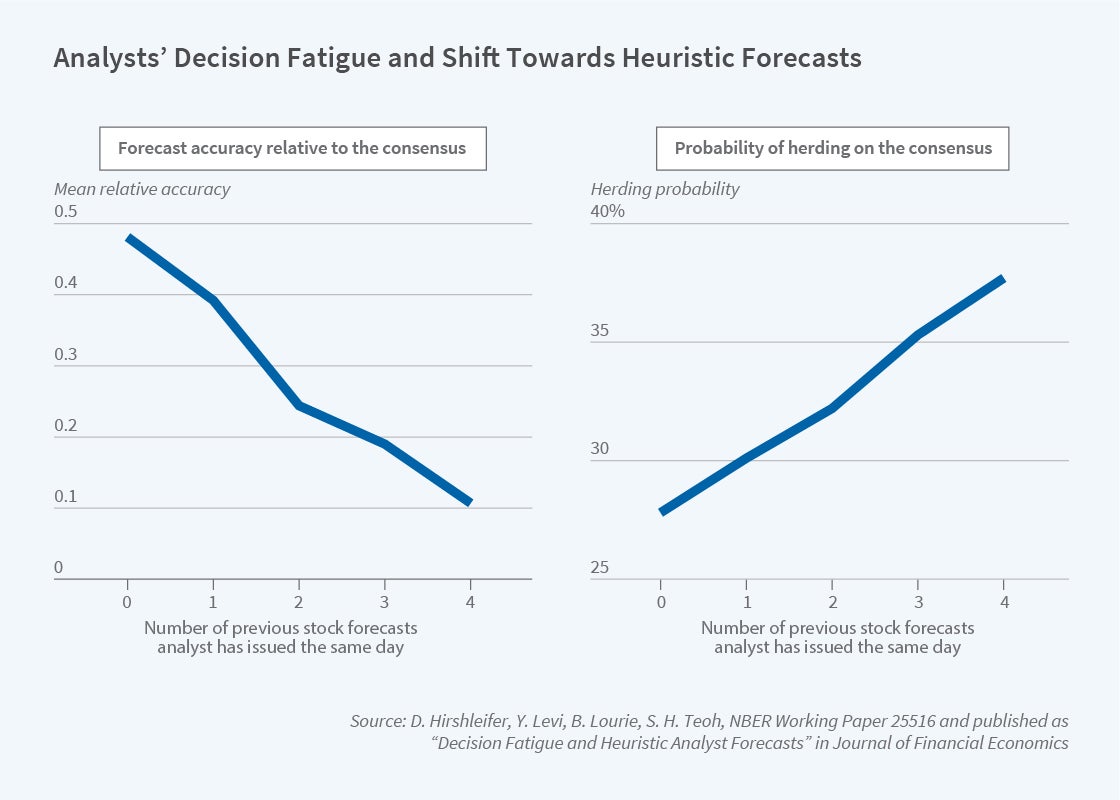

As a possible example of analyst psychological bias, consider decision fatigue, defined as the tendency for decision quality to decline after an extensive session of decision-making. Whether decision fatigue exists has been a topic of controversy as part of the greater replication crisis in experimental psychology. My collaborators Yaron Levi, Ben Lourie, Siew Hong Teoh, and I provide a test of whether decision fatigue affects a set of skilled financial professionals in the field.1 Specifically, we test whether decision fatigue causes stock market analysts to be more heuristic in their forecasting.

Decision Fatigue, First Impressions, and Analyst Forecasts

Analysts cover multiple firms and need to periodically revise forecasts. They often issue several forecasts in a single day, which requires analysis and judgment. Consistent with decision fatigue [as seen in Figure 1], forecast accuracy declines over the course of a day as the number of forecasts the analyst has already issued increases (controlling for time). Furthermore, the more forecasts an analyst issues, the higher the probability that the analyst forecasts more heuristically by herding on the consensus forecast, self-herding (reissuing the analyst’s own previous outstanding forecast), and forecasting a round number. Nevertheless, we find no evidence that the stock market is inefficient in the sense of failing to adjust for analyst decision fatigue.

Analyst behavior also provides insight into whether skilled professionals are subject to first-impression bias, the tendency for a decision maker, in making evaluations, to place undue weight on early experiences. For example, psychologist Solomon Asch found that if a person is described as “intelligent, industrious, impulsive, critical, stubborn, [and] envious,” people form a more positive impression of that person than when the descriptors are provided in the reverse order. First-impression bias is closely related to confirmation bias, also studied in behavioral economics.

Lourie, Thomas Ruchti, Phong Truong, and I test whether an analyst’s forecasts about a firm, and related behaviors, are tilted toward the first impression that the equity analyst forms.2 We measure this first impression by the firm’s abnormal stock return in the year before the analyst issues his or her first forecast for that firm. During this period, the analyst develops an understanding of the firm’s operations, management, governance, and competitive positioning.

In a sample of 1,643,089 firm-analyst observations over 1984–2017, we find that an analyst’s first impressions of a firm have a lasting positive association with the analyst’s future forecasts for that firm relative to the consensus forecast. Analysts with positive first impressions also issue higher price targets — predicted levels of stock prices — and are more likely to issue a buy recommendation. The opposite patterns hold for negative first impressions. These first-impression effects persist, on average, for 36 months after the analyst starts to follow a stock. Furthermore, the stock market only partly adjusts for first-impression bias; an analyst’s first impression about a firm can be used to predict future returns.

Past research has provided evidence suggesting that investors or other decision makers put greater weight on recent events than on earlier events. Analyst first-impression bias contrasts notably with such findings. We therefore investigate the comparative weights analysts place on first impressions versus more recent impressions. We find a U-shaped relationship between impressions and time. Analysts appear to place greater weight on recent experiences and on their earliest experiences relative to intermediate experiences.

As the example of first impressions illustrates, the stock market sometimes fails to fully incorporate relevant publicly available information items. A possible reason for this is that investors have limited attention. Sonya Lim, Teoh, and I have shown that, owing to limited attention, investors sometimes neglect relevant public information signals, which causes stock mispricing and induces return predictability.3 For example, if investors do not fully incorporate the information in earnings news, the stock price will tend to underreact to earnings surprises, a phenomenon known as post-earnings-announcement drift (PEAD). Consistent with limited attention, we find that when investors are distracted by a larger number of earnings announcements occurring on the same day, the stock market reaction to the earnings surprise is more sluggish, and PEAD is stronger.4 As seen in Figure 2, the greater the earnings surprise (by decile), the higher the post-event return from trading days 2 through 61, which is PEAD. The slope of this relationship is much steeper on high-news days, indicating much stronger PEAD.

Although earnings surprises positively predict returns, I have recently developed a framework in which it may sometimes, conditionally, predict returns negatively.5 Consider a stock market price bubble period. During the upswing, the stock is overpriced and is, on average, growing more overpriced. The arrival of earnings news tends to partly correct the overpricing, so on average the announcement-date return is negative. But since the bubble is still growing, on average the post-event return is positive — a reversal. This novel implication merits empirical exploration.

Stock market underreaction to publicly available information is not limited to earnings news. For example, there is also evidence that the stock market does not fully incorporate information about a firm’s historical effectiveness in innovative activity. It is tempting for investors to assess the prospects for a firm’s innovative activities based on the exciting projects at hand, rather than the cold and abstract information contained in statistics of past performance. Daniel Kahneman and Dan Lovallo call this the temptation to take the “inside view.” Nevertheless, Po-Hsuan Hsu, Dongmei Li, and I find that past innovative efficiency (IE), the ratio of patents or citations to R&D expenditures, is a positive predictor of future return on assets and cash flows. Consistent with investor inattention, IE is a strong positive predictor of future returns after standard controls.6 A long-short trading strategy based on this effect earns a high Sharpe ratio, and is profitable after adjusting for well-known factors.

Furthermore, the market does not seem to fully incorporate the information on the originality of the firm’s historical innovative activity. By “originality’’ we mean the range of knowledge built on by the firm in its recently granted patents, measurable by using the citations of the firm’s patents to other patents. This interpretation is based on the idea that innovation is recombinant, and that patents that draw knowledge from a wide range of technology classes tend to deviate more from more typical within-class technological trajectories.

Hsu, Li, and I find that greater innovative originality strongly predicts persistently higher and less-volatile profitability.7 Consistent with investor neglect, innovative originality also predicts higher abnormal stock returns after standard controls. Also consistent with mispricing and limited investor attention, the return predictive power of innovative originality is stronger for firms with greater valuation uncertainty, lower investor attention, and greater sensitivity of future profitability to innovative originality. These findings suggest that innovative originality acts as a competitive moat that is undervalued by the market.

Momentum Spillovers and Return Anomalies

Limited investor attention also offers a possible explanation for a wide array of anomalies based on cross-firm return predictability. These involve underreaction by one firm to the publicly observable returns of a similar or linked firm. Usman Ali and I call these effects “momentum spillovers” across firms.8 Past research has documented such return lead-lag relationships among stocks of firms in the same industry, firms that are geographically close, firms that are linked along the supply chain, firms with similar technologies, and single- and multi-segment firms operating in the same industries.

These findings raise two key questions. The first is whether this panoply of effects can be unified by a stronger measure of firm linkage or relatedness. If so, this suggests that there is a single underlying force driving these effects. It also provides a means for future empirical studies to control for momentum spillovers in a parsimonious way. The second question is whether the effect is exacerbated by the complexity of firm linkages.

Our evidence indicates that what we call connected-firm momentum unifies all the momentum spillover anomalies. This is based on identifying firm connections by shared analyst coverage. Stock analysts generate costly information, so they have a strong incentive to make effective use of complementary information about linked or related firms. They therefore tend to co-cover firms that are strongly related in relevant ways, regardless of whether this relevance is derived from industry, geography, supply chain, technology, or other sources.

Furthermore, shared analyst coverage sharpens measurement and allows for more refined testing in several ways. First, it uniquely identifies linked firm pairs; most previous studies aggregate stocks into much wider buckets, such as industry or geographical region. Second, studies that do examine specific firm pairs use specialized contexts, whereas analyst peers are available for the majority of publicly traded firms throughout the globe. Third, since the number of shared analysts of a pair of firms is not a binary variable — in contrast, for example, with whether two firms are in the same industry — the strength of linkage can be measured by the number of shared analysts.

We first verify that analyst co-coverage does identify fundamental relatedness. We find that firm fundamentals such as sales and profit growth are strongly correlated with current and lagged fundamentals of analyst-linked peer firms. These correlations are much higher than the corresponding correlations using other linkage proxies.

We further find that analyst linkages are associated with extremely strong momentum spillovers. A value-weighted long-short portfolio based on quintiles of stocks that are predicted by peers to have high versus low returns generates a five-factor — market, size, value, momentum, and short-term reversal factors — alpha of 1.19 percent per month (t = 6.71). As seen in Figure 3 on the next page, this portfolio continues to generate positive returns over the subsequent 11 months; its cumulative return is 3.21 percent by one year after portfolio formation. An equal-weighted long-short portfolio generates roughly double this alpha and cumulative 12-month return.

We then perform spanning and cross-sectional tests to see whether the various momentum spillover effects from different studies are really one unified effect. In both types of tests, the other forms of momentum spillovers become insignificant or even negative after controlling for connected-firm momentum. A similar point applies almost universally in international markets as well. So the growing collection of momentum spillover effects is really just one effect, and presumably has one underlying driver. The leading candidate is investor neglect, when evaluating one firm, of the performance of linked or related firms.

We further find that analyst forecasts are sluggish in reacting to the information in the forecast revisions of analyst-linked firms in the preceding month. This may derive from either analyst psychological bias or agency problems. It also suggests that analysts are not a full remedy for the inattention of investors to the information provided by analyst-linked firms.

If momentum spillovers are driven by limited analyst or investor attention, then we expect spillovers to be stronger when attention and cognitive processing is more costly. This is likely to be the case when firm linkages are more complex. For example, updating is a harder problem when news from a greater number of linked firms needs to be monitored. So one way of measuring complexity is the number of analyst links a firm has to other firms. The theoretical literature on social networks refers to this as degree centrality. This literature also offers a subtler notion, eigenvector centrality, which iteratively reflects the extent to which a firm is linked to other firms that are in turn heavily linked. Using both measures, we find that the return lead-lag relationship between the returns of connected firms is stronger when the firm is more central in the analyst coverage network.

An even more ambitious goal than integrating momentum spillover effects is to see whether return predictability in general can be organized as depending upon just a few common factors. Kent Daniel, Lin Sun, and I argue that stock mispricing comes in two main forms: short-horizon and long-horizon mispricing.9 Inattention to earnings-related news, as with PEAD, generates short-horizon mispricing. Such mispricing tends to self-correct within a year as subsequent earnings news arrives. Long-horizon mispricing is reflected in long-term overreactions and corrections, perhaps induced by investor overconfidence.

To capture short-horizon underreaction, we use a return factor based upon earnings news. To capture long-horizon overreaction, we use a return factor based upon firms’ financing activity — new issues and repurchases. The long-horizon factor exploits the information in managers’ decisions to issue or repurchase equity to exploit persistent mispricing. We provide a theoretically motivated risk-and-behavioral three-factor model by adding the market factor to the earnings factor and the financing factor. We find that this three-factor model outperforms other proposed factor models in explaining a broad range of return anomalies. This finding provides guidance for future theoretical work by suggesting that most well-known stock market anomalies are derived from just two main sources.

Endnotes

“Decision Fatigue and Heuristic Analyst Forecasts,” Hirshleifer D, Levi Y, Lourie B, Teoh SH. NBER Working Paper 24293, February 2018, and Journal of Financial Economics 133(1), July 2019, pp. 83–98.

“First Impression Bias: Evidence from Analyst Forecasts,” Hirshleifer D, Lourie B, Ruchti T, Truong P. Forthcoming in Review of Finance.

“Limited Investor Attention and Stock Market Misreactions to Accounting Information,” Hirshleifer D, Lim SS, Teoh SH. The Review of Asset Pricing Studies 1(1), December 2011, pp. 35–73; “Limited Attention, Information Disclosure, and Financial Reporting,” Hirshleifer D, Teoh SH. Journal of Accounting and Economics 36(1-3), December 2003, pp. 337–386.

“Driven to Distraction: Extraneous Events and Underreaction to Earnings News,” Hirshleifer D, Lim SS, Teoh SH. Journal of Finance 64(5), October 2009, pp. 2289–2325.

“Presidential Address: Social Transmission Bias in Economics and Finance,” Hirshleifer D. Forthcoming in Journal of Finance, August 2020.

“Innovative Efficiency and Stock Returns,” Hirshleifer D, Hsu PH, Li D. Journal of Financial Economics 107(3), March 2013, pp. 632–654.

“Innovative Originality, Profitability, and Stock Returns,” Hirshleifer D, Hsu PH, Li D. NBER Working Paper 23432, May 2017, and Review of Financial Studies 31(7), July 2018, pp. 2553–2605.

“Shared Analyst Coverage: Unifying Momentum Spillover Effects,” Ali U, Hirshleifer D. NBER Working Paper 25201, October 2018, revised February 2019, and Journal of Financial Economics 136(3), June 2020, pp. 649–675.

“Short- and Long-Horizon Behavioral Factors,” Daniel K, Hirshleifer D, Sun L. NBER Working Paper 24163, December 2017, revised February 2019, and Review of Financial Studies 33(4), April 2020, pp. 1673–1736.