The Role of Mega Firms in Patenting and Follow-On Innovation

“Mega firms,” defined as the 50 publicly traded firms in the US with the highest annual sales, hold a disproportionate share of novel patents and may play a key part in spreading innovative ideas to smaller firms, Serguey Braguinsky, Joonkyu Choi, Yuheng Ding, Karam Jo, and Seula Kim found in Mega Firms and Recent Trends in the US Innovation: Empirical Evidence from the US Patent Data (NBER Working Paper 31460).

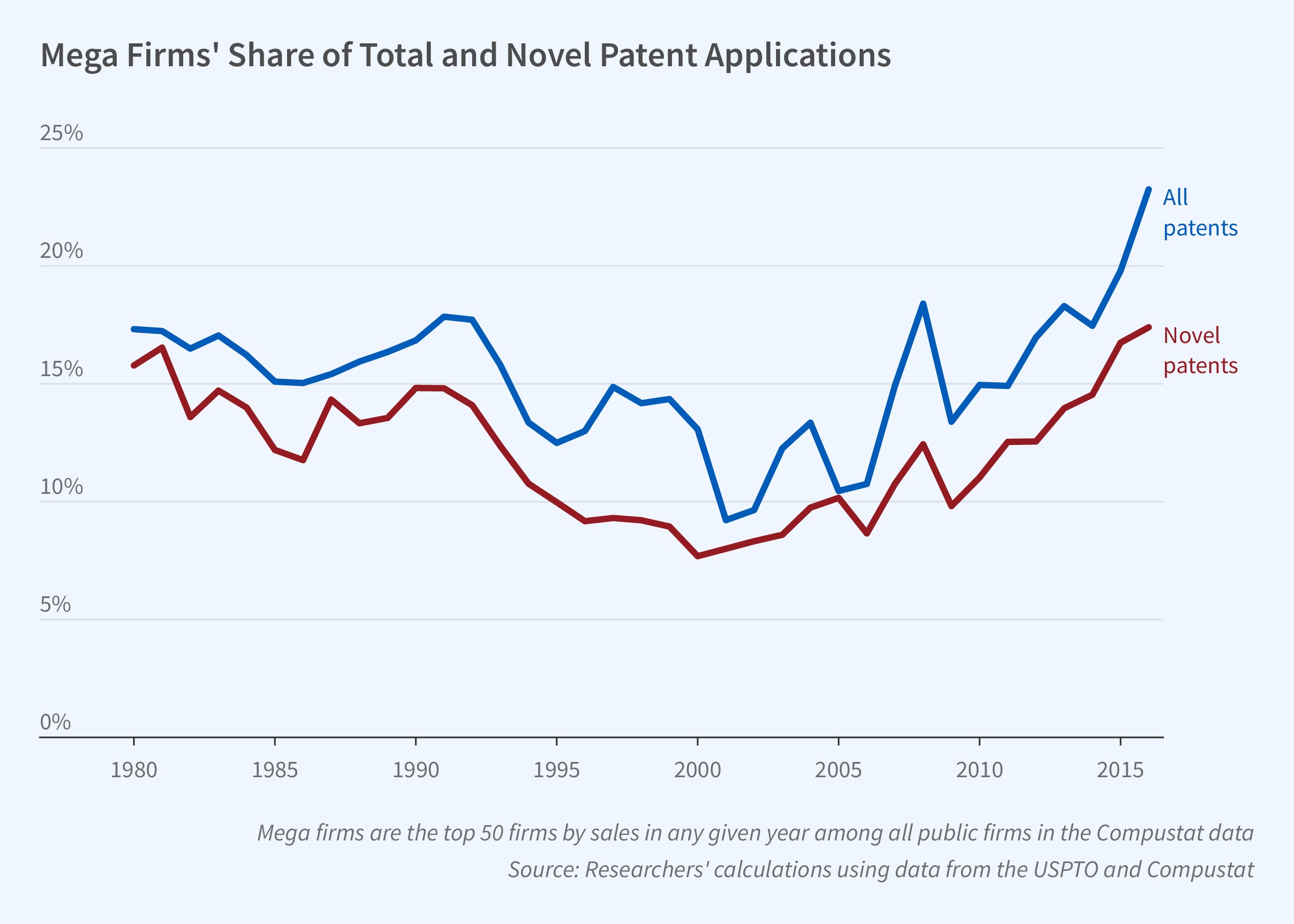

The researchers compared the time trends in novel patent filings (patents combining technological components never combined before). They found that mega firms’ share of novel patents granted by the US Patent and Trademark Office (USPTO) among all patenting entities increased from about 8 percent in the early 2000s to around 17 percent by 2016 (from about 14 percent to around 33 percent among publicly traded firms). Furthermore, since 2007, mega firms’ novel patents were disproportionately likely to spark follow-on patenting, additional patents using the same combination of technologies, within five years after a patent grant. These follow-on patents were more likely to be assigned to other entities, not the mega firms responsible for the initial novel patent, a finding that calls into question claims that mega firms prevent diffusion of new knowledge within their industries.

The share of novel patents held by very large publicly traded US firms has risen sharply since the 1990s. Since 2007, novel patents held by these firms are disproportionately likely to spark further development.

The researchers combined three data sources to develop a dataset integrating key business information and details of the patents filed by those businesses. They used the PatentsView dataset, comprising all patents granted by the USPTO since 1976, to access information about patent filings and the technological components they contained. They also used S&P’s Compustat data on all publicly listed firms in the US as well as VentureXpert data on startups backed by venture capital. Together, these datasets allowed them to track individual patents — and novel technology combinations in those patents — filed by companies and researchers. They used the data on filings by all patenting companies as their baseline, and compared that to the filings by mega firms and venture capital–backed startups.

The researchers also found a shift in the nature of patent filings. In the 1991–2000 period, 62 percent of novel patents combined two information and communications technologies (ICTs), while in the 2007–16 period, 55 percent combined an ICT component with a non-ICT component.

Mega firms, alongside VC-backed startups, were disproportionately likely to have a “hit” patent, defined as a patent in the top 1 percent when ranked by the number of follow-on patents. Furthermore, there was significant overlap between VC-backed startups and firms with a “hit” patent that grew to become mega firms after 2007. In contrast to patents filed by established mega firms, however, the follow-on patents derived from novel patents filed by VC-backed startups were more likely to be filed by the startups themselves, rather than by other entities. The researchers conclude that mega firms are investing in new ideas that others can further develop.

—Emma Salomon