Reallocation of Global Supply Chains

The structure of US international trade has undergone a dramatic transformation since 2018 when the US began imposing substantial tariffs targeting Chinese imports. This trade policy shift, combined with pandemic-era supply chain disruptions and subsequent geopolitical tensions, led US firms to reconsider their global sourcing strategies.

In An Anatomy of the Great Reallocation in US Supply Chain Trade (NBER Working Paper 34490), Laura Alfaro and Davin Chor analyze detailed product-level trade data from the US Census Bureau, examining over 5,300 product categories over the period 2017 to 2025. They combine this trade data with information on tariff rates, product characteristics such as capital and skill intensity, and measures of relationship-specific investments in supply chains.

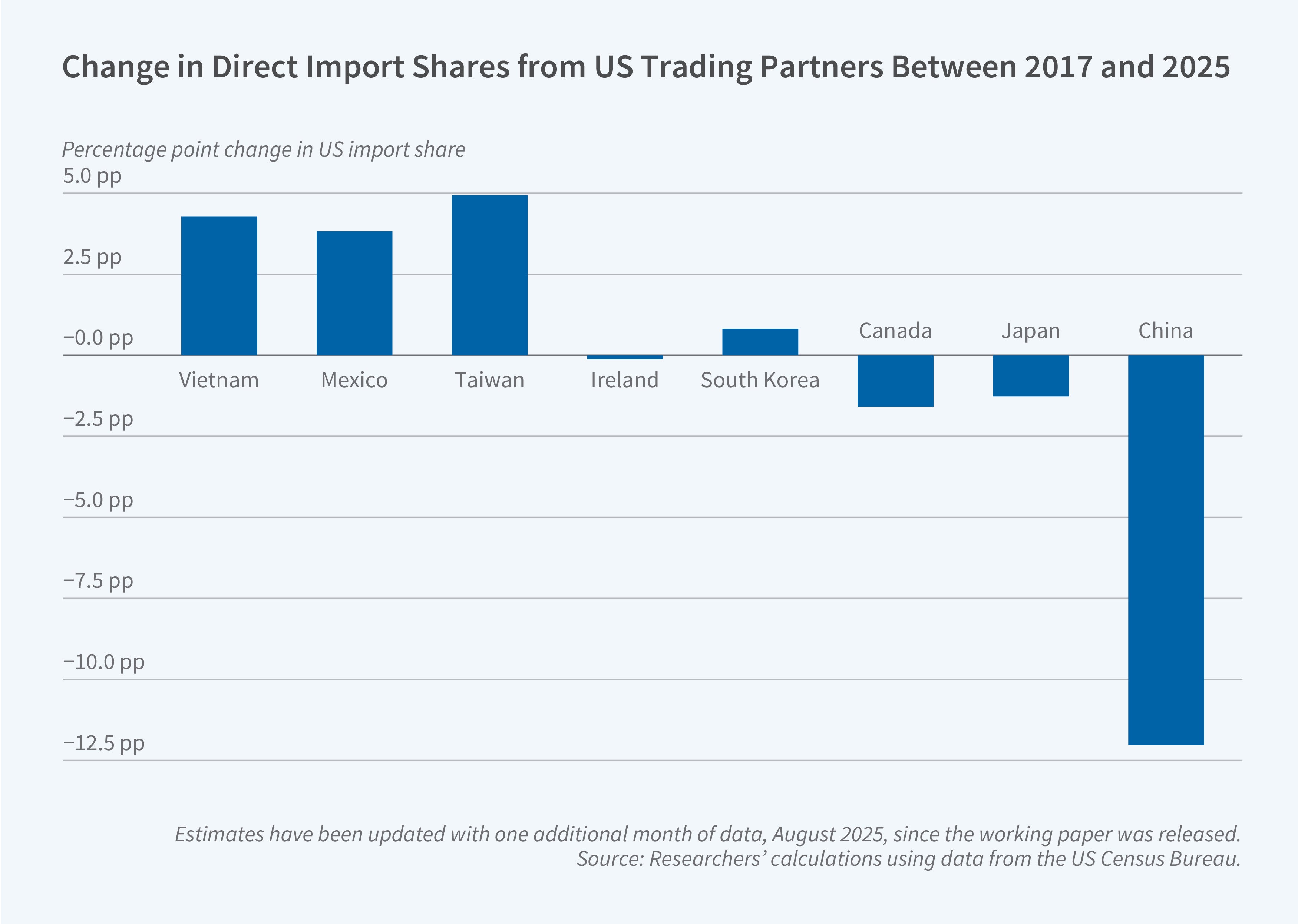

Between 2017 and mid-2025, China's share of US imports fell from 21 to 9 percent, with displaced trade reallocated primarily among existing top-20 US trade partners.

They find that China's share of US imports declined from approximately 21 percent in 2017 to 9 percent in the first 8 months of 2025. This decline accelerated sharply following the "Liberation Day" tariff announcements in April 2025, effectively reversing two decades of trade integration and bringing US imports from China to levels last seen when China joined the World Trade Organization in 2001. This shift represents a selective decoupling from China rather than broader US deglobalization; total US imports from all countries grew at an average annual rate of 5.7 percent between 2017 and 2024. The April 2025 tariffs produced faster reallocation responses than the 2018–19 tariffs, suggesting firms had already developed contingency plans for supply chain reorganization based on earlier trade policy experiences.

China's declining share of US imports coincided with rising import shares from a relatively stable set of trading partners. Vietnam and Mexico each gained more than 3 percentage points of US import market share between 2017 and 2025. There was minimal expansion of import share to countries ranked outside the top 20 sources of US imports.

The researchers estimate that products subject to the Trump administration's tariffs experienced substantial trade flow adjustments. For Chinese products facing the average additional tariff of 20 percentage points, import shares declined by approximately 5 percentage points, with both extensive margin effects (reduced likelihood of importing the product) and intensive margin effects (lower volumes conditional on importing). They also find tariff pass-through to duty-inclusive import prices of about 71 percent.

Between 2017 and 2020, import share declines for Chinese goods were concentrated in skill-intensive products and products for which alternative production capacities could be mobilized relatively quickly. However, between 2021 and 2025, the reallocation extended to contract-intensive goods requiring specialized inputs and products characterized by sticky buyer-supplier relationships. This pattern suggests companies initially adopted a "wait and see" approach for products with higher relationship-specific sunk costs but proceeded with supply chain reorganization once the persistence of tariff policies became clear.

Across countries, the mechanisms of trade diversion varied. Vietnam's gains were concentrated in labor-intensive products with below-median capital intensity, with significant extensive margin expansion into new product categories. Mexico's increases occurred primarily on the intensive margin for contract-intensive goods, likely facilitated by geographic proximity and institutional familiarity under NAFTA/USMCA. Taiwan's export growth centered overwhelmingly on computer products and semiconductors, driven by intensive margin increases in existing comparative advantage sectors.