The Evolution of Firms’ Retirement Plan Offerings

Two-thirds of private-sector workers in the US have access to an employer-sponsored defined contribution plan. Annual contributions to such plans by employers and employees are about $500 billion. Retirees will increasingly rely on defined contribution plan wealth to supplement Social Security and maintain living standards in retirement, due to the long-term shift in employer pension plans from defined benefit to defined contribution type plans.

While employer-sponsored defined contribution plans operate within a common framework, many plan features are determined by the employer. Employers may choose to match employee contributions up to some threshold and may require minimum tenure lengths before employer contributions are vested. They may choose to automatically enroll and escalate their employees’ contributions. Employer choices with respect to all of these features can significantly impact workers’ accumulation of retirement account balances.

In The Evolution of US Firms’ Retirement Plan Offerings: Evidence from a New Panel Data Set (NBER RDRC Working Paper NB20-14), researchers Antoine Arnoud, Taha Choukhmane, Jorge Colmenares, Cormac O’Dea, and Aneesha Parvathaneni document how the features of employer-sponsored defined contribution pension plans evolved from 2003 to 2017.

The authors construct a data base by hand-coding the narrative plan descriptions that are provided as an attachment to the annual Form 5500 for firms with more than 100 participants. They are able to identify key features such as matching, vesting, and auto-enrollment from these descriptions. Their sample of 5,000 plans covers up to 37 million participants annually, or more than half the population of workers enrolled in private and nonprofit sector defined contribution plans.

A first finding is that matching schedules, when offered, have become more generous over time. The combined employer and employee contribution rate of an individual fully exploiting the employer match has increased, on average, by roughly 1 percent of salary between 2003 and 2017.

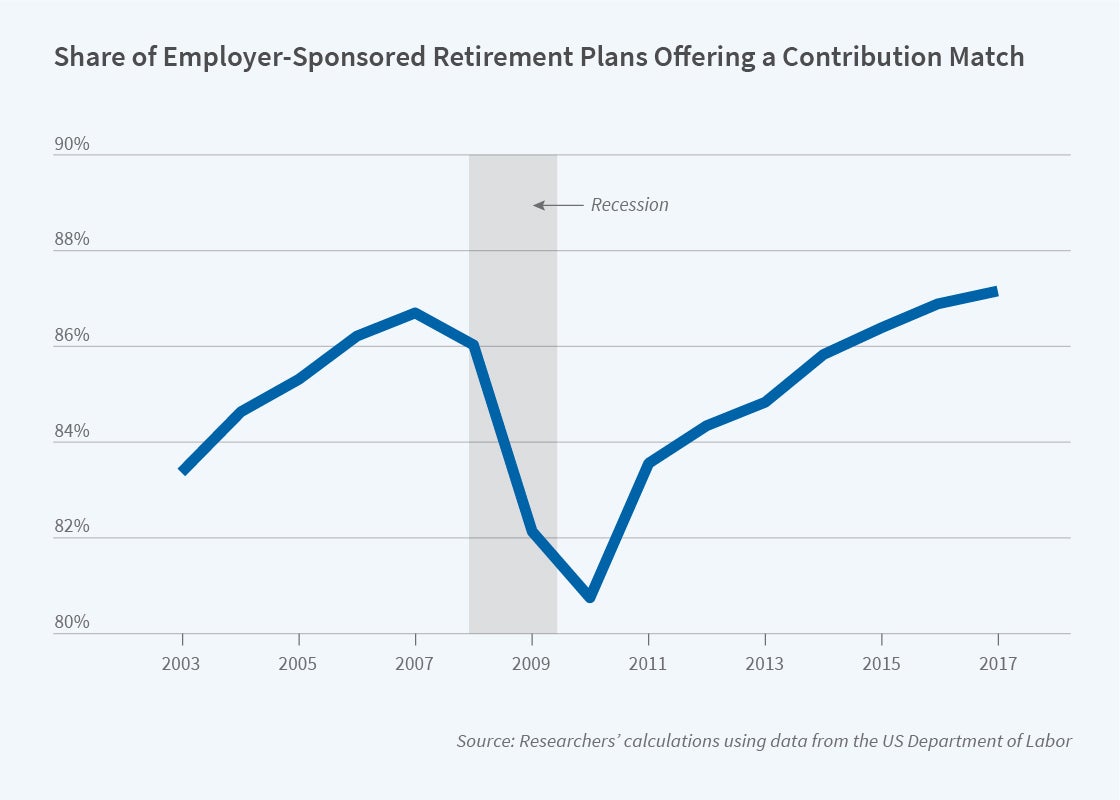

The authors examine match suspensions during the Great Recession. Among plans offering a match in the previous year, nearly 10 percent of plans suspended their match in 2009, at the height of the recession. While 70 percent of these plans reintroduced matching within two years, often with the same matching formula, about one in ten plans that suspended their match had not reintroduced it by 2017. Plans that did not suspend their match during the Great Recession did not tend to change the matching formula.

A third finding is that government regulations play an important role in plan design. Policymakers incentivize the adoption of specific matching formulas, vesting schedules, or auto-features by granting “safe-harbor” status to firms with certain characteristics, exempting them from non-discrimination testing. By 2017, over 40 percent of plans satisfy one of the safe-harbor plan conditions, with around half of these satisfying them at the minimum requirements.

The authors also document a large increase over time in the prevalence of auto-enrollment, from 2 percent of plans in 2003 to 41 percent of plans in 2017. There is also an increase in the share of plans that automatically escalate employee contributions over time, from virtually no plans in 2003 to 18 percent of plans in 2017. Most with auto-enrollment have a default contribution rate that is lower than the level that would fully exploit the employer match – only about one-third set the default at this level.

Finally, the authors report that vesting schedules have not changed much over time, and that about 85 percent of plans have a shorter vesting period than the maximum allowed by law.

The authors conclude by noting their findings may have relevance for the COVID-19 pandemic, which has brought on a new wave of match suspensions. They suggest that future research extending their data collection would be useful to examine the incidence and composition of match suspensions caused by the pandemic-related economic disruption.

The research reported herein was performed pursuant to grant #RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of NBER, SSA or any agency of the Federal Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.