Parental Labor Supply and the Expanded Child Tax Credit

The American Rescue Plan Act of 2021 increased the maximum benefit per child of the Child Tax Credit (CTC) to between $3,000 and $3,600 for the period between July and December of 2021. It also removed the requirement that taxpayers earn income to receive this benefit. This temporary policy change provided a unique opportunity to study the effect on labor force participation of switching from a transfer with work requirements to an unconditional cash benefit.

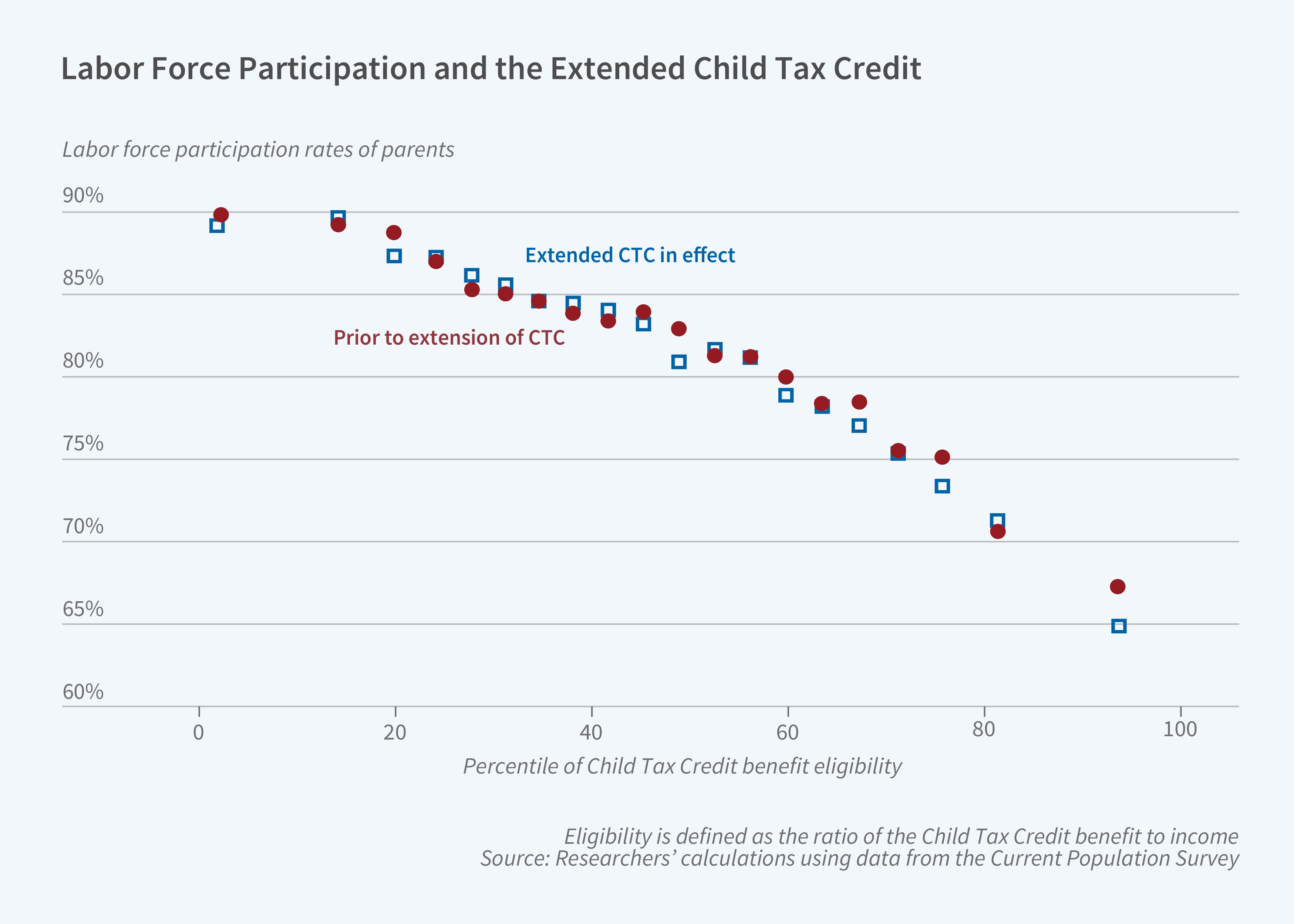

In The Short-Term Labor Supply Response to the Expanded Child Tax Credit (NBER Working Paper 31110), Brandon Enriquez, Damon Jones, and Ernest V. Tedeschi find that the fully refundable child tax credit with no work requirement had no discernable effect on labor force participation or total hours worked of the low- and middle-income taxpayers who qualified for it.

Neither labor force participation nor total hours worked changed significantly during the months when benefits were increased and work requirements were removed.

Transfer programs typically involve a tradeoff between redistribution benefits and financing costs. In the US during the 1990s, there was a marked shift from so-called “traditional welfare programs” that provided cash transfers to beneficiaries but created potential work disincentives through income-related eligibility rules to transfer programs that required recipients to work. The Earned Income Tax Credit (EITC) and the CTC are both examples of programs with work requirements. The 2021 changes to the CTC temporarily shifted it from a program with a work requirement and phase-in to a fully refundable credit program that provided benefits to families with no earnings.

Drawing primarily on the monthly Current Population Survey of about 60,000 US households with detailed demographic and labor market outcome data, the researchers compare labor force participation and hours worked among households with children that qualified for different amounts of CTC benefits before the program’s expansion and the associated drop of earnings conditioning, during the expansion period, and after work requirements were reinstated. They follow the Bureau of Labor Statistics’ definition of labor force participation, namely including all those who are employed, actively seeking a job, or on temporary layoff or furlough. They consider hours worked for all respondents; individuals who are not employed and who are absent from work are coded as zero hours worked.

The researchers do not find significant labor supply differences across families over time as a function of the magnitude of the additional CTC benefits during the temporary expansion period. Their findings are similar for a variety of demographic subgroups. They conclude that neither labor force participation nor total hours worked appear to have responded to variation in eligibility for, or the magnitude of, the CTC.

—Lauri Scherer