Estimating the Macroeconomic Impacts of Fed Policies

How monetary policy actions affect the trajectory of the macroeconomy is a key question for central bankers and macroeconomists. Researchers face formidable challenges in answering this question because of the endogeneity of the Federal Reserve’s decisions. If these decisions were made randomly, researchers could simply examine the statistical correlation between the Fed’s actions and subsequent economic outcomes to uncover the causal effects of decisions on outcomes. But of course, the Fed’s decisions are not made randomly; they are responsive to both contemporaneous and anticipated economic conditions. This makes it difficult to disentangle their effects from the other factors that simultaneously influence both economic outcomes and Fed decisions. If inflation stays constant after the Fed raises interest rates, is this because the Fed’s decision had no effect, or because the Fed raised rates in anticipation of inflation-increasing developments, implying that inflation would have increased absent the Fed’s rate hike?

One way to solve this empirical challenge is what Christina D. Romer and David H. Romer term “the narrative approach.” In Does Monetary Policy Matter? The Narrative Approach after 35 Years (NBER Working Paper 31170), they apply this methodology to historical data and draw inferences about the likely impact of recent monetary policy actions.

Empirical estimates of the effects of previous monetary contractions suggest that recent rate hikes will reduce employment, output, and inflation.

The narrative approach focuses on identifying and analyzing historical monetary policy decisions that were not influenced by contemporaneous or expected economic outcomes. Studying these episodes, and comparing macroeconomic conditions before and after the policy changes, can yield causal evidence on the effects of policy changes.

To identify relevant policy changes, the researchers note that Fed decisions are influenced by two factors: policymakers’ assessments of current and future economic conditions, and their preferences over inflation and unemployment. Sometimes their preferences change in a way unrelated to contemporaneous economic activity, which results in a monetary policy change. For example, in January 1972, policymakers decided to prioritize a reduction in the then-stable unemployment rate at the expense of potentially higher inflation; they lowered interest rates. Conversely, in December 1988, policymakers decided the inflation rate was intolerably high and hiked rates.

The researchers identify such changes by reading the minutes and transcripts of Federal Open Market Committee (FOMC) meetings. Since these transcripts are released publicly only after five years have passed, meeting participants can speak freely about their expectations and preferences, and reading these transcripts makes it possible to identify the reasoning behind monetary policy decisions. The researchers identify 10 monetary policy changes in the postwar period in the United States attributable to changing policymaker preferences, and study the evolution of economic outcomes around these changes.

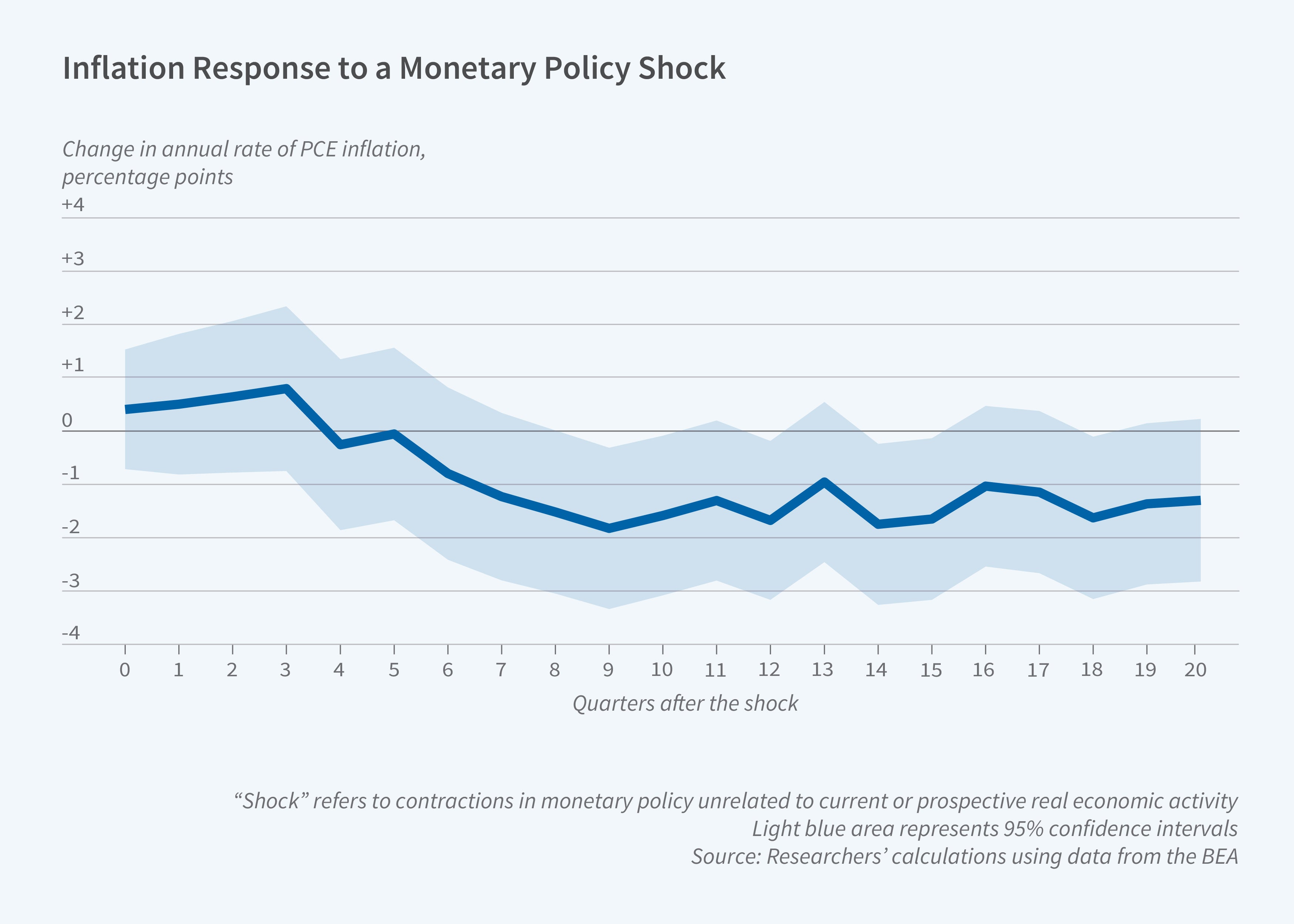

They find that the average effect of a contractionary monetary policy shock is an increase in the unemployment rate, with the effect peaking at a 1.6 percentage point increase about two years after the shock. Real GDP, meanwhile, falls, with the effect peaking at 4.4 percent after about two years. The estimates are highly statistically significant. Both effects dissipate by five years after the policy shock. Inflation, meanwhile, falls after a contractionary shock, though these effects are less precisely estimated. Five years after the policy tightening, the inflation rate is about 1.5 percentage points lower than it would have been otherwise.

Although the transcripts of the 2022 FOMC meetings will not be available until 2028, when the researchers apply their methodology to the FOMC documents from 2022 that are currently available, they conclude that there was likely a contractionary monetary shock in the third quarter of 2022. Their estimates imply that the associated interest rate hikes will reduce employment, output, and inflation, but that most of the effects will not occur until mid-2023 and after.

—Shakked Noy