International Linkages and the Business Cycle: Lessons from Micro for Macro

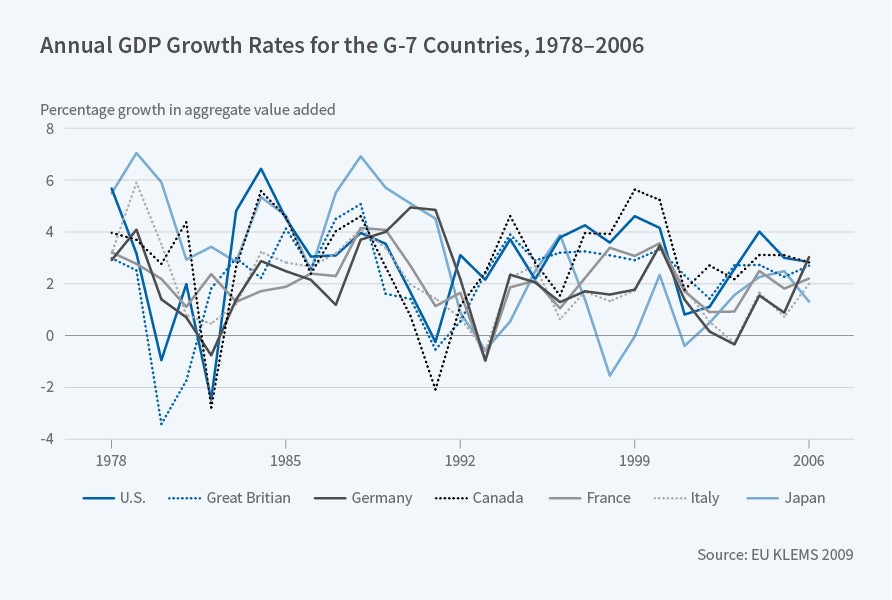

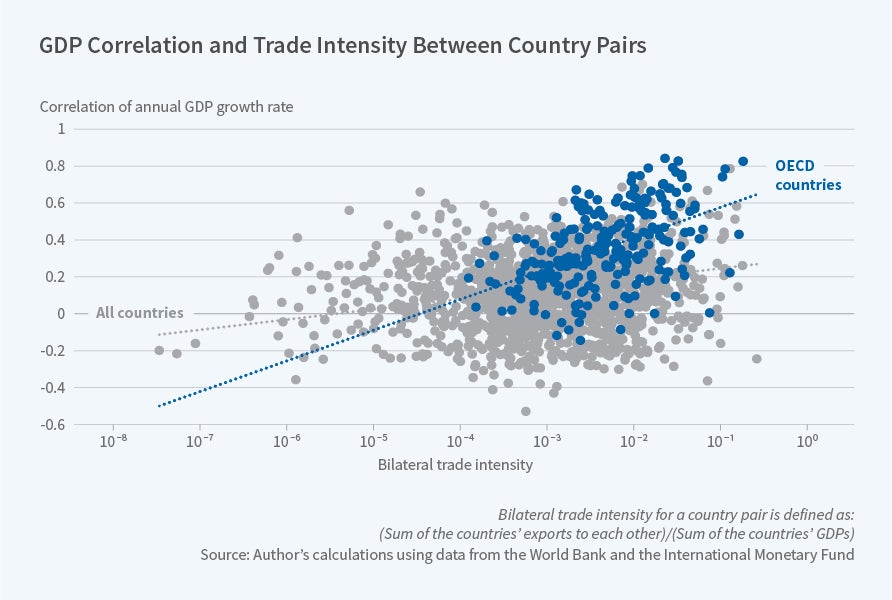

The international business cycle exhibits two prominent features. The first is significant positive comovement among countries. Figure 1 illustrates this by plotting the GDP growth rates for the G-7 countries. The tendency of GDP growth rates to move together is evident. Second, country pairs that are more closely linked through trade in goods and multinational production exhibit greater comovement. Figure 2 illustrates this with a scatterplot of the GDP correlation and the bilateral trade intensity for a sample of country pairs.

While the empirical literature has documented these relationships in the aggregate data, the reasons behind them are not well understood. There are two open questions. First, to what extent are these regularities due to transmission of shocks across countries, rather than simply correlated shocks? Second, what types of shocks — technology shocks or demand shocks — drive international comovement?

My collaborators and I take a fresh look at the international business cycle using recent insights from macroeconomics and newly available datasets. A central premise of our research program is that measuring and modeling shocks at the micro level (to firms and sectors) is essential for understanding the macro consequences of globalization. Our ultimate goal is to provide a unified perspective on business cycle comovement at the micro and aggregate levels.

Transmission vs. Common Shocks

In our first project on this topic, Julian di Giovanni and I explore the trade-comovement relationship at the industry, rather than aggregate, level.1 Industry-level data have two main advantages for studying comovement.

First, sector-country-pair panel data permit the inclusion of set country pair fixed effects to control for aggregate common shocks that plague the interpretation of estimates based on cross-country data. As a result, our approach provides much more robust evidence on transmission of shocks.

Second, sector-level data permit a more precise measurement of input linkages. We use input-output matrices to gauge the intensity with which individual sectors use each other as sources of intermediate inputs in production. We then investigate whether input linkages across industries can help explain the impact of international trade on comovement. This provides evidence on transmission through a particular channel: the use of intermediate inputs in production.

Our main finding is that vertical linkages are an important driver of the trade-comovement relationship: Bilateral international trade increases comovement significantly more in cross-border industry pairs that use each other as sources of intermediate inputs. Our estimates imply that these vertical production linkages account for some 30 percent of the total impact of bilateral trade on the business cycle correlation.

Di Giovanni, Isabelle Méjean, and I then go to the firm level to better understand the role of international linkages in comovement.2 We use data covering the universe of French firm-level value-added, destination-specific imports and exports, and cross-border ownership from 1993 through 2007. Observing cross-border links at the firm level allows us to establish with forensic precision the role of each type of trade and multinational relationship in cross-border comovement. In addition, because we have data on many firms selling to multiple countries, our estimation can include both firm and country effects. This allows us to show that trade and multinational linkages are indeed a source of transmission of shocks, rather than simply a stand-in for the presence of common shocks.

At the firm level, our main finding is that firms directly connected to foreign countries through trade or multinational linkages are more correlated with those countries, even after controlling for common shocks. At the macro level, we highlight the consequences of heterogeneity across firms in both size and the extent of international linkages. Larger firms are more likely to trade internationally and to own affiliates in foreign countries. Indeed, in most countries, international trade flows are dominated by a handful of large firms. It is a natural conjecture that these large, internationally connected firms matter for cross-border comovement. We compute the change in the aggregate correlation between France and each foreign country that would occur if direct linkages at the firm level disappeared. To do this, we combine the regression-based estimates of the change in the correlation at the firm level with firm-level weights. If direct linkages at the firm level were severed, the aggregate correlation would fall by 0.098 on average in our sample of ten partner countries. This is a non-negligible change relative to the average correlation between France and its main trading partners — 0.291 — over this period.

Javier Cravino and I focus on how multinational firms contribute to the transmission of shocks across countries.3 We use Orbis, a firm-level database that covers several million firms operating in 34 countries over the period 2004–12. The key feature of the dataset is that it contains information on domestic and foreign ownership. This information allows us to study micro-level cross-country comovement between the different parts of multinational corporations. At the same time, the data cover the bulk of economic activity in our sample of countries, making it possible to aggregate the firm-level results and derive their implications for aggregate comovement.

We document two novel empirical patterns. First, foreign affiliate and headquarters sales exhibit strong positive comovement: 10 percent growth in headquarters sales is associated with 2 percent growth in the sales of the affiliate. Second, shocks to the source country account for a significant fraction of the variation in sales growth at the source-destination level.

We propose a parsimonious quantitative model to interpret these findings and to evaluate the role of multinational firms for international business cycle transmission. For the typical country, foreign shocks transmitted by all foreign multinationals account for about 10 percent of aggregate productivity shocks. However, since bilateral multinational production shares are small, interdependence between most individual country pairs through this channel is minimal. Our results do reveal substantial heterogeneity in the strength of this mechanism, with the most integrated countries significantly more affected by foreign shocks.

While most work on the international business cycle focuses on comovement in quantities, we can gain additional insight by studying comovement in prices. Inflation rates are, if anything, even more synchronized across countries than GDP. The open question regarding inflation synchronization is the same as that for output synchronization: Is it driven by common shocks or by transmission of inflationary shocks across countries? Raphael Auer, Philip Sauré, and I investigate whether inflation synchronization is due to propagation of price shocks through input linkages.4 We assemble a multi-country, industry-level dataset that combines information on monthly sector-level Producer Price Indices (PPI) and exchange rates with international and domestic input-output linkages.

We use these data to recover the cost shocks that are consistent with observed price dynamics and the global network of input-output trade. We then compare the extent of global synchronization in observed PPI and the recovered cost shock series, and attribute the difference to the impact of linkages. We find that input linkages contribute substantially to inflation synchronization across countries, accounting for about half of the global component of PPI inflation.

Building on the theme of transmission of price shocks, Cravino and I study a particularly important type of price shock: large exchange-rate changes.5 Our main interest is gauging the distributional impact of large devaluations. The main insight combines two observations. First, devaluations lead to large changes in relative prices. Second, consumers at different points on the income distribution have different consumption baskets. Poor households spend relatively more on tradable product categories, and consume lower-priced varieties within categories. Changes in the relative price of tradables and of lower-priced varieties will then affect the cost of living of low-income and high-income households differentially. We quantify these effects following the 1994 Mexican devaluation and show that they can have large distributional consequences. Two years post-devaluation, the cost of living for the bottom income decile rose 1.48 to 1.62 times more than for the top income decile. Thus, in the case we study, the devaluation was strongly anti-poor.

TFP vs. Non-Technology Shocks

The second open question in the international business cycle literature is whether comovement is driven by total factor productivity (TFP) shocks or non-technology (sometimes called "demand") shocks. The challenge is to separately identify and measure technology and non-technology shocks. Nitya Pandalai-Nayar and I propose a novel identification scheme for a non-technology business cycle shock, which we label "non-technology expectations" (NTE).6 This is a shock that moves expectations of economic activity but is unrelated to productivity. We then estimate the international transmission of three identified shocks — surprise TFP, news of future TFP, and NTE — from the United States to Canada.

The U.S. non-technology shock produces a business cycle in the U.S., with output, hours, and consumption rising following a positive shock, and accounts for the bulk of U.S. short-run business cycle fluctuations. The non-technology shock also has a significant impact on Canadian macro aggregates. In the short run, it is more important than either the surprise TFP or the news of future TFP shocks in generating business cycle comovement between the U.S. and Canada, accounting for over 40 percent of the forecast error variance of Canadian GDP and over one-third of the variation in Canadian hours, imports, and exports.

Next, we extend the analysis to multiple countries and sectors.7 Using industry-level data on 30 countries over up to 28 years, we develop estimates of utilization-adjusted TFP shocks, and an approach to infer non-technology shocks. We then set up a quantitative model calibrated to the observed international input-output and final-goods trade data, and use it to assess the contribution of both technology and non-technology shocks to international comovement. We show that unlike the traditional Solow residual, the utilization-adjusted TFP shocks are virtually uncorrelated across countries. Transmission of TFP shocks across countries also cannot generate noticeable comovement in GDP in our sample of countries. By contrast, non-technology shocks are highly correlated across countries, and the model simulation with only non-technology shocks generates substantial GDP correlations.

Taking Stock

What have we learned from this research program? First, firm- and sector-level data are the right place to measure transmission of shocks across countries. In the micro data, evidence of transmission is pervasive. Whether transmission estimated at the micro level leads to substantial comovement in the macro aggregates is somewhat less certain, and depends on the details of how shocks are propagated and on the general equilibrium mechanisms.

Second, non-technology shocks are much more important for international comovement than technology shocks, both because they are transmitted across countries to a greater extent, and because they are more correlated across countries than TFP shocks. Our main takeaway is that in order to understand international comovement, it is essential to both model and measure non-TFP shocks.

Endnotes

J. di Giovanni and A. Levchenko, "Putting the Parts Together: Trade, Vertical Linkages, and Business Cycle Comovement," American Economic Journal: Macroeconomics, 2(2), April 2010, pp. 95-124.

J. di Giovanni, A. Levchenko, and I. Méjean, "The Micro Origins of International Business Cycle Comovement," NBER Working Paper 21885, January 2016, and forthcoming in American Economic Review.

J. Cravino and A. Levchenko, "Multinational Firms and International Business Cycle Transmission," NBER Working Paper 22498, August 2016, and the Quarterly Journal of Economics, 132(2), May 2017, pp. 921-62.

R. Auer, A. Levchenko, and P. Sauré, "International Inflation Spillovers Through Input Linkages," NBER Working Paper 23246, March 2017.

J. Cravino and A. Levchenko, "The Distributional Consequences of Large Devaluations," NBER Working Paper 23409, May 2017, and American Economic Review, 107(11), November 2017, pp. 3477-509.

A. Levchenko and N. Pandalai-Nayar, "TFP, News, and 'Sentiments:' The International Transmission of Business Cycles," NBER Working Paper 21010, March 2015.