Tax-Efficient Mutual Funds Do Better Before Taxes, Too

Pursuing trading and investment strategies that could limit investment opportunities does not appear to lower average pre-tax returns.

Millions of baby boomers who are set to retire over the next few years may some day regret that they didn't pay more attention to the tax implications of their mutual fund investments during their working lives.

In Tax-Efficient Asset Management: Evidence from Equity Mutual Funds (NBER Working Paper No. 21060), Clemens Sialm and Hanjiang Zhang investigate the performance of U.S. equity mutual funds that are "tax efficient" in the sense of following investment and trading strategies that minimize tax burdens on taxable investors. The study finds that tax-efficient funds have tended to outperform other funds with respect to both before-tax and after-tax returns.

Income taxes on dividends, short-term capital gains, and long-term capital gains can significantly reduce the after-tax return that a taxable investor earns, relative to the pre-tax return on a mutual fund. The magnitude of this tax wedge depends on the investment style of the fund, on some decisions of the portfolio manager, such as when to realize capital gains and losses on the fund's investments, and on the behavior of fund investors.

As an example of how a fund's investment style can matter, the researchers consider the difference between small-cap and large-cap equity funds. Small-cap funds sometimes face situations that require them to liquidate their holdings, for example when the market capitalization of a small firm increases so much that it is no longer suitable for inclusion in a "small cap" fund. In these cases the funds often liquidate their positions in these winner stocks and thereby realize taxable capital gains. Meanwhile, large-cap funds tracking larger and more-established firms will tend to liquidate positions in poorly-performing companies, which cannot be classified any longer as "large cap" stocks. Such liquidations often lead to the realization of capital losses, which actually reduce the tax burdens of the fund investors. Tax burdens also tend to be higher on funds that hold stocks paying high dividend yields and on funds that see high rates of redemptions and volatile investor flows.

The authors find that shareholders of taxable mutual funds pay an average of about 1.12 percent of the value of their fund holding each year in dividend and capital gains taxes. That annual tax burden is similar in magnitude to fund expenses, including management fees, which tend to receive more attention from investors and scholars when they analyze the built-in costs of funds' investments.

One way for a mutual fund to reduce the tax burden it imposes on its investors is by deferring the realization of capital gains and accelerating the realization of capital losses. Another is by steering away from highly-taxed securities. But such strategies could theoretically come at a cost: Funds seeking to avoid tax burdens might constrain their investment opportunities and thus potentially reduce their pre-tax returns.

The authors examine U.S. equity mutual funds from 1990 through 2012, based largely on information from the CRSP Survivorship Bias Free Mutual Fund database that tracks fund returns, dividend and capital gains distributions, total net assets, fees, flows, and investment objectives. They find that, on average, mutual funds that follow tax-efficient investment strategies generate better after-tax returns for taxable investors than funds that do not. Funds in the lowest tax-burden quintile over the prior three years exhibited excess returns net of taxes of 0.19 percent over the subsequent year. Funds in the highest tax-burden quintile, by comparison, exhibited excess returns of 2.29 percent after taxes.

The authors found that the pre-tax return on funds in the lowest tax-burden quintile over the previous three years averaged 0.91 percentage points higher, in the subsequent year, than funds in the highest tax-burden quintile. The results do not suggest that tax-efficient funds perform worse than their peers with regard to pre-tax returns.

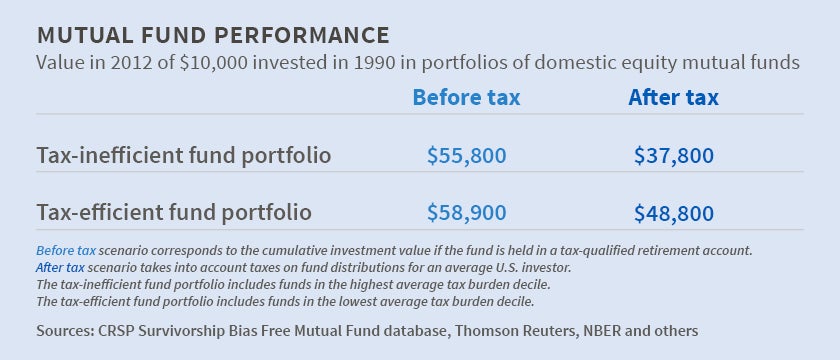

These performance differences compound to a substantial extent over time for long-term taxable investors, as illustrated in the accompanying graphic. An investment in 1990 of $10,000 in mutual funds in the highest tax burden decile would have compounded in 2012 to $55,800 before taxes and to just $37,800 after taxes. On the other hand, an equivalent investment in mutual funds in the lowest tax burden decile would have compounded to $58,900 before taxes and to $48,800 after taxes over the identical time period. Thus, investing in tax-efficient funds would have increased the final wealth of a typical taxable investor by more than $10,000.

"This result can be explained primarily by the lower trading costs and by the superior investment ability of tax-efficient mutual funds," the authors write.

—Jay Fitzgerald