Implicit Taxes on Work at Older Ages

The biggest financial challenge for most Americans is funding their retirement. In recent decades, working lives have not kept pace with increasing life expectancies, leading to longer retirements.1 Longer retirements are more challenging to finance, whether through private savings or federal entitlement programs such as Social Security and Medicare. The structure of retirement programs can produce large implicit taxes and subsidies for work at older ages as well as for alternative strategies to tap into retirement resources. These implicit taxes and subsidies can distort behavior, and failure to understand them can result in households passing up six-figure arbitrage opportunities.

The three of us, together with a set of outstanding coauthors, have been writing about these issues for more than a decade. This article summarizes our work, drawing on the results of several studies.

We first describe the implicit taxes on wages earned by the elderly that are embedded in Social Security retirement and disability insurance and Medicare. Then we cover the subsidy or actuarial advantage of delaying the commencement of Social Security, a decision that for many people will involve working longer. A clearer understanding of the work and claiming incentives embodied in federal programs can help policy- makers improve their design and avoid unintended consequences.

Implicit Taxes for Older Workers

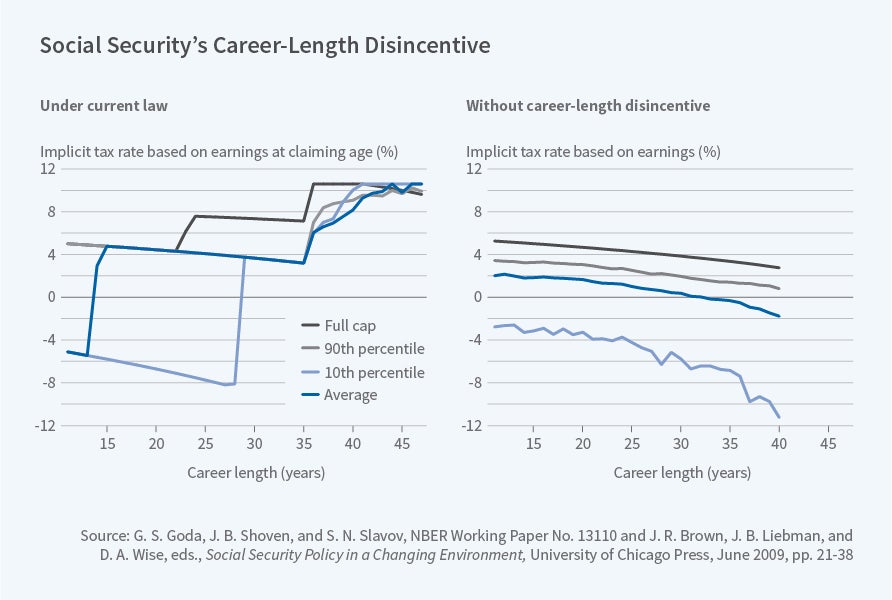

Our earliest study of implicit taxes on wages earned at older ages focuses on the Social Security retirement program. The study documents that current Social Security tax and benefit rules lead to an increasing implicit tax on work at longer career lengths.2 Social Security benefits are based on the average of the highest 35 years of earnings, indexed for economy-wide average wage growth. A progressive formula is applied to this average to arrive at the monthly Social Security benefit. We show that as career length increases and career average earnings rise, benefits rise less quickly than earnings and taxes, resulting in implicit net taxes. Once 35 years of earnings are reached, additional years of earnings have little or no effect on Social Security benefits, resulting in an implicit tax that approximates the full 10.6 percent payroll tax rate. The implicit tax rates for four stylized workers are shown in the left panel of Figure 1.3

We also analyze three policy changes that could collectively reduce implicit taxes: (1) basing benefits on the highest 40 years of indexed earnings; (2) changing the benefit formula so that short careers with high earnings are treated differently than long careers with low earnings; and (3) eliminating the payroll tax for individuals who have reached 40 years of work. The resulting implicit taxes generated by the retirement program of Social Security are shown in the right panel of the figure. These changes could be implemented in a revenue-neutral way that maintains average benefits.

We find a similar effect for Social Security disability insurance.4 To be eligible for disability insurance, a claimant must have worked in at least five of the past 10 years. Thus, workers who are within five years of full retirement age — at which point disability benefits are converted to retirement benefits — can maintain eligibility for disability benefits regardless of whether they work, although they continue to pay the 1.8 percent payroll tax to fund the program. Moreover, even though workers who are more than five years from full retirement age will lose eligibility if they stop working entirely, the incentive to earn income beyond the minimum required to maintain coverage weakens as they age because the length of time over which any potential disability benefits would be paid shrinks.

We have also studied the implicit taxes resulting from the Medicare as Secondary Payer (MSP) provision.5 Requiring employer-sponsored health insurance to be the primary payer for Medicare-eligible workers increases the cost to employers of hiring these workers and reduces the pay they are willing to offer. The provision effectively forces Medicare-eligible individuals to forgo their Medicare coverage if they work for an employer that offers health insurance. Using data on Medicare costs, we estimate that this implicit tax is between 15 and 20 percent of wages at age 65 for average earners. It increases to 25-35 percent by age 70.6 These implicit taxes are on top of the 15.3 percent payroll tax that funds the retirement, disability, and Medicare programs.

For workers under age 65, employer-sponsored health insurance has in the past offset some of these work disincentives. Our research shows that, among workers with access to employer-provided health insurance, those who are also eligible for subsidized retiree health insurance have a one-year departure rate that is 36–49 percent greater at ages 62 to 64 than those who are not.7 We also show that providing retiree health insurance for public sector workers increases the probability of their switching to part-time work in their late 50s and increases the probability of stopping work in their early 60s.8 Retiree health insurance is relatively rare: Less than a quarter of large firms that offer employee health insurance also offer retiree health insurance.9 However, since 2014, the Affordable Care Act has effectively made subsidized retiree health insurance available to all individuals. Our research suggests that the availability of such coverage is likely to encourage pre-Medicare retirements.

Gains from Delaying Social Security

While much research has been done on the optimal level and allocation of retirement wealth, less attention has been paid to the optimal strategy for drawing down on that wealth. Social Security is the largest retirement asset for most Americans. Benefits may be claimed at any age between 62 and 70, with later claims resulting in higher monthly benefits. The increase is more than actuarially fair, given recent mortality rates and real interest rates. We have examined optimal Social Security claiming and the coordination of Social Security claiming with withdrawals from private retirement savings.

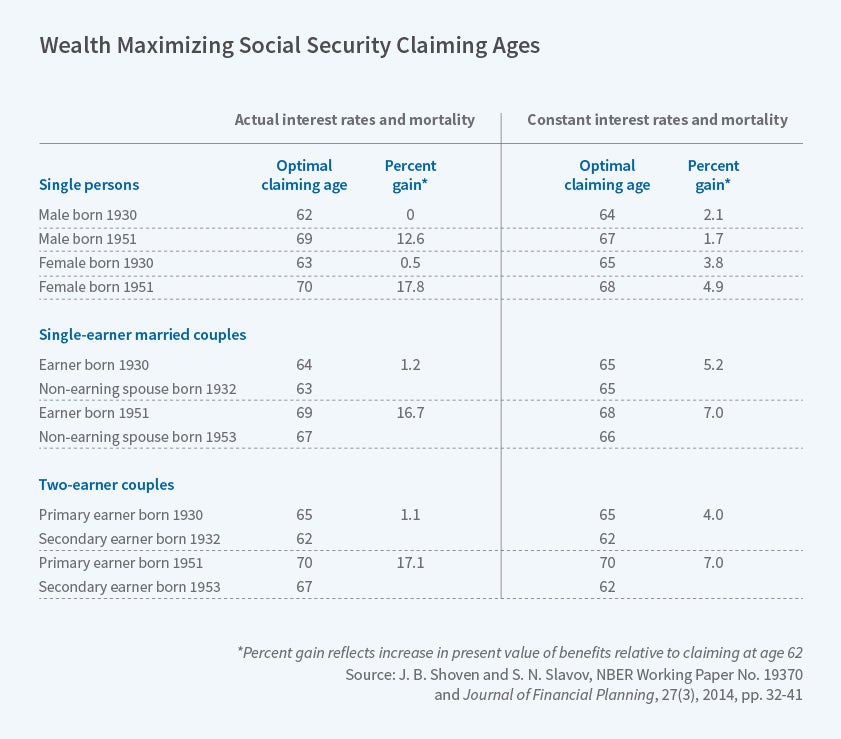

We show that some degree of delay in claiming Social Security benefits maximizes the expected present value of retirement wealth for a large subset of people. The gains from delay are largest for primary earners. Since Social Security is paid as a joint and survivor annuity, primary earners who delay claiming boost not only their own monthly benefit but also the survivor benefit they leave to their spouse. Most primary earners maximize lifetime income by claiming at age 70. However, even singles boost their expected lifetime incomes by delaying to 70. Most surprisingly, even single males who are in poorer-than-average health and face mortality rates twice the average can maximize lifetime income by claiming at age 65 rather than 62. 10These gains from delay have increased substantially in the past 20 years due to rising life expectancy, changes in Social Security rules, and historically low real interest rates. Panel (a) of Table 1, on the following page, shows the wealth-maximizing claiming ages, as well as the potential increase in expected lifetime income, relative to claiming at age 62, for a variety of stylized households, with average mortality for their cohort and gender. The panel suggests that gains from delay were small for the 1930 (and 1932 for secondary earners) birth cohort but large for the 1951 (and 1953 for secondary earners) birth cohort. Panel (b) decomposes the impact of the three factors that contributed to the gains from delay by holding mortality and interest rates constant. Mortality is held to 1951/1953 levels and the real interest rate is held to 2.9 percent.11

If the gains from delaying Social Security are so large, why don't most people delay? We investigate the role of liquidity constraints by examining whether individuals who claim early have sufficient private savings to finance a significant delay, assuming they also stop working. We find that around a third of those who claim before full retirement age have Individual Retirement Account (IRA) assets sufficient to finance a two-year delay. In addition, many people who claim before full retirement age wait until they are 70½, when they are required by law to take distributions from their IRAs. Thus, liquidity constraints alone cannot explain why most people do not delay. 12We fielded an original survey asking people about their rationale for claiming when they did, as well as their satisfaction with their claiming decisions. Our survey results suggest that claiming Social Security upon stopping work and claiming at full retirement age are strong social norms.13

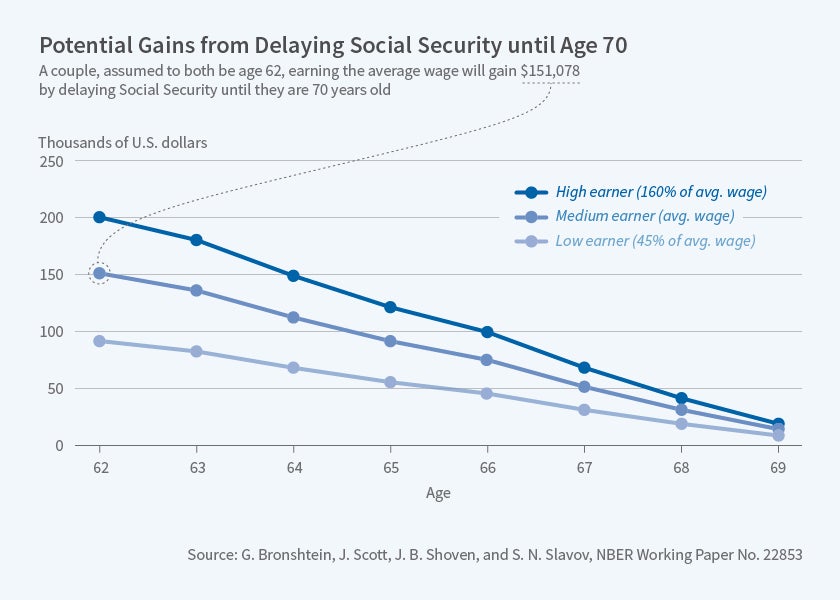

Since delaying Social Security benefits involves a tradeoff between current and future income, it is difficult to say that early claimers are making a mistake even if their choice does not maximize expected retirement wealth. However, we show that primary earners who either purchase a retail annuity or take an annuity payout from a defined benefit plan when a lump sum is available, while simultaneously failing to delay Social Security, are purchasing relatively expensive annuities when a cheaper annuity — the increased lifetime payments resulting from delaying Social Security — is available. They could enjoy higher income in every year of their lives if they used their retirement savings or lump sum payout to delay Social Security. Figure 2.

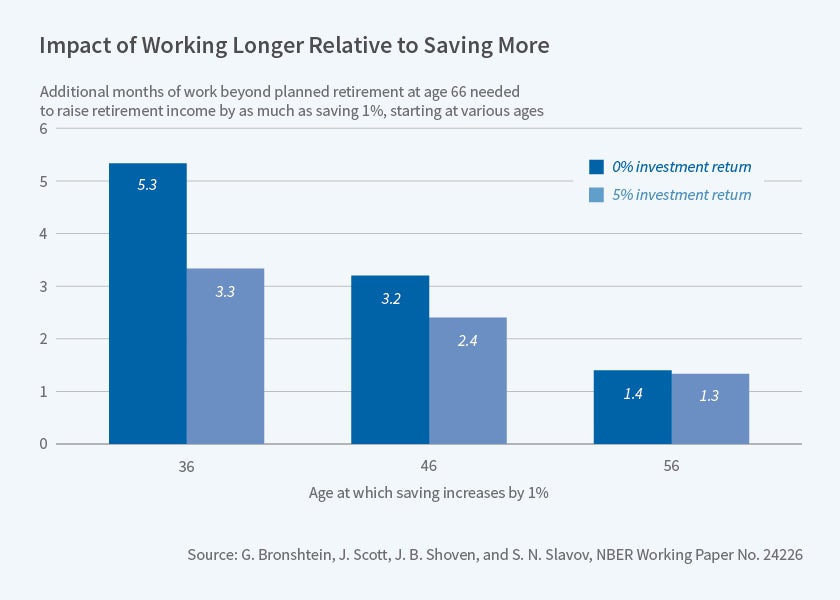

We recognize that for many people delaying Social Security will involve working longer, whether due to liquidity constraints or to social norms. And we have calculated the impact of working longer and simultaneously delaying Social Security on the level of sustainable consumption in retirement. Figure 3 shows — for various real investment returns and ages — the number of months of additional work and Social Security delay that would produce the same increase in retirement consumption as saving an additional 1 percent of income through age 66. For example, for 46-year-olds, working an extra 2.4 months produces the same increase in retirement consumption as saving an additional 1 percent of income over the next 20 years if real investment returns are zero.

Working longer increases consumption in retirement for several reasons. First, individuals can save a portion of the income they earn during the extra time worked. Second, individuals can earn additional returns on accumulated savings. Third, they will have fewer years of retirement to finance. Finally, delaying Social Security increases monthly benefits. The last factor is by far the largest for most people.15

Conclusion

Implicit taxes on work at older ages can be remarkably large. For those 65 and over, the total implicit tax resulting from the Social Security retirement and disability programs plus Medicare can easily top 40 percent. Alternative policies could substantially reduce these implicit taxes and have a large impact on labor supply, particularly given that older workers supply labor more elastically than younger ones. The actuarial advantage of delaying claiming Social Security is equally large, and even a single male with twice the average mortality risk (for example, a smoker) could gain in expected value terms from some delay. We find that many households fail to get the most out of their retirement resources. Some can and do pass up a six-figure arbitrage opportunity that could have made their retirement standard of living significantly higher.

Endnotes

See, for example, B. Cushing-Daniels and C. E. Steuerle, "Retirement and Social Security: A Time Series Approach," Center for Retirement Research at Boston College, Working Paper No. 2009-1, January 2009.

G. S. Goda, J. B. Shoven, and S. N. Slavov, "Removing the Disincentives in Social Security for Long Careers," NBER Working Paper 13110, May 2007, and in J. R. Brown, J. B. Liebman, and D. A. Wise, eds., Social Security Policy in a Changing Environment, Chicago, Illinois: University of Chicago Press, June 2009, pp. 21–38.

G. S. Goda, J. B. Shoven, and S. N. Slavov, "Work Incentives in the Social Security Disability Benefit Formula," NBER Working Paper 21708, November 2015, and forthcoming in the Journal of Pension Economics and Finance.

G. S. Goda, J. B. Shoven, and S. N. Slavov, "A Tax on Work for the Elderly: Medicare as Secondary Payer," NBER Working Paper 13383, September 2007.

A summary of these findings, as well as the findings for Social Security, was published by G. S. Goda, J. B. Shoven, and S. N. Slavov, "Implicit Taxes on Work from Social Security and Medicare," in J. Brown, ed., Tax Policy and the Economy, Volume 25, Chicago, Illinois: University of Chicago Press, September 2011, pp. 69-88.

S. Nyce, S. Schieber, J. B. Shoven, S. N. Slavov, and D. A. Wise, "Does Retiree Health Insurance Encourage Early Retirement?" NBER Working Paper 17703, December 2011, and Journal of Public Economics, 104, 2013, pp. 40–51.

J. B. Shoven and S. N. Slavov, "The Role of Retiree Health Insurance in the Early Retirement of Public Sector Employees," NBER Working Paper 19563, October 2013, and "Retiree Health Insurance for Public School Employees: Does It Affect Retirement?" Journal of Health Economics (Special section: Health Insurance and the American Public Sector Labor Market), 38, 2014, pp. 99–108.

Kaiser Family Foundation and Health Research and Educational Trust, "Employer Health Benefits 2016 Annual Survey," http://files.kff.org/attachment/Report-Employer-Health-Benefits-2016-Annual-Survey

J. B. Shoven and S. N. Slavov, "The Decision to Delay Social Security Benefits: Theory and Evidence," NBER Working Paper 17866, February 2012; and J. B. Shoven and S. N. Slavov, "When Does It Pay to Delay Social Security? The Impact of Mortality, Interest Rates, and Program Rules," NBER Working Paper 18210, July 2012, combined and published as "Does It Pay to Delay Social Security?" in Journal of Pension Economics and Finance, 13(2), 2014, pp. 121–44.

J. B. Shoven and S. N. Slavov, "Recent Changes in the Gains from Delaying Social Security," NBER Working Paper 19370, August 2013, and Journal of Financial Planning, 27(3), 2014, pp. 32–41.

G. S. Goda, S. Ramnath, J. B. Shoven, and S. N. Slavov, "The Financial Feasibility of Delaying Social Security: Evidence from Administrative Tax Data," NBER Working Paper 21544, September 2015, and forthcoming in Journal of Pension Economics and Finance.

J. B. Shoven, S. N. Slavov, and D. A. Wise, "Social Security Claiming Decisions: Survey Evidence," NBER Working Paper 23729, August 2017.

G. Bronshtein, J. Scott, J. B. Shoven, and S. N. Slavov, "Leaving Big Money on the Table: Arbitrage Opportunities in Delaying Social Security," NBER Working Paper 22853, November 2016.

G. Bronshtein, J. Scott, J. B. Shoven, and S. N. Slavov, "The Power of Working Longer," NBER Working Paper 24226, January 2018.