The Impact of Tariff Changes: U.S. Sugar Duties, 1890-1930

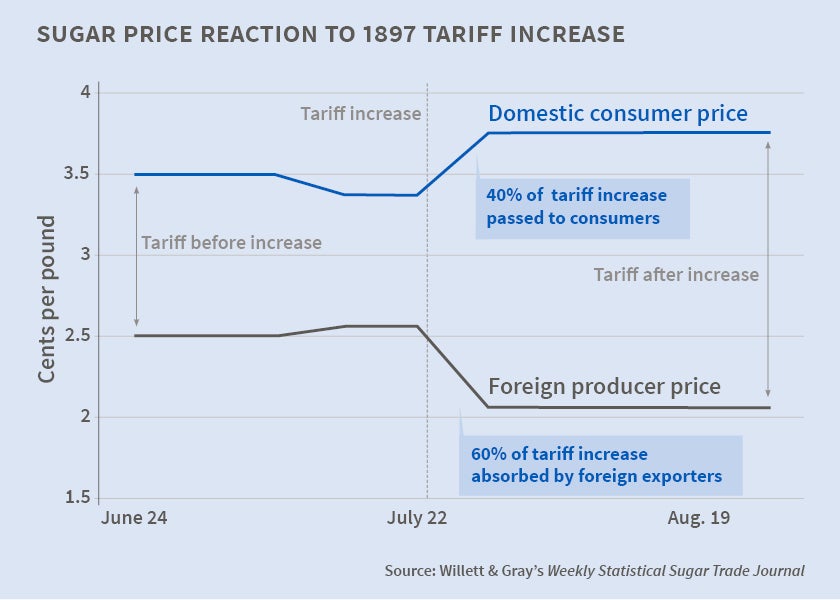

Tariff reductions were fully passed on to domestic consumers, but the burden of increases was shared by consumers and foreign exporters.

In Tariff Incidence: Evidence from U.S. Sugar Duties, 1890-1930 (NBER Working Paper No. 20635), Douglas A. Irwin uses a unique dataset to provide new empirical evidence on whether domestic consumers or foreign exporters bear the burden of import duties and how tariffs affect the terms of trade.

This paper uses high-frequency data on raw cane sugar imports into New York City from 1890 to 1930. Over this time period, the United States consumed about a quarter of the world's sugar, making it possible that it might be able to shift some of the burden of its tariffs onto its trading partners. The study explores whether large and unilateral tariff changes that were implemented by the United States during the period had significant influence on the world price of sugar.

Since the data contain both the pre-duty import price and the post-duty market price, the author can compare the response of prices on both sides of the tariff wall to every tariff change. The results, based on eight tariff changes that included both increases and decreases, suggest that the price responses depended on the direction of the tariff change. Tariff reductions were immediately and fully passed on to domestic consumers with no apparent impact on the import price, while tariff increases were shared between foreign suppliers and domestic consumers, with the foreign suppliers bearing the larger portion.

This difference is mostly explained by demand responses around the time of tariff changes. Since these changes are known in advance and are expected to remain in place for many months, if not years, market participants shift the timing of their purchases in different ways, depending on whether tariffs are increased or decreased, with different effects on import prices.

When tariffs increase, importers shift more of their purchases to the weeks prior to the implementation of the higher tariff. In the data, the largest tariff increase - roughly 40 percent - led to a tripling of imports in the months preceding the tariff hike and a collapse of sugar purchases for several months afterwards. This shifting of purchases explains the upward pressure on prices prior to the tariff increase and the downward pressure on prices immediately following the event.

On the other hand, the incentive to shift purchasing behavior was low with tariff reductions, because the lower tariff was expected to remain in place for some time. While there was some postponement of purchases in anticipation of the lower tariff, the data do not reveal a surge in demand immediately following the decrease in the tariff. Consequently, there was little effect on world prices. The pass-through of the tariff reduction to domestic prices was nearly instantaneous and contemporaneous with the change in the tariff rate. The author suggests that an implication of the results is that even large countries need not fear an adverse terms-of-trade effect from a unilateral tariff reduction.

-- Claire Brunel