When Government Borrows Heavily, Firms Reduce Leverage

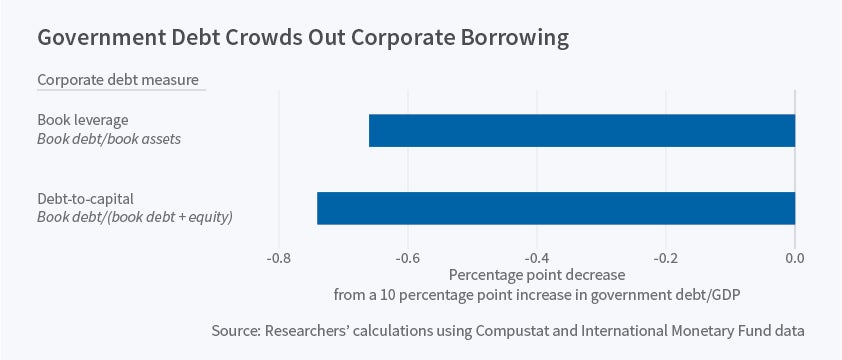

Higher levels of government borrowing are associated with lower leverage ratios in the corporate sector.

Most governments in developed countries responded to the financial crisis of 2008 by pursuing expansionary fiscal policies, raising budget deficits and issuing government debt. Some warned that growing supplies of government debt might have unintended consequences in the realm of corporate finance. In Government Debt and Corporate Leverage: International Evidence (NBER Working Paper 23310), Irem Demirci, Jennifer Huang, and Clemens Sialm find robust evidence of "crowding out," a tendency for higher levels of government debt to reduce the level of corporate borrowing.

The researchers explain that an increased supply of government debt could lead fixed-income investors to demand a higher rate of return on both government and corporate bonds. Although government and corporate debt are not perfect substitutes, with the latter typically being viewed as riskier than the former, there are likely to be linkages between the two markets. As the cost of issuing corporate debt rises, firms may respond by shifting their capital structure toward greater reliance on equity rather than debt.

The researchers test the impact of government borrowing on corporate financial behavior with data from more than 38,000 firms in 40 different countries between 1990 and 2014. They observe that higher levels of government debt to GDP are associated with lower levels of book leverage, market leverage, and the corporate debt-to-capital ratio. They also find that the effects of government debt levels on corporate financing are more pronounced when government debt and corporate debt are more similar and are thus in closer competition with each other. For example, when the level of government debt held by domestic investors rises, the crowding out effect on corporate debt is particularly strong. The researchers posit that this is due to the fact that corporate debt is primarily held by domestic investors, so domestically held government debt and corporate debt are in more direct competition. They also find a larger crowding out effect of government debt on larger and more profitable firms, whose debt is likely to be viewed as a closer substitute for government debt than the debt of smaller, less stable firms.

The researchers hypothesize that firms with more flexibility to switch between debt and equity financing are more likely to respond to increases in the levels of government debt. They find that government debt levels have a larger impact on corporate borrowing in countries with large equity markets and in which companies are less dependent on bank financing. The researchers also study the crowding out effect around the establishment of the European Economic and Monetary Union (EMU). They hypothesize that the financial and monetary integration increased foreign demand for bond securities of EMU members. Consistent with this, they find that the local crowding out effect is reduced for EMU countries after the integration.

— Dwyer Gunn