Using the Shale Revolution to Infer Carbon Abatement Costs

The historic cost advantage of coal-fired electric power plants is reduced by carbon pricing and by use of cleaner-burning abundant natural gas.

In recent years, policymakers have grappled with a number of ideas on how to reduce carbon pollutants believed to be causing climate change. One of the approaches has been to apply a "carbon price," or "carbon tax," on CO2 emissions by electricity generators, thereby making it more expensive for power-plant owners to use fossil fuels that emit large amounts of carbon dioxide, particularly coal.

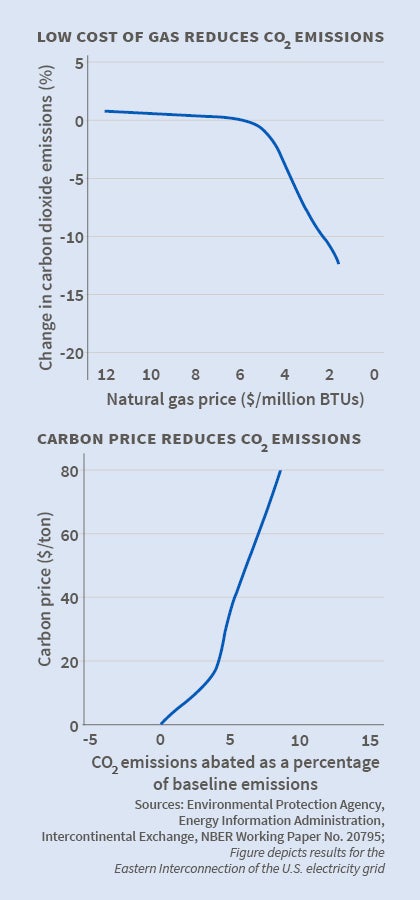

In Inferring Carbon Abatement Costs in Electricity Markets: A Revealed Preference Approach Using the Shale Revolution (NBER Working Paper No. 20795), authors Joseph A. Cullen and Erin T. Mansur use data from a number of sources —including actual natural-gas prices since the onset of the historic shale revolution in the U.S. —to show that carbon prices do lead to reductions in CO2 emissions in the electricity sector, and that this impact is greatest when natural gas prices are low.

Carbon-pricing systems already have been implemented in a number of states around the nation and countries around the world. The idea behind carbon-pricing programs is this: new carbon costs disproportionately affect the dirtiest generators on the grid, providing incentives to reduce carbon emissions. In the short-term, firms may engage in "fuel switching," or using alternate plants to lower costs, such as switching from coal-fired plants to gas-fired plants, a move that can reduce carbon emissions by 23 to 42 percent.

Using price, production, consumption, and emission data from the U.S. Environmental Protection Agency, Federal Energy Regulatory Commission, Energy Information Administration, Canada's National Energy Board, and other sources, the authors seek to examine how carbon emissions from the electricity industry reacted to dramatic falls in natural gas prices, such as have occurred since the historic surge in gas production from U.S. shale fields between 2005 and 2012. Since carbon prices and cheap natural gas reduce the historical cost advantage of coal-fired power plants, in a nearly identical manner, largely by making coal more expensive compared with cleaner-burning and increasingly more abundant natural gas, the authors show how emissions would decrease in response to actual carbon prices. The authors aim to base findings on "observable behavior" rather than simulated scenarios.

They estimate that a price of $10 per ton of carbon dioxide would reduce CO2 emissions by 4 percent. Significantly, a price of $60 per ton of carbon dioxide would be needed to cut emissions by 10 percent, suggesting that it becomes increasingly more expensive to achieve ever-larger target reductions of emissions in the short run.

In addition, the authors show that carbon prices are much more effective at reducing emissions when natural gas prices are low. If fuel prices evolve according to industry forecasts, the authors predict a 6 percent decrease in CO2 emissions from a $20 per ton price on carbon, but if gas prices were to return to their typical, pre-shale-gas levels, the same price on carbon would reduce emissions by only 1 percent.

In some cases, the authors conclude, policymakers might get more bang for the buck by imposing "relatively modest" carbon prices, such as a $20 per ton price that could reduce emissions by 6 percent almost immediately. Additional reductions of emissions could come in the long run as consumers facing higher electricity prices could adjust consumption and firms could opt to build new, cleaner generation facilities.

"Understanding how a carbon price will affect polluting firms in the short run is an important step in demonstrating the effectiveness of such an instrument for use in the long run," the authors conclude. "On a longer time horizon, even greater emissions reductions could be expected as new generation could be built and consumers could adjust to new equilibrium electricity prices."

-- Jay Fitzgerald