Network Relationships and Corporate Bond Trading

In contrast to stocks that are traded on established exchanges such as the New York Stock Exchange, corporate bonds are traded in over-the-counter (OTC) markets. Since a buyer or seller needs to find a specific counterparty to trade with in an OTC market, trade requests can take time and sometimes even fail. In a study of bond trading, Sequential Search for Corporate Bonds (NBER Working Paper 31904), Mahyar Kargar, Benjamin Lester, Sébastien Plante, and Pierre-Olivier Weill find that the characteristics of both bond traders and bond trade requests are important in determining the time to consummating a trade, and the failure rate, in OTC markets.

Buyers and sellers with connections to a higher number of traders consummate trades faster than their less-connected peers.

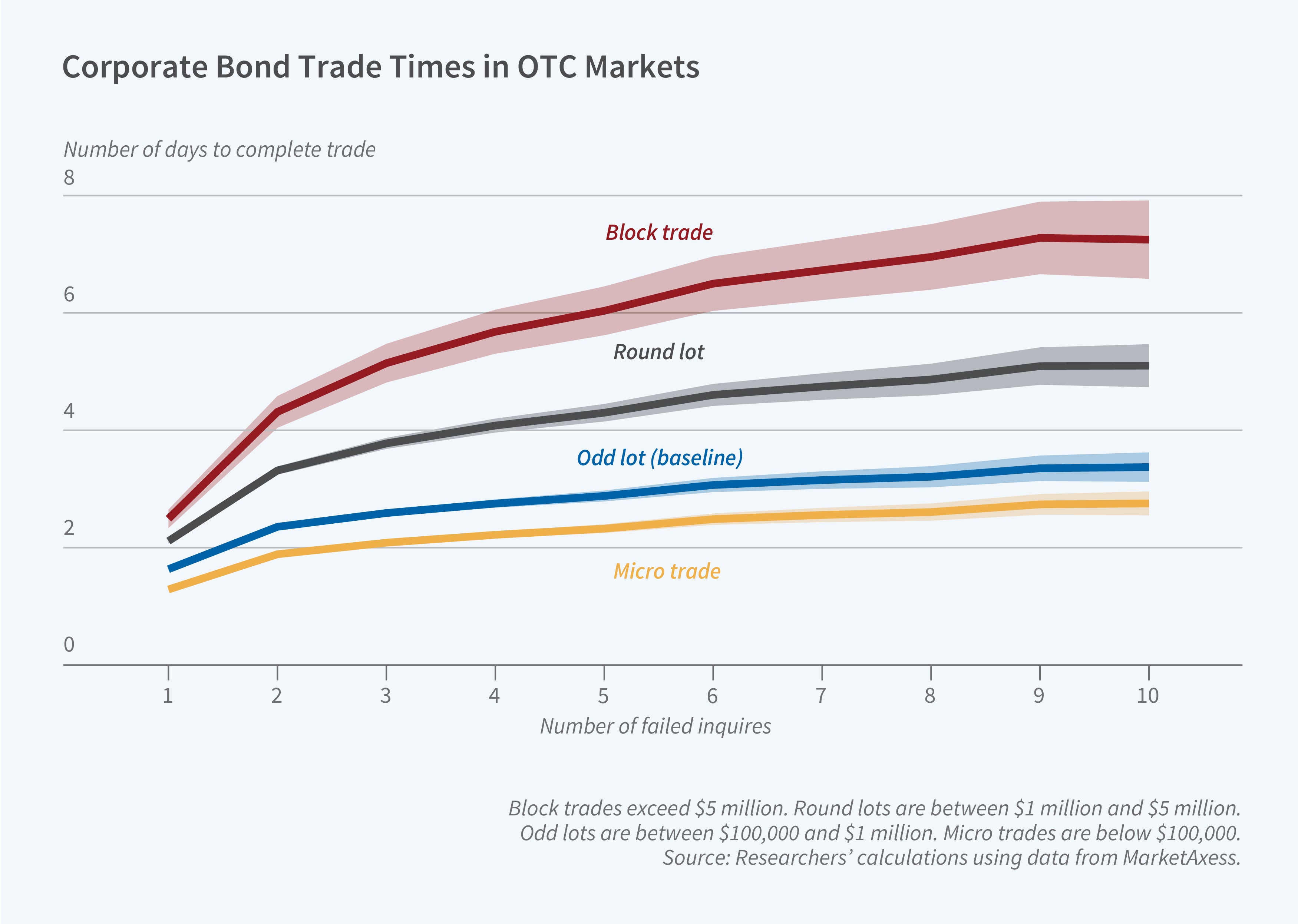

The researchers find that OTC trade inquiries fail approximately 30 percent of the time. However, many OTC investors make repeated inquiries and eventually complete a trade. The researchers find that following a failed initial inquiry, it takes two to three days to make a successful trade. Sales inquiries take about half as long as purchase inquiries to complete. Micro-size trades — valued at less than $100,000 — move quickest, taking as much as one day less to complete than block trades, which are valued at more than $5 million.

The “connectedness” of an inquiring customer, measured as the number of existing relationships that the customer has with dealers, is an important determinant of the number and quality of replies a customer receives. On average, customers in the top 10 percent of the connectedness measure complete orders in half the time that customers in the bottom 70 percent do. Connectedness also affects the overall likelihood of trade failure. Customers in the top 10 percent of connectedness fail just 14 percent of the time, compared to 50 percent of the time among those in the bottom 70 percent.

The researchers use a variety of proprietary data sources in their analysis. They include data on customer inquiries and dealer responses between January 2017 and March 2021 from the MarketAxess (MKTX) electronic trading platform. This platform accounts for about 21 percent of total trade volume in the corporate bond market as of the third quarter of 2022. This dataset includes information on both successful and unsuccessful trade inquiries. To capture some of the trades made outside the MKTX platform, the researchers also use data on all transactions recorded by the Trade Reporting and Compliance Engine, operated by the US Financial Industry Regulatory Authority. This dataset includes only successful trades, but it contains information on all completed trades, regardless of the platform used.

The researchers limit their analysis to what are referred to as “child orders,” which can arise when an OTC customer divides inquiries over a period of several days. For example, a customer hoping to sell 1,500 bonds might inquire about 300, then 500, then 700 bonds, rather than inquiring about 1,500 bonds at once. This customer might therefore accept or reject several offers on comparable trade units in a short period of time. Focusing on these small and repetitive orders provides insights into dealer and customer decision-making while controlling for the size and other specific characteristics of a given inquiry.

The researchers suggest that repeated failed inquiries and significant variation in time-to-trade could be the result of customers inquiring repeatedly in order to get the best price for their trade. Looking at trades in which a customer made two identical inquiries within several days, they find that 61 percent of the time, the customer received a better offer at the second inquiry than they did at the initial inquiry. This suggests that there can be some return to customers rejecting initial offers if they do not achieve a target response.

—Emma Salomon