The Role of ‘Green’ Investors in Reducing Corporate Carbon Emissions

Many institutional investors have objectives that include reducing the carbon footprint of their portfolios. The primary strategies through which investors can influence corporate behavior are divestment — selling shares of companies with high emissions, thereby potentially raising their cost of capital — and engagement, which entails maintaining an ownership stake and using voting power to advocate for climate-friendly actions. In Divestment and Engagement: The Effect of Green Investors on Corporate Carbon Emissions (NBER Working Paper 31791), Matthew E. Kahn, John Matsusaka, and Chong Shu analyze whether public pension funds, an important class of environmentally inclined investors, affect the level of greenhouse gas emissions at the companies they own.

The researchers categorize public pension funds based on the political affiliation of the leaders who control them. Those under Democratic control, either through governance or board trusteeship, were labeled “green.” Those under Republican control were labeled “non-green.” The researchers assume that Democrats generally favor carbon emission reductions more than Republicans.

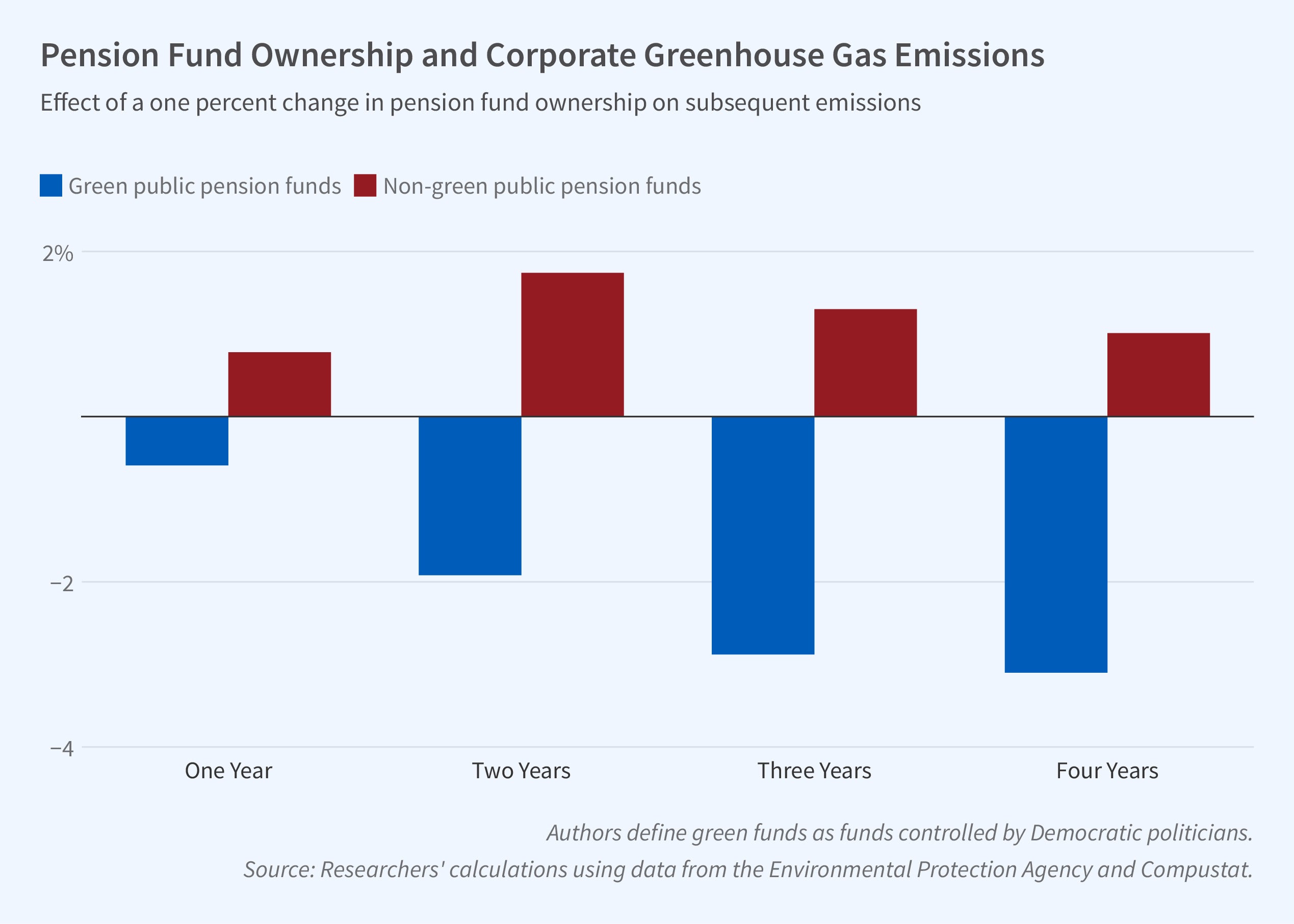

They study emissions data from 2010–21 for 5,241 facilities across 685 publicly traded companies, along with data on pension fund stock holdings for 24 of the US’s 50 largest public funds. These funds collectively managed over 88 percent of total public pension assets in the US. Companies reduced their greenhouse gas emissions as the ownership stake of green pension funds rose. A 1 percentage point rise in shares owned by green pension funds was associated with a 3.1 percent decline in carbon emissions over four years, and a 5.2 percentage point increase in the probability of some carbon emission reduction over this period. Increased ownership by non-green funds was not associated with any decline, and may be associated with an increase in emissions.

The researchers consider three ways in which increased green ownership could potentially affect emissions: managerial reactions to investor ownership, pressure exerted by investors through shareholder proposals, and persuasion of managers by pension shareholders. They find that emission cutbacks depend in part on the proactive engagement of green funds, suggesting that managers do not respond without some shareholder involvement. They reject the shareholder proposal channel since they find no increase in shareholder environmental proposals calling for companies to scrutinize and report on environmental concerns after a surge in green ownership. They conclude that persuasion carries more weight than confrontational pressure in driving emission reduction.

— Leonardo Vasquez