Lessons from Pandemic-Related Debt Forbearance

Low-income and less creditworthy households were more likely to obtain debt forbearance during the pandemic, but 60 percent of the forbearance dollars went to households with above median incomes.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted in March 2020, included a range of different policies designed to address the economic impact of the pandemic. In addition to income-based interventions such as stimulus checks and unemployment insurance, it also sought to limit household debt distress by mandating forbearance — a temporary suspension of debt repayment requirements — on about two-thirds of outstanding mortgages and 90 percent of all student loans. Unlike income-linked stimulus payments, debt forbearance targets households over a range of income levels that are facing credit constraints. The private sector also extended a significant amount of debt relief during the same period.

In Government and Private Household Debt Relief during COVID-19 (NBER Working Paper 28357), Susan F. Cherry, Erica Xuewei Jiang, Gregor Matvos, Tomasz Piskorski, and Amit Seru follow a representative panel of more than 20 million US consumers and analyze debt forbearance actions during the COVID-19 pandemic. Loans worth $2 trillion entered forbearance during the pandemic, allowing more than 60 million borrowers to miss $70 billion on their debt payments by the end of the first quarter of 2021.

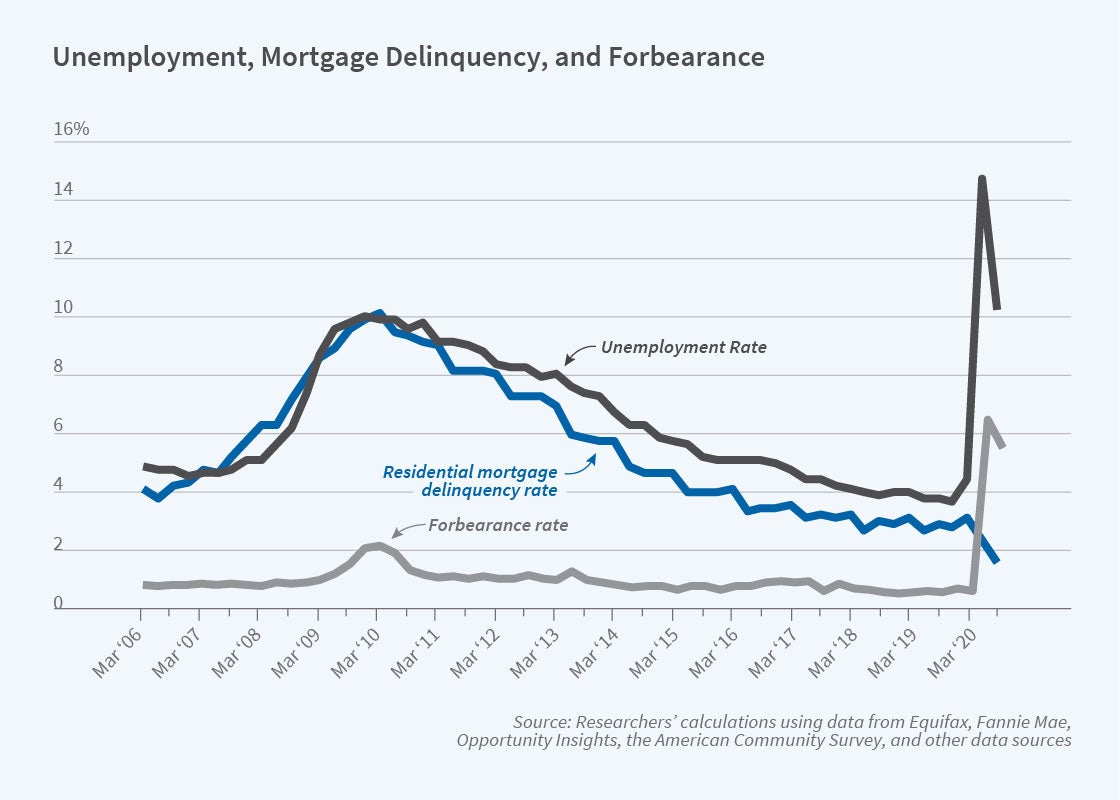

Economic crises are usually accompanied by significant household debt distress, which increases sharply with unemployment. In contrast, household debt distress levels during the COVID pandemic did not rise; they actually fell relative to the pre-pandemic period. The large amount of debt relief might help explain this.

Forbearance rates are higher in regions with the highest COVID-19 infection rates and the greatest deterioration in local economic activity as exemplified by high levels of unemployment insurance claims. Individuals with lower credit scores, lower incomes, and higher debt balances, and regions with a higher share of minority residents, received forbearance at a higher rate. Because higher-income households had higher credit burdens, conditional on getting forbearance, the dollar value of forbearance relief was tilted toward higher-income households. The researchers estimate that 60 percent of forbearance relief went to households with above-median incomes. This suggests that unlike policies based mainly on income, such as the stimulus check program, debt forbearance allowed less creditworthy borrowers with higher pre-pandemic incomes to obtain significant financial relief.

Private debt forbearance for debts which were not covered by the CARES Act provided more than a quarter of total debt relief. Exploiting a discontinuity in mortgage eligibility under the CARES Act, the researchers estimate that government-provided debt relief was about 25 percent more generous than that provided by the private sector.

The implementation of debt relief is also important. Student loans were automatically placed in administrative forbearance at zero interest, providing relief that the researchers note was not necessarily correlated with borrower need. Mortgage borrowers needed to request help. Among eligible borrowers, less than 10 percent appears to have taken up the option of debt relief. This suggests that allowing borrowers a choice of whether to request debt relief might have resulted in a potentially better-targeted and more cost-effective policy.

The researchers conclude by noting that the extent of forbearance overhang — that is, accumulated payments owed to lenders since March 2020 — is significant, especially for lower income households, and that unwinding it could have first-order consequences for household debt distress and the aggregate economy.

— Linda Gorman