Can 'Active Decisions' Encourage Saving in 401(k) Plans?

More than half of all U.S. workers are covered by a pension plan through their employer, yet approximately one in five eligible workers do not participate in the plan, according to the Employee Benefit Research Institute. Furthermore, even some of those who participate may not be saving adequately for retirement if their contribution rate is too low or their portfolio allocation is too conservative given their needs.

These concerns have led economists and employers to examine mechanisms to increase participation in 401(k) plans. Historically, there have been two enrollment options - standard enrollment, where employees are by default not enrolled and can choose to opt in, and automatic enrollment, where employees are by default enrolled and can choose to opt out. The automatic enrollment mechanism has a default contribution level and portfolio allocation selected by the employer. Previous evidence suggests that defaults tend to be sticky, so that many employees stay with the default option in their plan. Yet workers have very diverse savings needs and levels of risk tolerance, so the default will not be optimal for many workers.

In Optimal Defaults and Active Decisions (NBER Working Paper 11074), authors James Choi, David Laibson, Brigitte Madrian, and Andrew Metrick examine a new mechanism for 401(k) enrollment, active decision. In this mechanism, employees are required to make an explicit choice for themselves regarding their plan participation. An active decision mechanism has the advantage that employees are encouraged to avoid procrastinating when it comes to this important decision and are not corralled into a default option that may not suit their preferences. However, it may also be the case that some employees find this decision difficult and time-consuming to make and would prefer to have it made by a third party with their interests in mind.

In their study, the authors examine a "natural experiment" that occurred when a large firm switched from an active decision to standard enrollment mechanism unintentionally as part of their transition from a pen-and-paper to a phone-based administrative system. The authors compare the 401(k) participation decisions of about 4,500 new hires that joined the firm during the first seven months of 1997 and 1998, one group under the active decision mechanism and the other group under the standard enrollment mechanism.

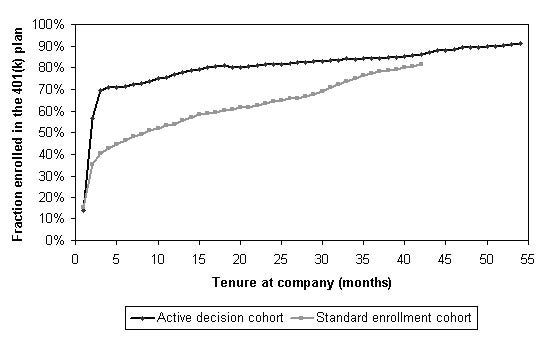

Figure 1 plots the fraction of employees who have enrolled in the 401(k) plan by months of tenure at the firm. At the three-month point, the participation rate of the active decision cohort is 69%, versus only 41% in the standard enrollment cohort. Over time, the enrollment gap decreases, to seventeen percentage points after two years and five percentage points after three and a half years, but the difference is always statistically significant.

The authors also examine whether the enrollment mechanism affects the contribution rate, as might be the case if active decision discourages employees from taking time to think carefully about their contribution rate. The authors find that the average contribution rate is lower for plan participants in the active decision cohort than participants in the standard enrollment cohort. However, they conclude that the difference can be explained entirely by the fact that active decision brings employees with weaker savings motives into the plan; the choice of mechanism does not affect the contribution rate of those who would have enrolled under either regime.

Unfortunately, the authors are not able to study the effect of the enrollment mechanism on asset allocation, as the firm changed the menu of investment fund options at the same time as the enrollment mechanism, but they identify this as an important area for future research.

In the final section of the paper, the authors use a structural model to derive some lessons about the optimal enrollment mechanism. They find that active decision is more appealing when workers have a strong tendency to procrastinate and more diverse savings preferences.

The authors anticipate that the evidence presented in their analysis may encourage broader adoption of the active decision mechanism. They suggest that active decision may offer a more cost-effective way to boost 401(k) participation than alternatives such as financial education or boosting the employer match rate, though they conclude that "[all of] these tools, when implemented well, can greatly enhance the retirement income security of a company's current and future employees."

The authors acknowledge financial support from the National Institute on Aging (R01-AG16605, R29-AG013020, T32-AG00186). Choi acknowledges funding from the National Science Foundation Graduate Research Fellowship and the Mustard Seed Foundation and Laibson acknowledges financial support from the Sloan Foundation.