How Does Raising the Early Retirement Age Affect Retirement Decisions?

The long-term fiscal challenge facing the U.S. Social Security system ensures that policy makers will continue to discuss possible reforms to the system. One frequently mentioned policy is raising the normal (or full) retirement age (NRA), the age at older workers are entitled to their regular pension benefit, without any reduction for early claiming. This age is legislated to rise slowly over time in the U.S., from age 65 to age 67, but some have proposed that the NRA be increased further or indexed to longevity. Any such change would represent a benefit cut relative to promised benefits and would generate financial savings for the system.

The early retirement age (ERA) is the age at which benefits are first available—currently age 62 in the U.S. If the NRA was to be raised, policy makers would need to decide whether to raise the ERA as well. Changes to the ERA offer less scope for financial savings, since the rate at which benefits are reduced for early claiming in the U.S. is set such that a typical retired worker would receive approximately the same lifetime benefits regardless of when she claims. Yet raising the ERA may have important effects on retirement decisions, since many older workers now retire and claim at the ERA and have little in the way of financial assets that could be used to finance consumption during any gap between retirement and the start of Social Security benefit receipt.

In The Effects of the Early Retirement Age on Retirement Decisions (NBER Working Paper No. 22561), researchers Dayanand Manoli and Andrea Weber examine the effects of raising the ERA on older workers' retirement decisions in Austria. The Austrian example is a useful one to explore for several reasons. First, pension reforms in Austria in 2000 and 2004 raised the ERA in multiple steps, providing a useful natural experiment to study; by contrast, the U.S. has not changed its ERA in over fifty years. In addition, detailed administrative data from Austria allow the researchers to examine pension claims and job exits for a large sample of workers.

Austrian workers with at least 15 years of contributions to the pension system (where years of unemployment, military service, or parental or sickness leave may also count towards the requirement) are eligible to receive an old age pension at the NRA of 65 for men and 60 for women. Prior to recent reforms, the system allowed individuals with 35 years of contributions to claim pension benefits at an ERA of 60 for men and 55 for women.

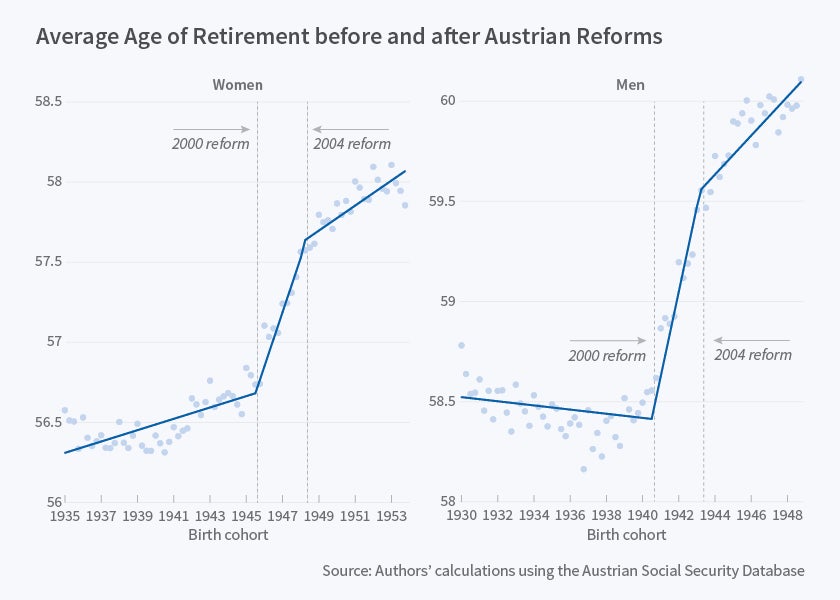

The first reform in 2000 raised the ERA by 18 months for both men and women, with increases of two months for each quarterly birth cohort. A subsequent reform in 2004 increased the ERA by a further six months, to age 62 for men and 57 for women, with smaller increases of one month per quarterly cohort. The reform also set a timetable for the ERA to converge to the NRA by 2017. An exception to these ERA increases was made for individuals with very long careers—the ERA remained at age 60 for men with 45 years of contributions and 55 for women with 40 years of contributions. The reforms thus created incentives for those with short contribution years (too few to qualify for the exception) to delay retirement until the new ERA and for those with long contribution years to delay retirement until they could qualify for the original ERA.

The figure shows the average age at which Austrian workers of different quarterly birth cohorts left their job. The data focuses on those workers who are ineligible for the ERA exemption. Prior to the reform, the average retirement age was rising slowly over time for women and falling slightly for men. After the 2000 reform, the average retirement age rose by about one year for women and by more than one year for men during the brief phase-in period. Once the 2004 reform was passed the average retirement age continued to rise, though at a somewhat slower rate, as might be expected based on the more leisurely implementation of additional ERA increases. There is a very similar pattern in the average pension claiming age by birth cohort.

Overall, the researchers find that a one-year increase in the ERA leads to a 0.4 year increase in the average retirement age and a 0.5 year increase in the average pension claiming age. They note that the magnitude of their findings is similar to some recent evidence from the U.S. that looked at increases in the NRA. They conclude, "[these] results highlight that the ERA is an important reference point for retirement decisions."

The researchers acknowledge funding from the Social Security Administration through the NBER Retirement Research Center and from the Austrian Science Fund (NRN Labor Economics and the Welfare State).