The Jones Act and Energy Prices

The Jones Act of 1920 mandates that goods transported by water between US ports must travel on ships constructed, owned, and operated by US entities and must display the US flag. It is frequently blamed for the higher costs of domestic shipping and of the products that are transported. In Impacts of the Jones Act on US Petroleum Markets (NBER Working Paper 31938), Ryan Kellogg and Richard L. Sweeney estimate that if the act had not been in force in 2018–19, fuel prices on the East Coast of the United States would have been lower.

Urban areas on the US East and West Coasts consume large amounts of petroleum fuels. Some of the fuel demand in these regions is met by shipments from Texas and the Gulf Coast, the major domestic oil and gas production centers, but a significant share of the fuel used on the East Coast is imported, and a substantial amount of Gulf Coast production is exported.

Repeal of the Jones Act would nearly eliminate East Coast imports of jet fuel and ultra-low-sulfur diesel fuel, lowering East Coast prices but raising gasoline prices on the Gulf Coast.

The researchers examine shipments of light crude oil and three refined products: gasoline, jet fuel, and ultra-low-sulfur diesel fuel. They use data from Argus Media on the costs of internationally exporting these fuels to estimate what the costs of domestic transport would be, absent the Jones Act’s restrictions, as a function of the distance traveled and the date of the shipment. These calculations allow the researchers to estimate the non-Jones Act costs of transporting fuel from the Gulf Coast to different points on the East Coast, separately for crude oil and refined products.

Data from Bloomberg track oil and refined product prices. For the three refined products, on average, the price difference between the Gulf Coast and the East Coast is around $2.00 a barrel; the difference between the price differential and the predicted shipping cost is between $0.35 and $1.00 a barrel. For these products, since the price difference is greater than the transport cost, it is more efficient to transport refined products from the Gulf to the East Coast than to trade internationally. In contrast, the average difference between the light crude prices on the Gulf and East Coasts is $0.34 a barrel lower than the predicted shipping cost on average, so coastwise trade would be inefficient in most months.

The US Energy Information Administration provides data on volumes of fuel movement and consumption at the Petroleum Administration for Defense Districts (PADDs) level; each PADD is a group of states. PADD 3 is the Gulf Coast, PADD 1a is New England, PADD 1b is the Central Atlantic, and PADD 1c is the Lower Atlantic area. The researchers estimate the impact of hypothetically eliminating the Jones Act by assuming that if the observed price differential exceeds their estimate of the transport cost, then observed PADD 3 exports would instead be transported first to PADD 1c, the closest domestic market, then (if some products remain) to PADD 1b, and then, if any products are left, to PADD 1a. Shipments from the Gulf Coast to New England (PADD 1a) incur higher costs than to either of the other markets.

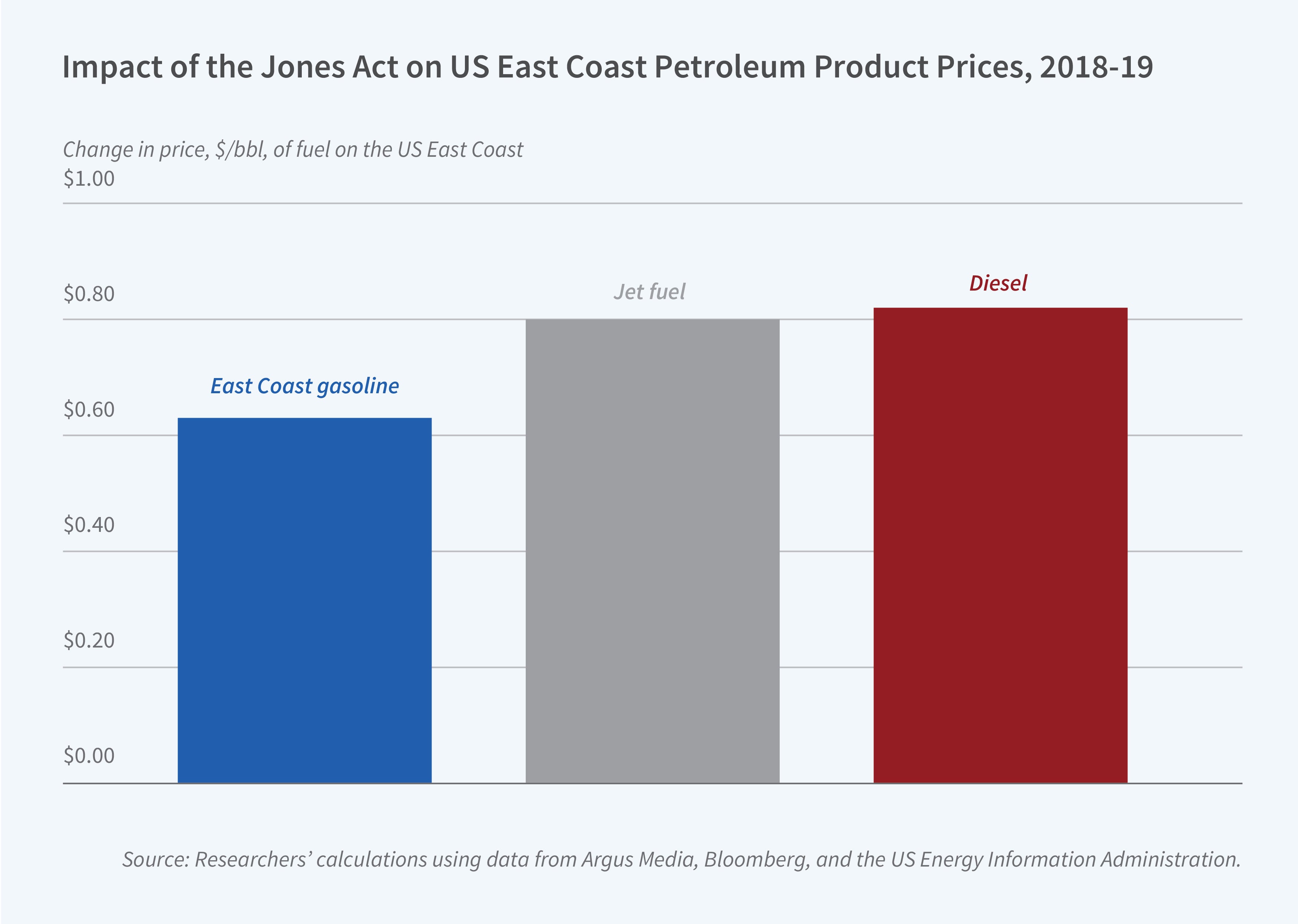

Based on this simulation exercise, if the Jones Act had not been in effect, Gulf Coast exports would have nearly completely replaced East Coast imports of jet fuel and ultra-low-sulfur diesel fuel. Gulf Coast exports would have replaced 36 percent of both the East Coast’s conventional gasoline and light crude oil imports. Averaging across East Coast PADDs, prices for conventional gasoline, jet fuel, and ultra-low-sulfur diesel fuel would have dropped by $0.63, $0.80, and $0.82 per barrel, respectively, with the largest decreases occurring in the Lower Atlantic.

The price of gasoline on the Gulf Coast would have risen by $0.30 a barrel. In aggregate, the researchers find that eliminating the Jones Act would have benefited US consumers by $769 million per year and reduced US fuel suppliers’ profits by $367 million per year.

—Whitney Zhang